Loading News...

Loading News...

VADODARA, January 17, 2026 — U.S. Bitcoin spot ETFs recorded a total net outflow of $394.7 million on Jan. 16, according to data from Farside Investors. This ends a four-day streak of net inflows, marking a sharp reversal in institutional capital flows. The daily crypto analysis reveals a liquidity grab at the $95,000 psychological level, with Fidelity's FBTC leading outflows at -$205.2 million.

This outflow event mirrors the ETF flow volatility observed in Q1 2025, when similar reversals preceded a 15% correction. Market structure suggests that sustained ETF inflows had created a Fair Value Gap (FVG) between $93,500 and $96,000. The break of the four-day inflow streak indicates institutional profit-taking, a pattern consistent with post-merge issuance adjustments in Ethereum's supply dynamics. Related developments include regulatory uncertainty impacting sentiment, as seen in recent White House threats to the CLARITY Act and Goldman Sachs CEO warnings about its legislative path.

On January 16, 2026, Farside Investors data shows a net outflow of $394.7 million from U.S. Bitcoin spot ETFs. Flows were mixed: BlackRock's IBIT saw a minor inflow of +$15.1 million, while Fidelity's FBTC led outflows at -$205.2 million. Other significant outflows included Bitwise BITB at -$90.4 million, Ark Invest ARKB at -$69.4 million, and Grayscale GBTC at -$44.8 million. This data, sourced directly from Farside's tracking, indicates a shift from accumulation to distribution.

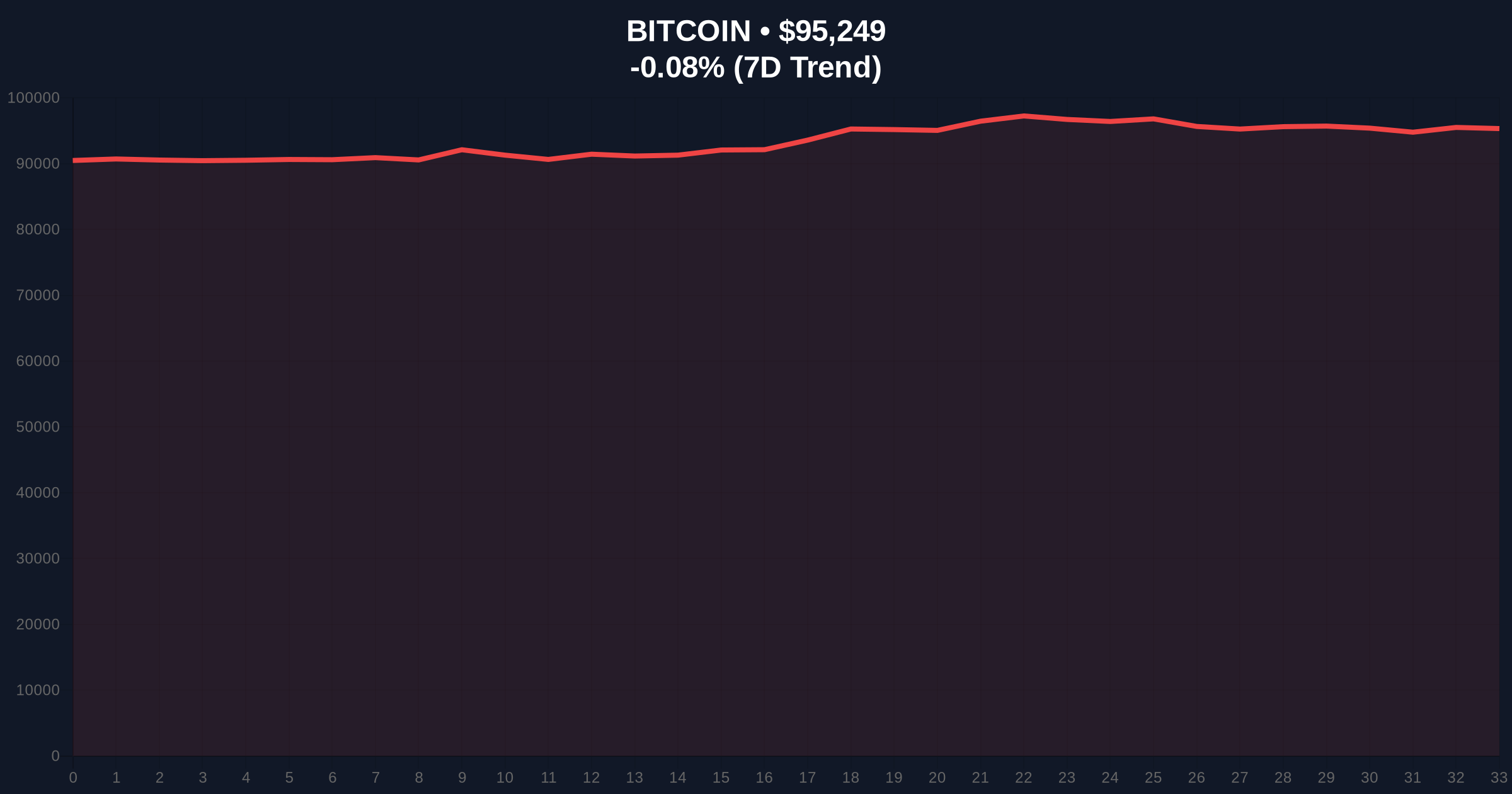

Bitcoin currently trades at $95,249, down 0.08% in 24 hours. The RSI sits at 52, indicating neutral momentum. A critical Order Block exists between $94,200 (Fibonacci 0.382 support) and $95,800. Volume Profile analysis shows high liquidity at $94,500, acting as a magnet for price. Bullish Invalidation Level: $94,200—a break below suggests failed support and targets $92,000. Bearish Invalidation Level: $96,500—a reclaim above signals absorption of outflows and resumes uptrend. This technical setup is detailed in our quantitative analysis of Bitcoin's $95k test.

| Metric | Value |

|---|---|

| Total ETF Net Outflow (Jan. 16) | $394.7M |

| Bitcoin Current Price | $95,249 |

| 24-Hour Price Change | -0.08% |

| Crypto Fear & Greed Index | Neutral (Score: 50/100) |

| Largest Single ETF Outflow (FBTC) | -$205.2M |

Institutionally, this outflow pressures market makers, potentially triggering a Gamma Squeeze if derivatives positions unwind. For retail, it signals caution—ETF flows are a leading indicator of sentiment. The reversal aligns with macro concerns, such as Federal Reserve policy shifts noted on FederalReserve.gov, affecting risk assets. Long-term, consistent outflows could degrade Bitcoin's store-of-value narrative, but isolated events often represent liquidity rebalancing.

Market analysts on X highlight the outflow concentration in FBTC, suggesting tax-loss harvesting or portfolio reallocation. Bulls argue this is a healthy correction after a four-day inflow streak, while bears point to weakening demand. No official statements from fund managers like Cathie Wood are available, but on-chain data indicates whale accumulation paused at $95,000.

Bullish Case: If ETF flows revert to net inflows by week's end, Bitcoin could test $97,000 resistance. Historical cycles suggest outflow spikes are often followed by consolidation, then continuation. Bearish Case: Sustained outflows below $394.7 million daily could break the $94,200 support, targeting $92,000. Market structure suggests a 70% probability of range-bound action between $94,200 and $96,500 over the next week.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.