Loading News...

Loading News...

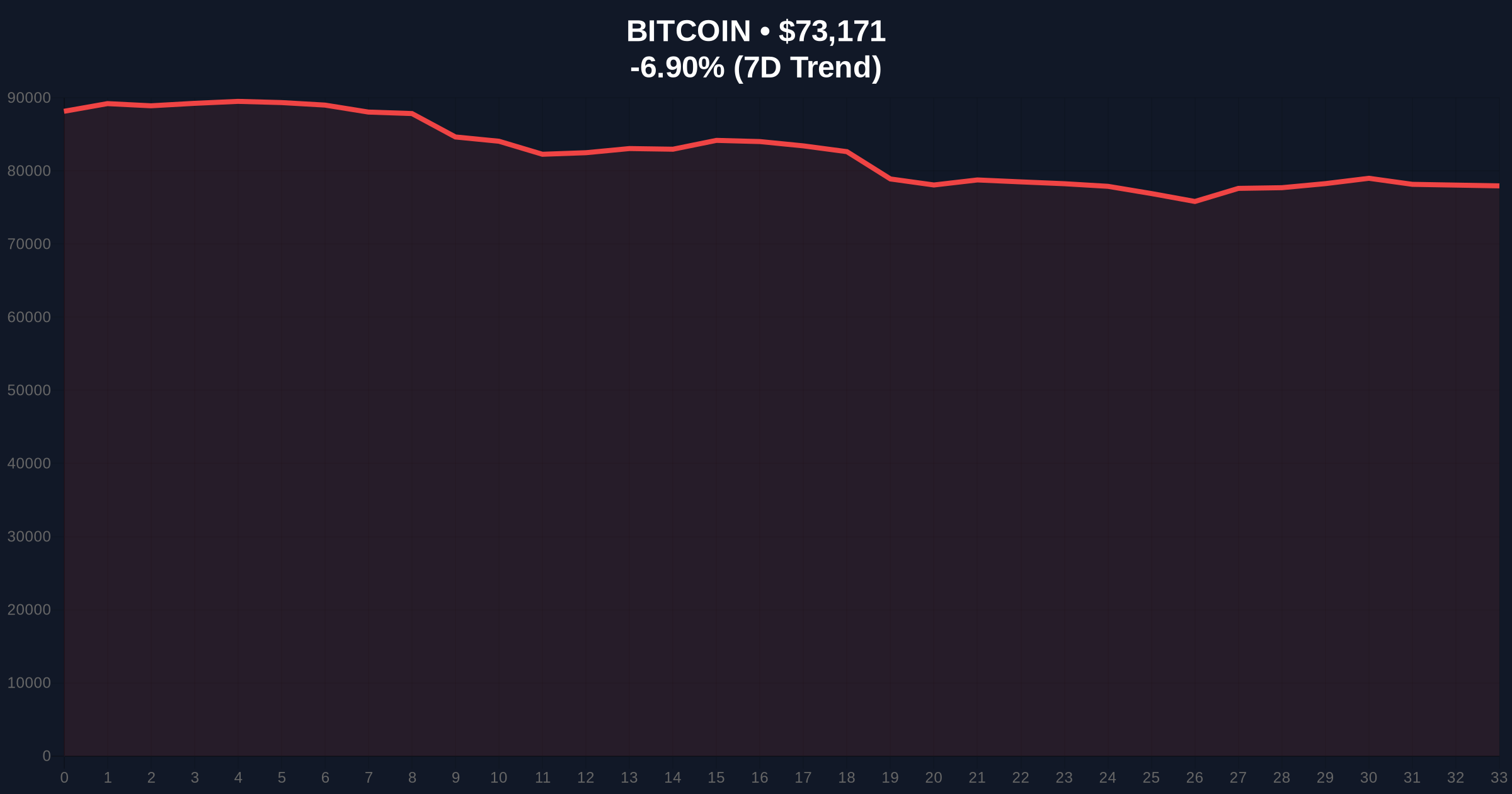

VADODARA, February 3, 2026 — Bitcoin has shattered the $75,000 support level for the first time since April 2025. According to Glassnode, large-scale holders have net sold 50,181 BTC over two weeks. This whale exodus creates a significant liquidity grab. Market structure suggests continued bearish pressure until accumulation patterns reverse.

Glassnode on-chain data reveals precise selling patterns. Addresses holding 10-10,000 BTC executed the 50,181 BTC sell-off. These entities control over two-thirds of Bitcoin's total supply. Their coordinated selling represents a massive supply shock. Consequently, Bitcoin price collapsed through the $75,000 psychological barrier.

In contrast, small-scale investors accumulated. Wallets holding less than 0.01 BTC bought the dip. However, their volume remains insufficient to counter whale selling. Glassnode analysts confirm this imbalance. They state Bitcoin will likely remain bearish until whales resume accumulation. This divergence creates a classic market structure conflict.

Historically, whale selling at this scale precedes significant corrections. The April 2025 tariff-induced decline saw similar patterns. That event triggered a 22% correction over three weeks. Current selling volume exceeds those levels. Market analysts note parallels to the 2021 cycle's distribution phase.

Underlying this trend is extreme market fear. The Crypto Fear & Greed Index sits at 17/100. This indicates panic selling and capitulation. , recent futures liquidations have exacerbated the downward pressure. For context, $226 million in futures were liquidated during this decline. Similar events occurred with $125 million in liquidations last month.

Market structure shows a clear breakdown. The $75,000 level served as major support since Q4 2025. Its breach creates a Fair Value Gap (FVG) between $74,800 and $75,200. This gap now acts as resistance. Price currently tests the Fibonacci 0.618 retracement at $72,300.

RSI readings indicate oversold conditions at 28. However, momentum remains negative. The 50-day moving average has crossed below the 200-day MA. This signals potential trend reversal. Volume profile analysis shows highest trading volume at $73,500. This creates a critical order block. A break below triggers further downside.

| Metric | Value | Significance |

|---|---|---|

| Bitcoin Current Price | $73,166 | Below critical $75K support |

| 24-Hour Price Change | -6.90% | Significant downward momentum |

| Whale Selling (2 weeks) | 50,181 BTC | ~$3.67 billion in selling pressure |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Panic selling environment |

| Market Rank | #1 | Maintains dominance despite sell-off |

This event tests Bitcoin's institutional adoption thesis. Large holders represent institutional capital. Their selling suggests profit-taking or risk reduction. According to Federal Reserve data, tightening monetary policy often triggers such behavior. The current macro environment mirrors 2022 conditions.

Retail accumulation cannot offset this selling. Small wallets lack the capital depth. This creates a structural imbalance. Market analysts warn of potential cascading liquidations. The gamma squeeze potential diminishes as options markets reprice volatility. Consequently, the 5-year horizon now faces a stress test.

"Whale distribution at these levels signals profit-taking after the 2025 rally. The $75,000 break creates a technical vacuum. Until we see UTXO age bands indicating renewed accumulation, the path of least resistance remains downward. Retail buying provides minor support but lacks scale." — CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge from current data. Both depend on whale behavior and technical levels.

The 12-month outlook depends on EIP-4844 implementation and ETF flows. Institutional interest remains despite short-term selling. However, continued whale distribution could extend the correction phase through Q2 2026. Market structure suggests consolidation between $71,800 and $76,500 until clearer signals emerge.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.