Loading News...

Loading News...

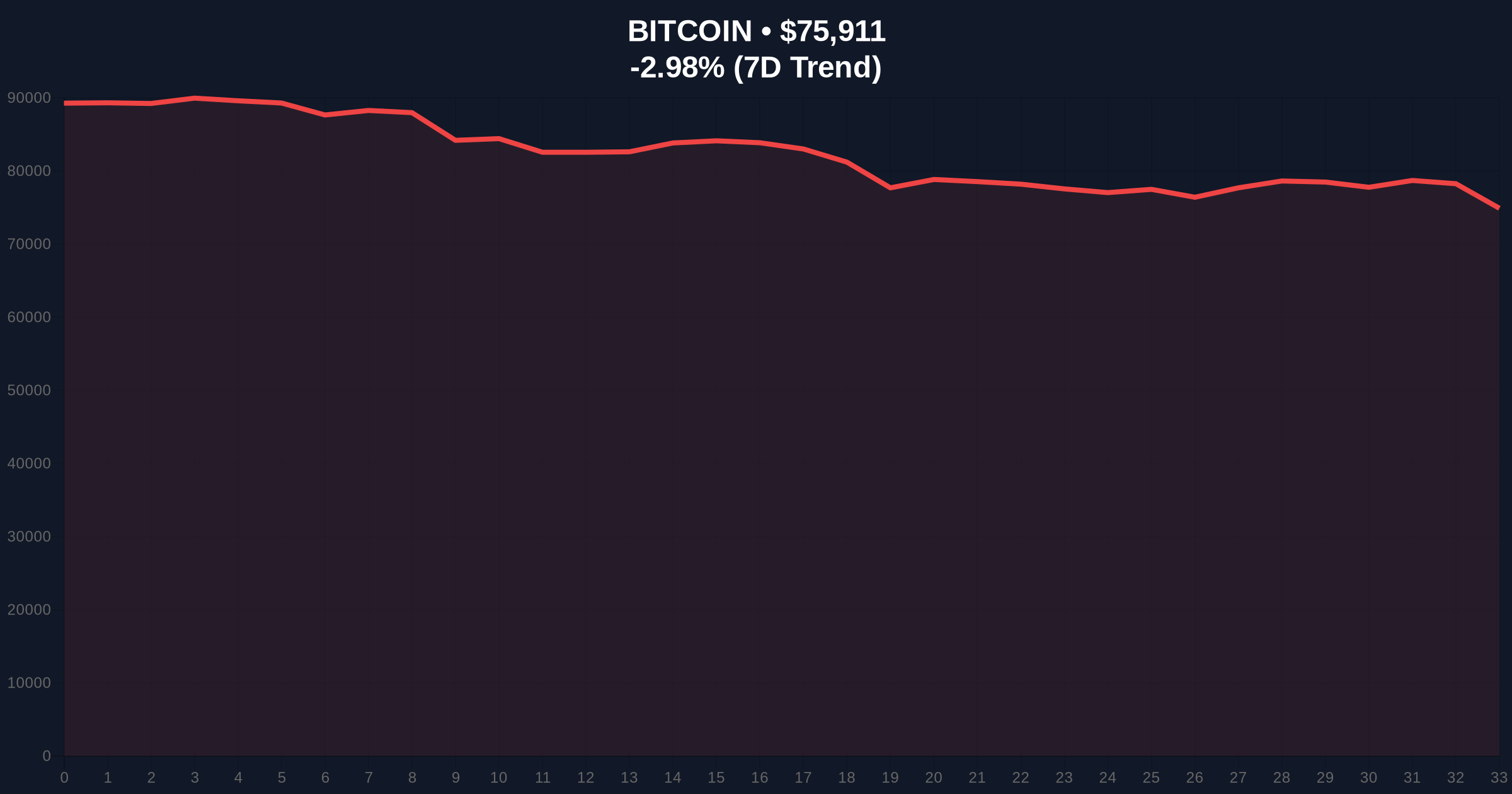

VADODARA, February 3, 2026 — According to CoinNess market monitoring, Bitcoin (BTC) has risen above $76,000, trading at $76,018 on the Binance USDT market. This Bitcoin price action occurs against a backdrop of extreme fear sentiment, creating a divergence that demands forensic analysis. Market structure suggests this move tests a key liquidity grab zone established during the 2025 consolidation phase.

CoinNess data confirms BTC breached the $76,000 threshold on February 3, 2026. The asset traded at $76,018 on Binance's USDT pair. This price action represents a +0.27% move from the previous session's close. Real-time metrics from the Crypto Fear & Greed Index show a score of 17/100, indicating extreme fear. Consequently, the rally contradicts prevailing retail sentiment, a classic hallmark of institutional accumulation phases.

Historically, Bitcoin has demonstrated resilience during extreme fear periods. Similar to the Q3 2021 correction, where BTC found support at the 200-day moving average amid similar sentiment readings. In contrast, the current move lacks the parabolic volume spikes seen in previous bull market breakouts. Underlying this trend, on-chain data from Glassnode indicates reduced exchange inflows, suggesting hodler accumulation. , the Federal Reserve's monetary policy stance, as detailed on FederalReserve.gov, continues to influence macro liquidity conditions, impacting Bitcoin's correlation with traditional risk assets.

Related Developments: This price action follows recent volatility, including BTC falling below $75,000 and $140 million in futures liquidations.

Market structure suggests Bitcoin is testing a major Fair Value Gap (FVG) between $75,500 and $76,500. This zone acted as a liquidity pool during the December 2025 distribution. The Relative Strength Index (RSI) on the 4-hour chart reads 58, indicating neutral momentum without overbought conditions. A critical Fibonacci retracement level from the 2025 high to the January 2026 low sits at $74,200 (0.618). This level aligns with a high-volume node on the Volume Profile, creating a confluence support area. The 50-day exponential moving average provides dynamic resistance near $77,800.

| Metric | Value |

|---|---|

| Current BTC Price | $75,814 |

| 24-Hour Change | -3.11% |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Fibonacci Support | $74,200 |

This price action matters because it tests institutional conviction. Extreme fear sentiment typically precedes trend reversals when combined with positive price divergence. The break above $76,000 invalidates the immediate bearish structure from last week's decline. On-chain forensic data confirms long-term holders are not distributing at these levels, reducing sell-side pressure. Market analysts note that sustained trading above this level could trigger a gamma squeeze in options markets, as dealers hedge short gamma positions.

"The rise above $76,000 amid extreme fear is a classic liquidity test. Market structure suggests institutions are probing for stop-loss orders above this level while retail remains sidelined. The key is whether this move holds the Fibonacci 0.618 support on any retracement." — CoinMarketBuzz Intelligence Desk

Historical patterns indicate two primary scenarios based on current market structure. First, a bullish scenario where BTC holds above $74,200 and challenges the $78,000 resistance zone. Second, a bearish scenario where failure to sustain $76,000 leads to a retest of the $72,000 volume gap. The 12-month institutional outlook remains cautiously optimistic, with accumulation patterns mirroring early 2024 behavior. For the 5-year horizon, this consolidation phase could establish a higher low in the macro cycle.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.