Loading News...

Loading News...

VADODARA, February 2, 2026 — Russia's largest Bitcoin mining company, BitRiver, faces imminent bankruptcy. This latest crypto news follows a creditor petition from energy giant En+. Market structure suggests a liquidity grab in the mining sector. On-chain data indicates stress among high-cost producers.

Local media outlet Kommersant first reported the bankruptcy risk. According to the report, En+ filed a bankruptcy petition against BitRiver. The energy firm claims unpaid debts totaling 700 million rubles ($9.2 million). This includes an advance and penalty fee.

No recoverable assets were found during initial assessments. Negotiations now focus on transferring company ownership. Investors and creditors are involved in these talks. The situation highlights operational fragility in energy-intensive industries.

Historically, mining bankruptcies signal local hash rate redistribution. In contrast, they rarely cause long-term network damage. Bitcoin's hash rate often migrates to lower-cost regions. Underlying this trend is the relentless search for cheap power.

Russia represented a key mining hub post-2022. Its cold climate and subsidized energy attracted capital. BitRiver's potential failure mirrors China's 2021 mining ban exodus. Consequently, hash rate may shift to Kazakhstan or the Middle East.

Related Developments:

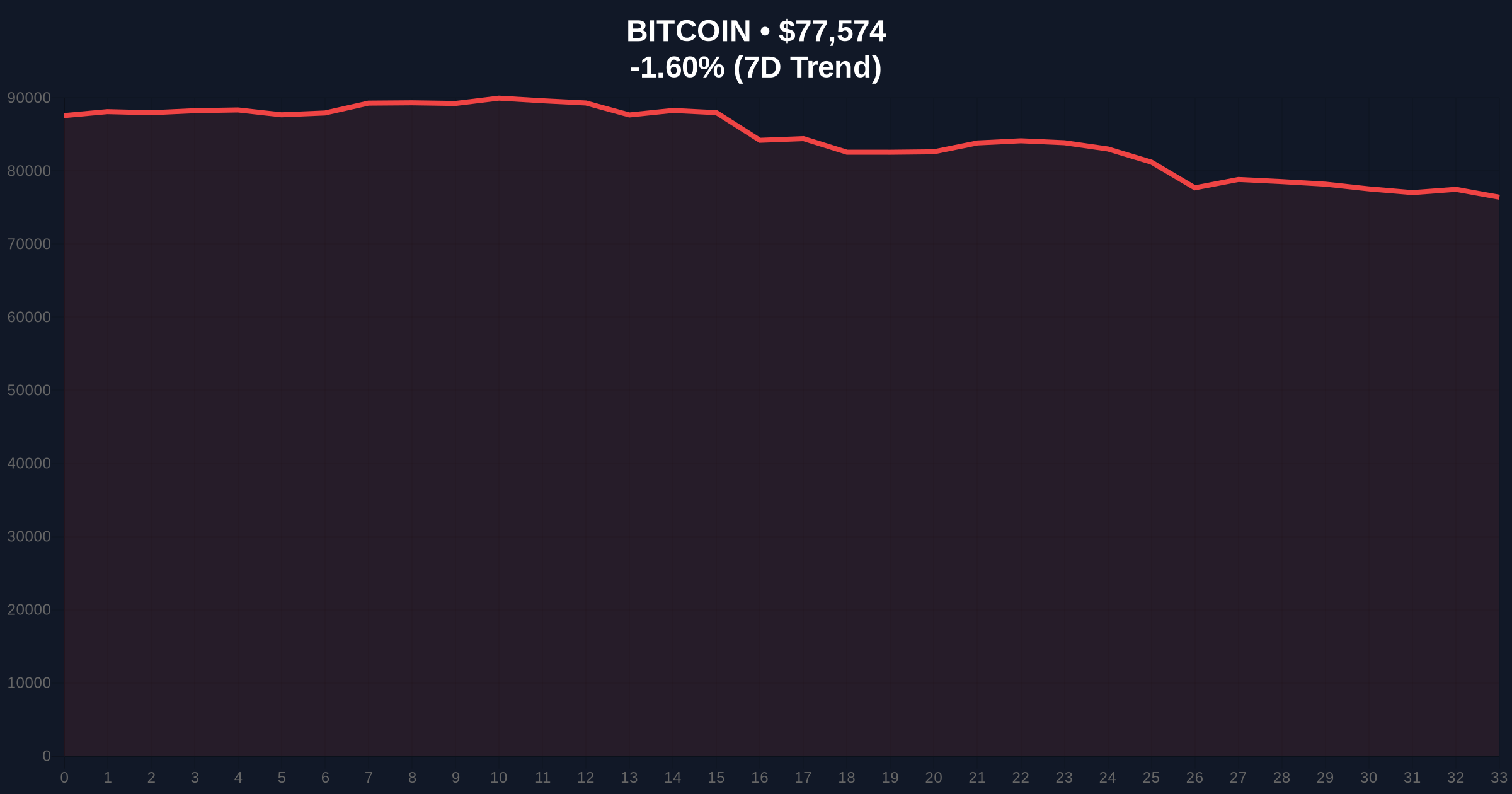

Bitcoin currently trades at $77,615. The 24-hour trend shows a -1.55% decline. Market structure suggests a test of the $75,000 support cluster. This level aligns with the 0.618 Fibonacci retracement from the 2025 high.

A break below $75,000 would create a significant Fair Value Gap (FVG). This FVG could target $70,000. The Relative Strength Index (RSI) sits at 38, indicating neutral momentum. The 50-day moving average acts as dynamic resistance near $80,000.

Mining difficulty adjustments, a core Bitcoin technical parameter, may soften if hash rate exits Russia. According to Bitcoin's official documentation, the network self-corrects every 2016 blocks. This mechanism ensures stability despite regional shocks.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically a contrarian buy signal |

| Bitcoin Current Price | $77,615 | Testing critical support zone |

| 24-Hour Price Change | -1.55% | Reflects ongoing market pressure |

| BitRiver Debt Claim | $9.2 million | Highlights energy cost sensitivity |

| Bitcoin Market Rank | #1 | Dominance remains intact |

BitRiver's collapse threatens Russia's mining dominance. The country contributed an estimated 15% of global hash rate. A shutdown could temporarily reduce network security. However, Bitcoin's decentralized architecture mitigates systemic risk.

Institutional liquidity cycles focus on operational efficiency. High-energy-cost miners face margin compression. Retail market structure often misprices these events. Consequently, volatility spikes around such announcements.

, this event the importance of sustainable energy sourcing. Miners must hedge against volatile electricity prices. Long-term contracts and renewable integration become critical. The Ethereum network's transition to proof-of-stake highlights alternative consensus mechanisms.

"Mining bankruptcies are liquidity events, not network failures. They redistribute hash rate to more efficient operators. Market participants should monitor the 90-day hash ribbon metric for capitulation signals. The current extreme fear reading often precedes a relief rally." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Mining reshuffling typically strengthens network resilience. Long-term, Bitcoin's hash rate recovers and grows. This aligns with the 5-year horizon of increasing institutional adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.