Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 26, 2026 — BlackRock has filed for a Bitcoin Premium Income ETF with the SEC, marking a strategic expansion in institutional crypto products. This latest crypto news reveals the asset manager's push into income-generating Bitcoin strategies amid a market gripped by extreme fear. According to Bloomberg ETF analyst Eric Balchunas, the fund will use a covered call approach on Bitcoin, registered as a spot product under U.S. securities law.

BlackRock submitted an S-1 application to the SEC for a Bitcoin Premium Income ETF. The filing details a covered call strategy. This involves buying Bitcoin while selling call options to generate regular income. The fund builds on BlackRock's existing spot Bitcoin ETF (IBIT). It aims to attract yield-seeking investors. The ticker and management fees remain undisclosed. BlackRock registered an entity for this ETF in Delaware last September. Market structure suggests this move targets institutional portfolios needing predictable cash flows.

Historically, covered call ETFs in traditional markets often signal mature product cycles. In contrast, Bitcoin's volatility typically discourages such income strategies. This filing contradicts the current extreme fear sentiment, where the Crypto Fear & Greed Index sits at 20/100. Underlying this trend, institutional adoption has accelerated since the 2024 spot ETF approvals. However, on-chain data indicates retail investors are capitulating. This divergence creates a potential liquidity grab by large players. For context, similar income products emerged in gold ETFs after years of mainstream acceptance.

Related Developments:

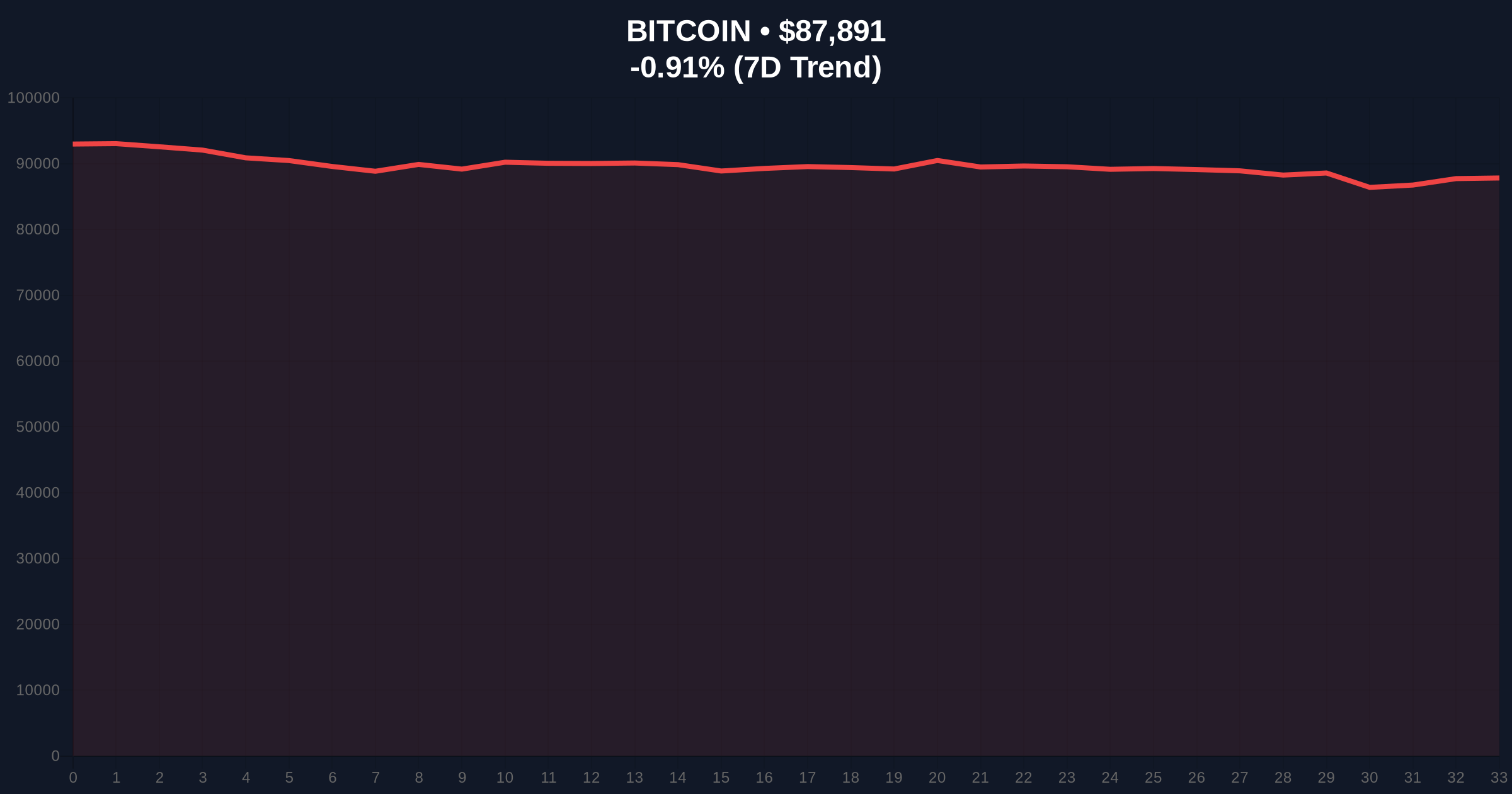

Bitcoin currently trades at $87,906, down 0.85% in 24 hours. The price action shows a consolidation pattern near the 50-day moving average. A critical Fibonacci support level at $85,000 (0.618 retracement from recent highs) must hold to maintain bullish structure. RSI readings hover near 45, indicating neutral momentum. Order block analysis reveals significant liquidity pools between $84,000 and $86,000. A break below this zone would create a fair value gap (FVG) likely to be filled. Volume profile data shows weak retail participation, supporting the institutional narrative.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitcoin Current Price | $87,906 |

| 24-Hour Price Change | -0.85% |

| Bitcoin Market Rank | #1 |

| Key Technical Support | $85,000 (Fibonacci 0.618) |

This ETF filing matters for Bitcoin's 5-year horizon. It introduces a yield component to Bitcoin investing. Institutional liquidity cycles often follow product innovation. A covered call strategy could dampen volatility, attracting conservative capital. However, it may also cap upside potential during rallies. Market analysts note that such products typically emerge when asset classes reach saturation. This could signal a top in retail enthusiasm. On-chain data indicates declining exchange reserves, suggesting accumulation. The SEC's approval process, detailed on SEC.gov, will be critical for timeline and structure.

"The covered call strategy reflects institutional demand for Bitcoin yield, but it introduces complexity in a market known for simplicity. Historical cycles suggest income products often precede consolidation phases, as seen in traditional ETF evolution." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data.

The 12-month institutional outlook hinges on ETF approval and adoption. If approved, this product could attract billions in assets under management, stabilizing Bitcoin's price action. However, regulatory delays or rejections may exacerbate current fear. Long-term, this filing aligns with Bitcoin's maturation as an institutional asset class, but short-term price action remains tied to macroeconomic factors and on-chain flows.