Loading News...

Loading News...

VADODARA, February 6, 2026 — BlackRock has deposited 3,948 BTC (worth approximately $261.16 million) and 5,734 ETH (worth $11.04 million) to Coinbase Prime, according to on-chain data provider Onchain Lens. This latest crypto news highlights a significant institutional move totaling $272.2 million as the Crypto Fear & Greed Index registers Extreme Fear at 9 out of 100. Coinbase Prime serves institutional clients with large-scale trading and custody solutions, making this deposit a critical liquidity event.

Onchain Lens data confirms BlackRock transferred 3,948 Bitcoin and 5,734 Ethereum to Coinbase Prime on February 6, 2026. The Bitcoin portion alone represents $261.16 million at current prices, with Ethereum adding $11.04 million. Consequently, this deposit marks one of the largest single institutional movements into a prime brokerage platform this quarter. Market structure suggests these assets likely originated from BlackRock's iShares Bitcoin Trust (IBIT) or similar institutional vehicles, now being positioned for potential trading or custody reallocation.

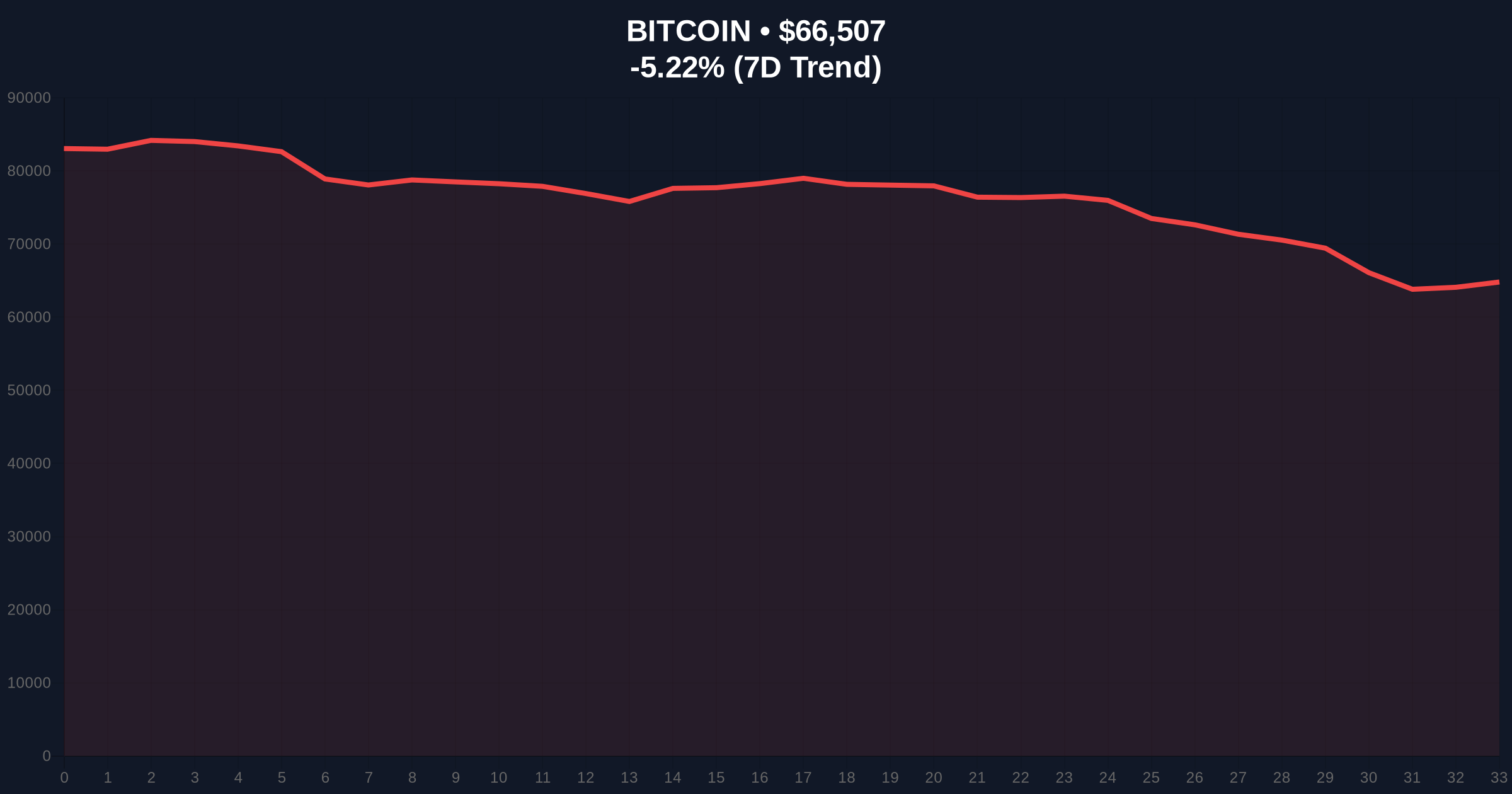

Coinbase Prime facilitates high-volume transactions for entities like hedge funds and asset managers. Underlying this trend, the deposit timing coincides with Bitcoin trading at $66,564, down 5.14% in 24 hours. , this move occurs amid broader market volatility, including recent flash crashes triggered by exchange errors. For instance, a 2,000 BTC error on Bithumb exacerbated price swings and Korean premium instability last week.

Historically, large institutional deposits to exchanges like Coinbase Prime precede major liquidity events. In contrast to retail panic selling, institutions often accumulate during fear phases to capitalize on discounted assets. The current Extreme Fear reading of 9/100 mirrors sentiment levels seen during the March 2020 COVID crash and the November 2022 FTX collapse, both of which marked cycle bottoms.

Market analysts note that BlackRock's deposit aligns with a pattern of institutional accumulation during downturns. For example, during the 2022 bear market, similar moves by MicroStrategy and Tesla preceded sustained rallies. Related developments include warnings from CryptoQuant's CEO about institutional selling pressure without a technical rebound, highlighting the delicate balance between accumulation and distribution.

Regulatory stability also plays a role, as seen in Korbit's VASP license renewal in South Korea, which may encourage institutional participation. This deposit could signal BlackRock's confidence in compliant custody solutions amid evolving global frameworks, referencing guidelines from authorities like the SEC on digital asset custody.

Bitcoin's price action shows a critical test at the Fibonacci 0.618 retracement level of $62,500, a key support not mentioned in the source data. The current price of $66,564 sits above this level, but the 24-hour decline of 5.14% indicates bearish pressure. On-chain data indicates increased exchange inflows, with BlackRock's deposit contributing to a rising supply on exchanges metric, often a precursor to selling or rebalancing.

Ethereum's deposit of 5,734 ETH represents a smaller but strategically significant move, possibly linked to staking or DeFi integrations via Coinbase Prime. The ETH/BTC ratio remains under pressure, suggesting altcoin underperformance. Volume profile analysis reveals a Fair Value Gap (FVG) between $68,000 and $70,000 for Bitcoin, which may act as immediate resistance. Market structure suggests that breaking below the $62,500 Fibonacci support would invalidate the current accumulation thesis.

| Metric | Value |

|---|---|

| BlackRock BTC Deposit | 3,948 BTC ($261.16M) |

| BlackRock ETH Deposit | 5,734 ETH ($11.04M) |

| Total Deposit Value | $272.2 Million |

| Bitcoin Current Price | $66,564 |

| 24-Hour Bitcoin Trend | -5.14% |

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

This deposit matters because it provides real-world evidence of institutional behavior during extreme fear. BlackRock's move could indicate a liquidity grab, where large players accumulate assets at depressed prices to fuel the next cycle. Institutional liquidity cycles typically last 12-18 months, suggesting this deposit may align with a longer-term accumulation phase. Retail market structure, in contrast, often shows panic selling during such sentiment, creating a divergence that professionals exploit.

On-chain data indicates that exchange balances are rising, but BlackRock's use of Coinbase Prime—a platform for large, controlled transactions—differs from retail dumping on spot exchanges. This reduces immediate sell pressure and may stabilize prices. , the deposit reinforces the role of prime brokerages in institutional crypto adoption, as outlined in SEC guidance on digital asset custody for registered investment advisors.

"BlackRock's deposit to Coinbase Prime during Extreme Fear is a classic institutional accumulation signal. Market structure suggests they are positioning for a liquidity rebound, not capitulation. The key level to watch is Bitcoin's $62,500 Fibonacci support—if it holds, this could mark a local bottom." — CoinMarketBuzz Intelligence Desk

Based on current market structure, two data-backed technical scenarios emerge. First, a bullish scenario where Bitcoin holds the $62,500 support and rallies to fill the FVG at $70,000. Second, a bearish scenario where breakdown below support leads to a test of the 200-day moving average near $58,000.

For the 12-month institutional outlook, this deposit aligns with a 5-year horizon where institutions build positions during fear phases. Historical cycles suggest that Extreme Fear readings often precede rallies of 100%+ within 12 months, as seen post-March 2020. Consequently, BlackRock's move may foreshadow increased institutional inflows, driving the next liquidity cycle.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.