Loading News...

Loading News...

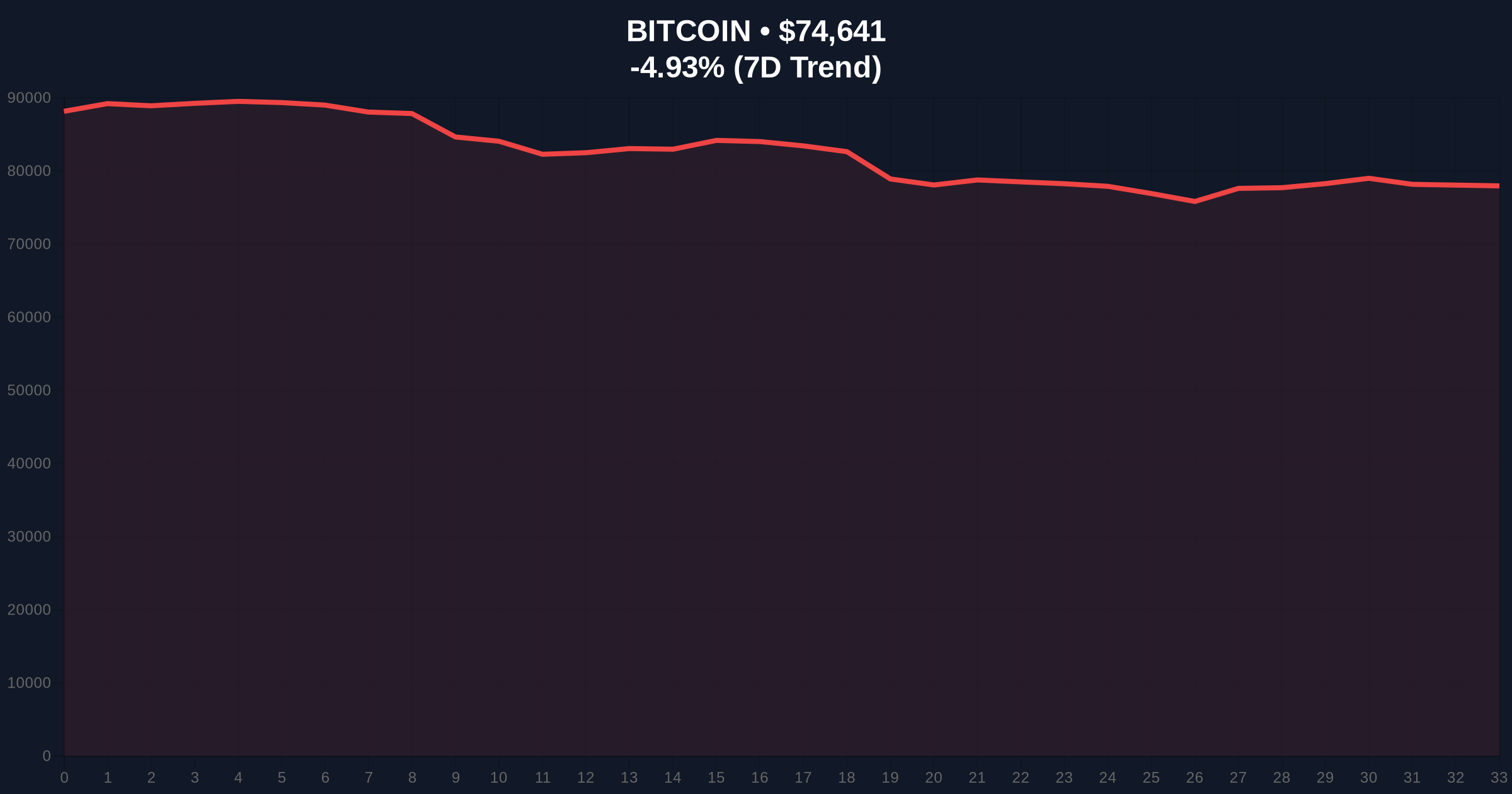

VADODARA, February 3, 2026 — Bitcoin briefly pierced the $75,000 psychological barrier today, according to CoinNess market monitoring, before retracing sharply as extreme fear gripped the market. This Bitcoin price action highlights a critical divergence between price momentum and underlying sentiment, raising questions about the sustainability of the move.

According to CoinNess market monitoring, BTC traded at $75,004.06 on the Binance USDT market. This price action occurred against a backdrop of severe market stress. The Crypto Fear & Greed Index registered an "Extreme Fear" score of 17/100, indicating widespread panic among retail participants. Market structure suggests this was not a genuine breakout but a classic liquidity grab above a major round number.

Consequently, the move failed to hold. Real-time data shows Bitcoin currently trading at $74,528, down 5.07% over the last 24 hours. This rapid rejection created a significant Fair Value Gap (FVG) between $74,800 and $75,200, which the market will likely seek to fill. The price action mirrors patterns seen during previous capitulation events, where brief spikes above resistance precede deeper corrections.

Historically, extreme fear readings coinciding with price attempts at new highs often signal distribution, not accumulation. In contrast to the 2021 bull run, where greed dominated at peaks, the current environment shows institutional hesitation. Underlying this trend is a surge in futures liquidations and whale selling pressure, as detailed in related coverage of significant Bitcoin whale dumps and massive futures liquidations.

, the market is grappling with macro headwinds not present in prior cycles, such as potential regulatory shifts from bodies like the U.S. Securities and Exchange Commission (SEC). The official SEC.gov website remains a critical source for tracking policy developments that could impact Bitcoin's institutional adoption curve.

On-chain data indicates thin order book liquidity above $75,000, making the level susceptible to stop-hunts. The 50-day Exponential Moving Average (EMA) near $73,000 provides dynamic support, but the more critical level is the Fibonacci 0.618 retracement from the last major swing low, sitting at $72,500. A break below this Fibonacci support would invalidate the current bullish structure and target the $70,000 psychological zone.

Market structure suggests the Relative Strength Index (RSI) on the 4-hour chart is hovering near oversold territory, which could trigger a short-term bounce. However, volume profile analysis shows declining buy-side volume on upswings, a bearish divergence. This technical setup often precedes a breakdown when combined with extreme fear sentiment.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Contrarian buy signal historically, but extreme readings can persist. |

| BTC Current Price | $74,528 | Below the $75,000 breakout level, indicating rejection. |

| 24-Hour Price Change | -5.07% | Significant sell-off following the brief spike. |

| Market Rank | #1 | Dominance remains intact despite volatility. |

| Key Fibonacci Support | $72,500 (0.618 level) | Critical level for trend validation; break targets $70k. |

This event matters because it tests the resilience of Bitcoin's institutional bid. Market analysts note that sustained prices above $75,000 require consistent inflows into spot Bitcoin ETFs and positive on-chain metrics like Net Unrealized Profit/Loss (NUPL). The current divergence between price and sentiment suggests either a bear trap is forming or a deeper correction is imminent. Retail market structure appears fragile, with many leveraged positions being liquidated, as seen in recent crypto futures liquidation events.

"The brief break above $75k lacks conviction. Order flow data shows it was primarily driven by short covering, not new capital inflows. Until we see a daily close above $76,000 with expanding volume, this remains a liquidity grab within a broader corrective phase."

Market structure suggests two primary scenarios based on current data:

Historical cycles suggest that extreme fear phases during bull markets often resolve with sharp rallies, but the 12-month outlook depends on macro liquidity conditions and regulatory clarity. The 5-year horizon remains positive due to Bitcoin's fixed supply and adoption trends, but near-term volatility is elevated.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.