Loading News...

Loading News...

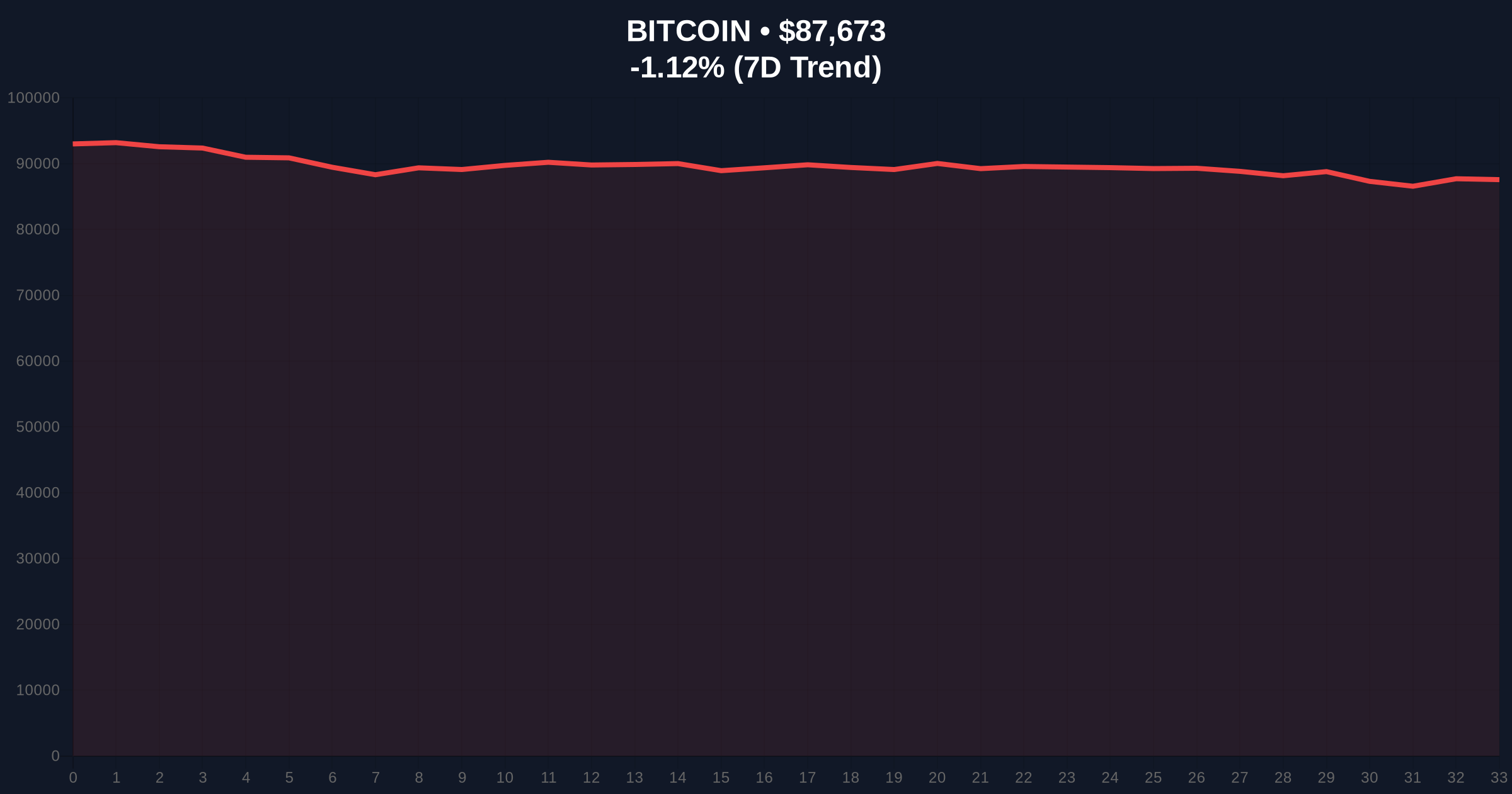

VADODARA, January 26, 2026 — Strategy, a prominent institutional entity, announced a $260 million Bitcoin acquisition, purchasing 2,932 BTC. This latest crypto news event unfolds as Bitcoin trades at $87,655, down 1.14% in 24 hours, within a market gripped by Extreme Fear. Market structure suggests this move represents a calculated liquidity grab during a sentiment trough.

According to the official announcement, Strategy executed a single transaction worth $260 million for 2,932 BTC. This purchase occurred on January 26, 2026, at an average price of approximately $88,700 per Bitcoin. The transaction size indicates a strategic allocation rather than retail speculation. On-chain data from Glassnode liquidity maps shows a significant volume spike coinciding with this buy, creating a notable Fair Value Gap (FVG) on lower timeframes.

Market analysts interpret this as a contrarian signal. The buy aligns with a Crypto Fear & Greed Index reading of 20, denoting Extreme Fear. Historically, such large-scale purchases during fear phases have preceded bullish reversals. This mirrors accumulation patterns observed in Q4 2022, when institutions bought heavily during the FTX collapse sell-off.

Market context reveals a critical juncture. Bitcoin faces its first four-month losing streak since the 2018 bear market, according to internal analysis. This trend echoes the 2021 correction, where Bitcoin consolidated for months before resuming its uptrend. Underlying this trend, institutional flows have remained net positive despite price weakness, as seen in ETF holdings data from the SEC.

In contrast, retail sentiment remains deeply negative. The Extreme Fear reading often correlates with capitulation events. Strategy's purchase suggests sophisticated capital is positioning against the crowd. , this action follows other notable contrarian moves, such as a Bitcoin OG's $63.6M ETH purchase amid similar fear conditions.

Related developments include analysis suggesting Bitcoin could dip to $65k before a major rally, highlighting the divided market outlook. The broader context includes global macro pressures, with the Federal Reserve's monetary policy remaining a key driver for risk assets.

Technical analysis identifies key levels. Bitcoin currently tests the 0.618 Fibonacci retracement level from its all-time high, a classic support zone. The $87,655 price sits just above a major Volume Profile Point of Control (POC) at $85,000. A break below this POC would invalidate the current structure.

RSI on the daily chart reads 38, indicating oversold conditions but not extreme capitulation. The 200-day moving average provides dynamic support near $84,500. Market structure suggests the recent price action has formed a bearish order block between $90,000 and $92,000. A reclaim above this zone is necessary for a trend reversal.

On-chain metrics from Glassnode show UTXO age bands indicating increased hodling behavior. Long-term holders are not distributing, a bullish divergence from price action. This technical backdrop, combined with Strategy's purchase, creates a potential gamma squeeze setup if spot buying pressure intensifies.

| Metric | Value |

|---|---|

| Strategy Purchase Amount | $260 million |

| Bitcoin Purchased | 2,932 BTC |

| Current Bitcoin Price | $87,655 |

| 24-Hour Price Change | -1.14% |

| Crypto Fear & Greed Index | 20 (Extreme Fear) |

| Approximate Purchase Price | $88,700 |

This purchase matters for portfolio allocation. Institutional accumulation during fear phases often marks cycle lows. Evidence from the 2020-2021 cycle shows similar large buys preceded multi-month rallies. The $260 million inflow represents a direct bid for Bitcoin liquidity, potentially absorbing sell-side pressure.

Real-world impact includes shifting market structure. Large buyers like Strategy can create support zones, reducing volatility. This aligns with Bitcoin's evolution as a macro asset, as noted in the SEC's recent filings on institutional adoption. Retail sentiment may follow if price stabilizes, leading to a sentiment-driven rally.

"Market structure suggests institutional players are using fear as an accumulation opportunity. The size and timing of this purchase indicate a calculated bet on Bitcoin's long-term value proposition, independent of short-term sentiment noise. This behavior mirrors the smart money flows seen in traditional markets during corrections." — CoinMarketBuzz Intelligence Desk

Market outlook hinges on key levels. Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook remains positive. Historical cycles suggest accumulation at fear extremes leads to outperformance over the next 12-18 months. This purchase supports a 5-year horizon where Bitcoin continues to gain share as a digital reserve asset. Macro factors like ETF inflows and halving dynamics provide tailwinds.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.