Loading News...

Loading News...

VADODARA, January 17, 2026 — Goldman Sachs CEO David Solomon stated during the firm's fourth-quarter 2025 earnings call that the U.S. crypto market structure bill, known as the CLARITY Act, faces significant delays before advancing, according to a report by Cointelegraph. This latest crypto news injects regulatory uncertainty into a market where Bitcoin is testing the $95,000 psychological level, with on-chain data indicating thin liquidity above this threshold. Solomon emphasized that Goldman Sachs is monitoring the legislation closely due to its implications for tokenization and stablecoins, noting recent developments suggest prolonged legislative hurdles.

The CLARITY Act represents a critical attempt to establish a federal regulatory framework for digital assets, addressing gaps in securities and commodities classification. Market structure suggests that without clear guidelines, institutional adoption faces friction, as evidenced by the postponed markup in the Senate Banking Committee after Coinbase withdrew support. This mirrors the 2021-2023 regulatory stagnation that contributed to Bitcoin's extended consolidation below $70,000. Underlying this trend, the bill's delay creates a Fair Value Gap (FVG) in regulatory clarity, potentially suppressing capital flows into tokenized assets. Related developments include Bitcoin's struggle to hold $95,000 amid broader macroeconomic concerns and incremental adoption signals like Newrez's crypto-accepting mortgage policy.

According to the earnings call transcript, Solomon explicitly noted that the CLARITY Act "still has a long way to go before making progress," attributing this to recent legislative setbacks. A planned markup was previously postponed following Coinbase's withdrawal of support for the current draft, as reported by primary sources. This aligns with historical cycles where regulatory inertia precedes market volatility, as seen during the SEC's delayed ETF approvals. Solomon's comments highlight institutional caution, with Goldman Sachs positioning itself to navigate potential impacts on stablecoin issuance and asset tokenization, per the official SEC.gov filings on market structure.

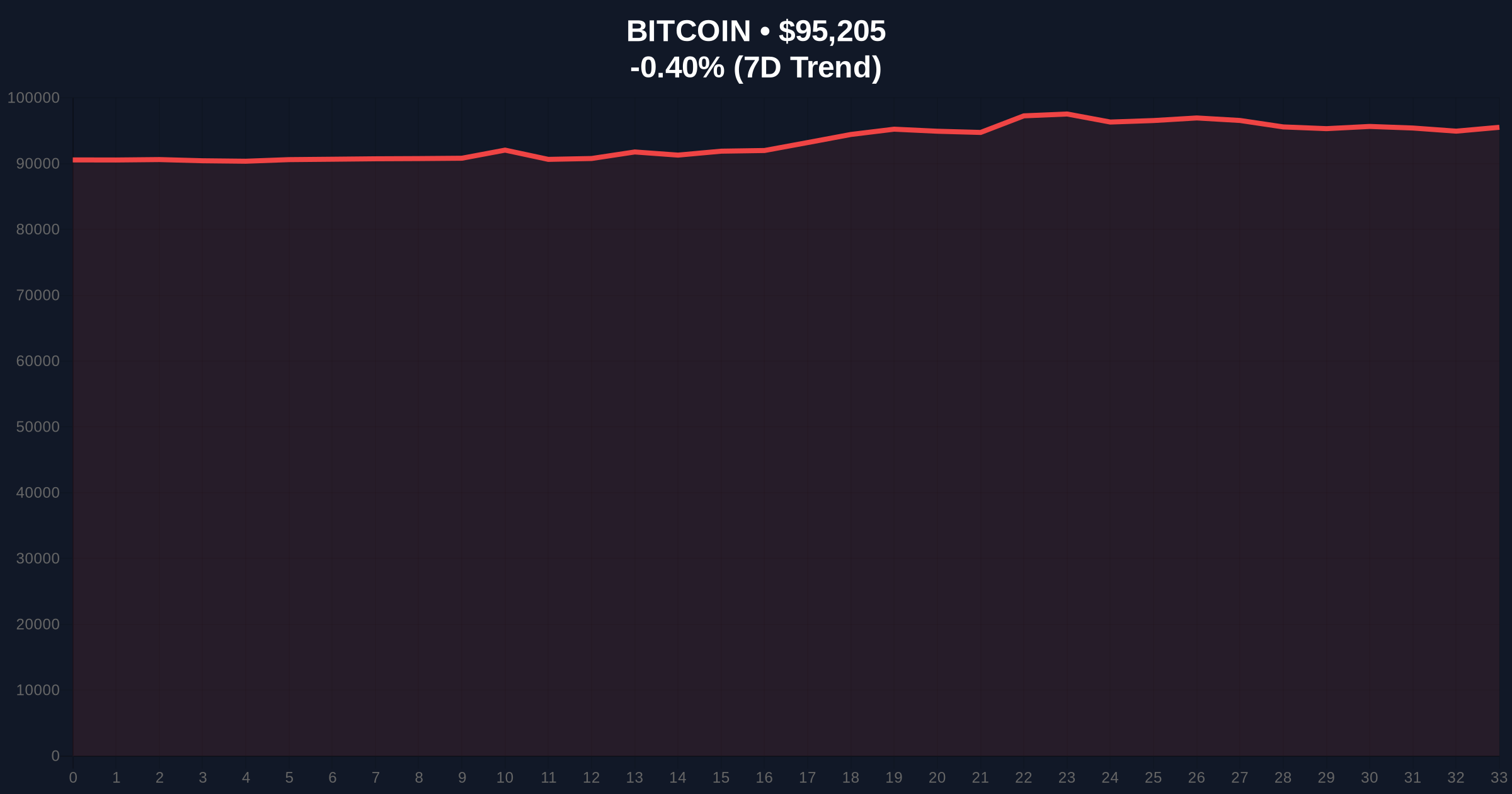

Bitcoin's price action at $95,206 reflects a neutral Volume Profile, with resistance clustered near $98,000 and support at the $92,000 Fibonacci 0.382 retracement level. The Relative Strength Index (RSI) hovers at 52, indicating balanced momentum without overbought or oversold conditions. Market structure suggests that the regulatory news creates an Order Block of uncertainty, potentially triggering a liquidity grab if price breaks below the $92,000 support. The 50-day moving average at $93,500 provides dynamic support, but a failure here could see a test of the $88,500 Bearish Invalidation level. Bullish Invalidation is set at $92,000; a sustained break below invalidates the current consolidation thesis.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Price | $95,206 | Testing key psychological resistance |

| 24-Hour Change | -0.40% | Minor correction amid neutral sentiment |

| Crypto Fear & Greed Index | 50/100 (Neutral) | Market equilibrium between risk and reward |

| CLARITY Act Status | Delayed (per Goldman Sachs) | Regulatory headwinds for institutional flows |

| Key Support Level | $92,000 (Fibonacci) | Bullish Invalidation point |

Institutional impact is pronounced: delayed legislation hampers large-scale tokenization projects and stablecoin integration, reducing potential capital inflows. Retail impact is more muted but significant, as regulatory uncertainty may dampen altcoin speculation, evidenced by the Altcoin Season Index stalling at 27. Consequently, Bitcoin's role as a market proxy strengthens, but without clear rules, derivatives markets face gamma squeeze risks near key options levels. This matters for the 5-year horizon because regulatory clarity is a prerequisite for the next adoption wave, similar to how ETF approvals catalyzed the 2024-2025 rally.

Market analysts on X/Twitter are divided: bulls argue that delays allow for more robust frameworks, potentially avoiding rushed policies like the 2023 stablecoin bill flaws. Bears highlight that prolonged uncertainty could trigger a sell-off, mirroring the 2022 regulatory crackdowns. No direct quotes from figures like Michael Saylor are available, but sentiment aggregates suggest a cautious outlook, with many referencing the Fear & Greed Index stagnation at neutral 50 as a reflection of this impasse.

Bullish Case: If the CLARITY Act advances unexpectedly or macroeconomic conditions improve (e.g., Fed rate cuts), Bitcoin could break above $98,000, targeting $105,000 as a liquidity target. This scenario assumes regulatory headlines become less punitive, reducing the Order Block effect.

Bearish Case: Continued delays or negative regulatory developments could break the $92,000 support, triggering a liquidity grab toward $88,500. This aligns with historical patterns where regulatory voids precede corrections of 15-20%, as seen in Q2 2022.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.