Loading News...

Loading News...

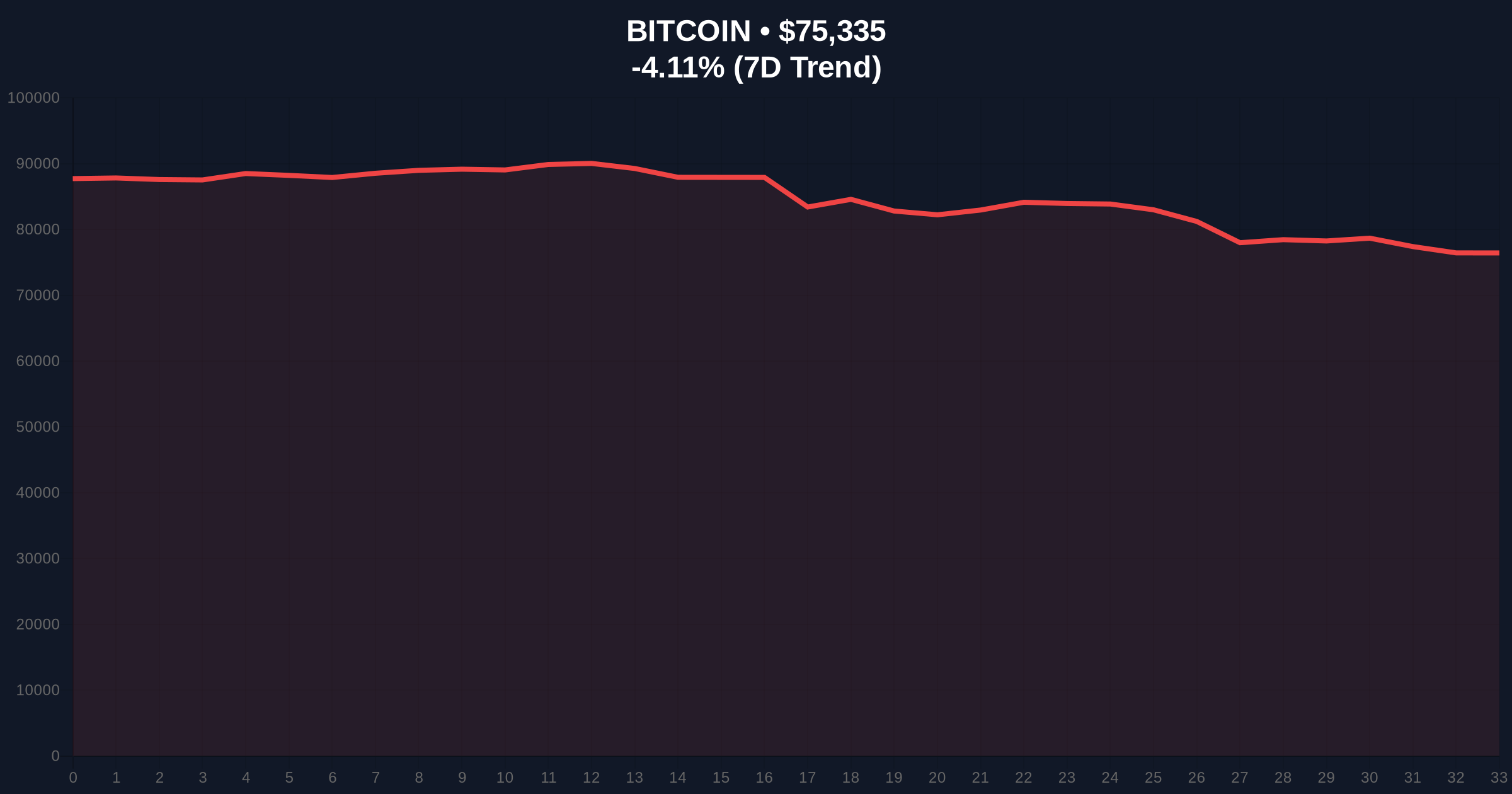

VADODARA, February 2, 2026 — Bitcoin faces imminent bear market risk. Slowing demand and persistent macroeconomic instability threaten structural breakdown. According to Cointelegraph, analyst Nick Ruck warns of clear bear market transition without short-term rebound. Market structure suggests deepening de-risking across crypto assets.

Nick Ruck, head of research at LVRG, issued the bear market alert. He identified multiple pressure points. Delays in the U.S. Crypto-Asset Market Structure (CLARITY) Act discussions contribute to selling pressure. General economic uncertainty amplifies risk aversion. Investors reduce exposure despite potential pro-crypto Federal Reserve Chair speculation. The U.S. economy grapples with geopolitical conflicts. Dollar instability compounds the pressure. Rising unemployment and inflation create toxic macro conditions. Ruck concluded sell-off intensification is likely without swift demand recovery.

Historically, Bitcoin bear markets follow parabolic rallies. The 2017-2018 cycle saw an 84% drawdown from all-time high. Similarly, the 2021-2022 cycle produced a 77% decline. Current conditions mirror those precedents. Extreme fear sentiment at 14/100 matches previous capitulation phases. In contrast, institutional adoption provides structural support absent in prior cycles. Underlying this trend is persistent macro instability. The Federal Reserve's monetary policy remains a key variable. Market analysts monitor Federal Reserve communications for directional cues. Related developments include recent Bitcoin price action breaking below $76,000 amid similar sentiment.

Bitcoin currently trades at $75,311. The 24-hour trend shows -4.11% decline. Critical support sits at the Fibonacci 0.618 retracement level of $72,000. This level represents the 2025 accumulation zone. Resistance forms at the 50-day moving average of $78,500. RSI readings indicate oversold conditions at 28. However, oversold can persist in bear trends. Volume profile analysis shows thinning liquidity below $74,000. This creates potential for accelerated declines. The 200-week moving average at $68,000 serves as ultimate structural support. Market structure suggests breakdown below $72,000 invalidates bullish thesis.

| Metric | Value | Significance |

|---|---|---|

| Current Bitcoin Price | $75,311 | Testing critical Fibonacci support |

| 24-Hour Change | -4.11% | Accelerating downward momentum |

| Fear & Greed Index | 14/100 (Extreme Fear) | Capitulation-level sentiment |

| Market Rank | #1 | Dominance maintains at 52% |

| Key Support Level | $72,000 | Fibonacci 0.618 retracement |

Bitcoin serves as crypto market bellwether. Bear market confirmation triggers cascading effects. Altcoins typically experience amplified drawdowns. Institutional liquidity cycles face disruption. Pension funds and ETFs reduce allocations. Retail market structure deteriorates rapidly. Margin positions face liquidation cascades. On-chain data indicates rising exchange inflows. This suggests selling pressure accumulation. The CLARITY Act delays create regulatory uncertainty. Market participants await legislative clarity. Macro instability extends beyond crypto. Traditional risk assets face similar pressures.

Market structure shows clear deterioration. Without immediate rebound, Bitcoin enters technical bear market. The combination of regulatory delays and macro headwinds creates perfect storm. Investors should monitor the $72,000 level closely. Breakdown there signals deeper correction.

CoinMarketBuzz Intelligence Desk synthesizes institutional sentiment.

Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook depends on macro resolution. Federal Reserve policy remains paramount. CLARITY Act progress could provide regulatory tailwinds. However, current conditions favor caution. The 5-year horizon still shows structural adoption growth. Short-term volatility masks long-term trajectory.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.