Loading News...

Loading News...

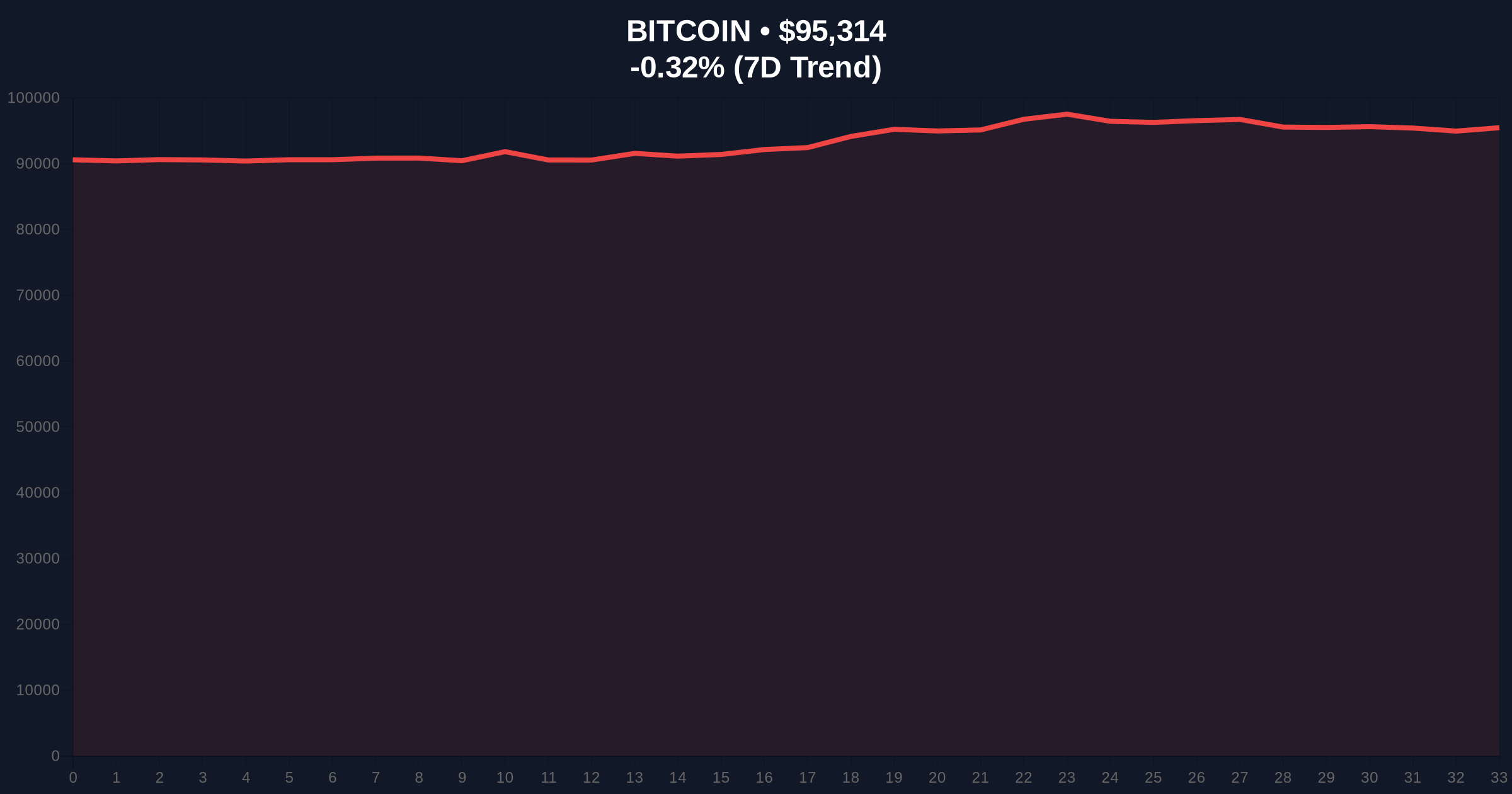

VADODARA, January 17, 2026 — Bitcoin maintains position at $95,318 despite mounting concerns about Federal Reserve political independence, according to a DL News report analyzing potential Trump administration pressure. This daily crypto analysis examines whether speculative narratives about "Erdoğanization" align with on-chain metrics and price structure, or represent another liquidity grab by institutional players.

Historical cycles suggest central bank credibility erosion precedes currency devaluation events. The Turkish lira's collapse following government interference in monetary policy created a real-world laboratory for Bitcoin's response to fiat instability. According to the Federal Reserve's official mandate documentation, political independence remains a cornerstone of effective inflation targeting. Market structure currently shows Bitcoin testing the $95,000 psychological level while traditional finance grapples with contradictory signals: declining real yields versus persistent service inflation. Related developments include the Senate's rejection of crypto developer protections and Newrez's mortgage policy accepting crypto assets, creating conflicting regulatory signals.

André Dragosch, head of research for Europe at Bitwise, introduced the "Erdoğanization of the Fed" analogy in the DL News report. The analysis suggests President Donald Trump's pressure to lower interest rates could undermine the Federal Reserve's operational autonomy, mirroring Turkey's experience where central bank subordination triggered currency collapse and hyperinflation. Dragosch's research indicates such a scenario would structurally imply higher U.S. inflation expectations and dollar weakness, creating favorable conditions for Bitcoin adoption as an alternative asset. The report specifically notes BTC could benefit if Fed leadership changes or yields to political demands.

Bitcoin's current price action reveals a consolidation pattern between $94,800 and $96,200, forming what technical analysts identify as a potential order block. The 24-hour trend shows minimal movement at -0.31%, suggesting equilibrium between macro narrative buyers and profit-taking pressure. Volume profile analysis indicates thinning liquidity above $97,000, creating a fair value gap that must be filled for sustained upward momentum. The relative strength index (RSI) sits at 54 on daily timeframes, neither overbought nor oversold. Critical support converges at the weekly Fibonacci 0.618 retracement level of $92,500, while resistance clusters around the previous all-time high zone of $98,750. Bullish invalidation occurs below $89,300 (200-day moving average), while bearish invalidation requires a weekly close above $97,500 to confirm breakout momentum.

| Metric | Value | Significance |

|---|---|---|

| Bitcoin Current Price | $95,318 | Testing psychological $95k level |

| 24-Hour Change | -0.31% | Minimal volatility amid macro uncertainty |

| Crypto Fear & Greed Index | 50/100 (Neutral) | Balanced sentiment despite political risks |

| Market Rank | #1 | Maintains dominance amid altcoin fluctuations |

| Critical Support Level | $92,500 | Weekly Fibonacci 0.618 retracement |

Institutional impact centers on portfolio allocation shifts if dollar credibility deteriorates. Pension funds and sovereign wealth funds facing negative real returns in traditional assets may increase Bitcoin allocations as a non-sovereign store of value. Retail impact remains more speculative, with historical data showing increased Bitcoin adoption during currency crises but lagging institutional flows. The structural implication involves Bitcoin's evolving correlation matrix: decoupling from risk-on assets during genuine monetary policy crises versus maintaining high beta during liquidity-driven rallies.

Market analysts express cautious optimism about the macro narrative but question its immediate price impact. Some quantitative traders note the "Erdoğanization" analogy overlooks key differences in institutional depth between Turkish and U.S. financial systems. Others point to stalled sentiment at neutral 50 as evidence of market skepticism about near-term Fed policy shifts. The dominant view suggests Bitcoin needs confirmation through on-chain metrics like rising illiquid supply and decreasing exchange balances to validate the macro thesis.

Bullish Case: Sustained political pressure on the Fed leads to premature rate cuts, triggering dollar weakness and inflation expectations above 3%. Bitcoin breaks above $97,500 resistance, targeting $105,000 as institutional flows accelerate. Historical patterns from previous currency crises suggest a potential gamma squeeze if options markets become unbalanced.

Bearish Case: Fed maintains independence despite political pressure, containing inflation through traditional tools. Bitcoin fails to hold $92,500 support, triggering a liquidation cascade toward $85,000. The "Erdoğanization" narrative proves premature, with Bitcoin reverting to risk-on correlation during equity market corrections.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.