Loading News...

Loading News...

- 13 UK-listed companies hold 4,300 BTC purchased at average price of $113,105, now down 22%

- Total unrealized losses estimated at £79 million ($99.5 million) including Satsuma Technology sale

- Market structure suggests potential liquidity grab below $90,000 as global sentiment hits "Extreme Fear"

- Technical analysis indicates critical Fibonacci support at $82,000 with bearish invalidation at $95,500

VADODARA, December 22, 2025 — A quantitative analysis of UK corporate Bitcoin holdings reveals significant unrealized losses, with 13 publicly traded British companies facing approximately $99.5 million in paper losses after accumulating Bitcoin at an average price of $113,105. This daily crypto analysis examines whether this represents a strategic failure or a temporary market dislocation amid extreme fear sentiment scoring 25/100.

The narrative of corporate Bitcoin adoption as a treasury reserve asset has faced increasing scrutiny since MicroStrategy's initial 2020 purchases. Market structure suggests institutional accumulation typically follows retail euphoria phases, creating natural sell walls at previous accumulation zones. The UK corporate entry at $113,105 occurred near what technical analysts identify as a previous order block from Q1 2025, suggesting these firms may have been chasing momentum rather than executing disciplined dollar-cost averaging strategies. This pattern mirrors the 2021 corporate adoption wave where companies like Tesla faced similar unrealized losses during subsequent corrections.

Related developments in the regulatory include South Korea's FIU targeting Korbit Exchange with sanctions, indicating global regulatory pressure continues to influence institutional participation thresholds.

According to analysis by The Telegraph cited in the source material, 13 UK-listed companies purchased a total of 4,300 Bitcoin at an average price of $113,105. With Bitcoin's price declining to $87,000 last Friday, these holdings show a 22% decline from their average entry point. The report specifically identifies Satsuma Technology, an AI infrastructure firm listed on the London Stock Exchange, as having realized losses through sales. Smarter Web Company (SWC), a UK-based web developer that adopted a Bitcoin reserve strategy, has recorded substantial losses with its stock price declining approximately 90% from its peak.

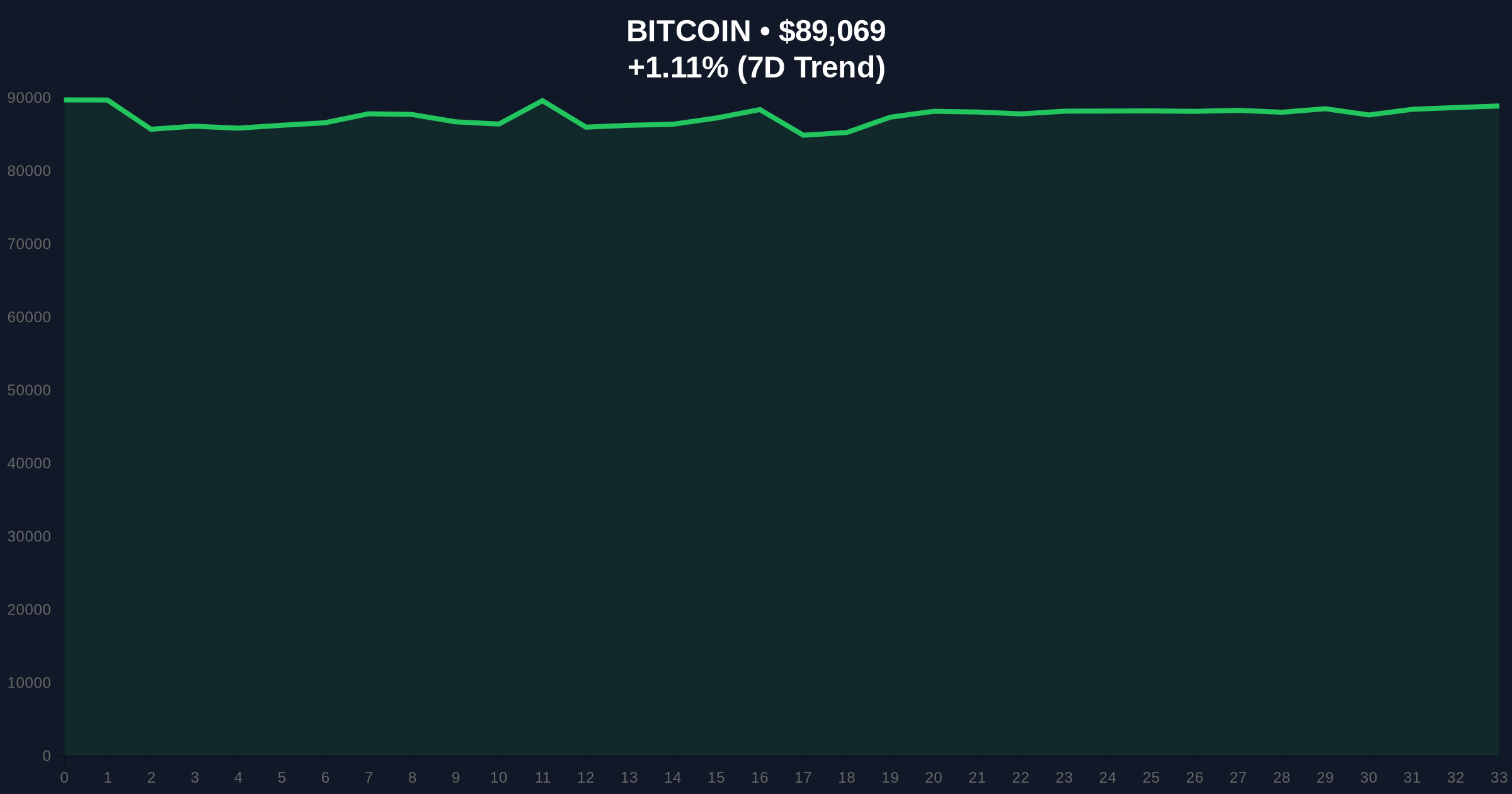

Market data indicates the current Bitcoin price stands at $89,055, representing a modest 1.10% recovery from recent lows but still significantly below the UK corporate average entry. On-chain data suggests minimal movement from these corporate wallets, indicating most positions remain held despite the paper losses.

The $113,105 average entry price sits within what volume profile analysis identifies as a low-volume node, suggesting weak institutional support at that level. Current price action shows Bitcoin testing the $89,000 psychological level, which coincides with the 0.382 Fibonacci retracement from the 2024 low to the 2025 high. The daily RSI reads 42, indicating neither oversold nor overbought conditions, while the 50-day moving average at $92,500 provides immediate resistance.

Market structure suggests a potential liquidity grab below $90,000 as stop-loss orders from retail and institutional positions cluster in this zone. A critical fair value gap exists between $85,000 and $88,000 that may need filling before any sustained recovery. The $82,000 level represents the 0.5 Fibonacci retracement and previous consolidation zone from October 2025, serving as major support.

Bullish Invalidation Level: $82,000. A sustained break below this Fibonacci support would invalidate any near-term recovery thesis and likely trigger further corporate selling.

Bearish Invalidation Level: $95,500. A reclaim above this level would fill the current fair value gap and suggest the UK corporate losses represent a temporary dislocation rather than structural weakness.

| Metric | Value |

| UK Corporate BTC Holdings | 4,300 BTC |

| Average Purchase Price | $113,105 |

| Current Unrealized Loss | 22% |

| Total Loss Value | $99.5 million |

| Global Crypto Sentiment | Extreme Fear (25/100) |

| Current BTC Price | $89,055 |

| 24-Hour Trend | +1.10% |

For institutional participants, this analysis questions the narrative of corporate Bitcoin adoption as a straightforward treasury strategy. The concentration of purchases at $113,105 suggests herd behavior rather than strategic accumulation, potentially creating a supply overhang if these positions are liquidated. Retail investors face indirect exposure through publicly traded companies like SWC, whose 90% stock decline demonstrates how corporate Bitcoin strategies can amplify equity volatility.

The broader implication concerns Bitcoin's maturation as an institutional asset. According to SEC disclosure requirements, publicly traded companies must report material cryptocurrency holdings, creating transparency but also market pressure during downturns. This contrasts with private accumulation strategies that face less immediate scrutiny.

Market analysts on X/Twitter express divided views. Bulls argue these unrealized losses represent temporary paper losses that will reverse in the next cycle, pointing to similar patterns in previous corporate adoption waves. Bears highlight the concentration risk, noting that 13 companies accumulating at nearly identical price points suggests poor timing rather than strategic diversification. Quantitative analysts question whether the $113,105 average represents intelligent accumulation or simply chasing the 2025 rally peak.

Bullish Case: If Bitcoin holds the $82,000 Fibonacci support and reclaims $95,500, the UK corporate losses become irrelevant as paper losses. Market structure suggests a potential gamma squeeze above $95,000 could trigger short covering, with a measured move target to $105,000. This scenario assumes the extreme fear sentiment represents a contrarian buying opportunity rather than fundamental deterioration.

Bearish Case: A break below $82,000 invalidates the bullish structure and likely triggers stop-loss selling from both retail and institutional positions. The next significant support sits at $75,000, which represents the 0.618 Fibonacci retracement and the 200-day moving average. In this scenario, UK corporate losses could deepen to 30-35%, potentially forcing some positions to liquidate for accounting or regulatory reasons.

1. Which UK companies bought Bitcoin at $113K?The Telegraph analysis identified 13 publicly traded British firms, specifically naming Satsuma Technology and Smarter Web Company (SWC) among them.

2. How much Bitcoin do UK companies own?The 13 companies analyzed hold approximately 4,300 BTC collectively, purchased at an average price of $113,105.

3. What happens if Bitcoin price drops further?Additional declines would increase unrealized losses, potentially triggering margin calls or forced liquidations if companies used leverage, though most appear to hold outright.

4. Is this similar to MicroStrategy's Bitcoin strategy?Superficially yes, but MicroStrategy employed dollar-cost averaging over several years, while UK firms appear to have made concentrated purchases near market peaks.

5. How does this affect Bitcoin's long-term outlook?Market structure suggests corporate adoption waves typically experience initial losses before eventual profitability in subsequent cycles, though timing and entry points remain critical variables.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.