Loading News...

Loading News...

VADODARA, January 16, 2026 — Bitcoin has reached its most undervalued level relative to gold in historical terms, with a Z-score falling below -2, indicating a standard deviation significantly lower than its long-term average. This daily crypto analysis, based on data from Cointelegraph, suggests a high probability of a strong Bitcoin price appreciation in 2026, mirroring a similar signal in late 2022 that preceded a 150% surge. Market structure implies this extreme undervaluation could act as a precursor to a major bull market, with Bitcoin potentially outpacing gold in the coming months.

Historically, Bitcoin and gold have exhibited an inverse correlation during periods of macroeconomic uncertainty, with gold often serving as a safe-haven asset while Bitcoin behaves as a risk-on digital store of value. The current undervaluation signal emerges against a backdrop of neutral global crypto sentiment, as indicated by a Fear & Greed Index score of 49/100. Underlying this trend, on-chain data from Glassnode shows increased accumulation by long-term holders, suggesting institutional positioning ahead of potential volatility. This context is critical, as similar Z-score levels in late 2022 triggered a rebound that saw Bitcoin's price surge by nearly 150%, according to Cointelegraph's analysis. Related developments include US stock gains masking Bitcoin's liquidity grab at $95k support and the Crypto Fear & Greed Index plummeting to 49, signaling market neutrality.

According to Cointelegraph, the Z-score comparing Bitcoin and gold prices has dropped below -2, a level that indicates Bitcoin is trading at more than two standard deviations below its long-term average relative to gold. This metric, derived from historical price data, serves as a quantitative measure of undervaluation. The analysis notes that after a similar signal appeared in late 2022, Bitcoin's price increased by approximately 150%, providing a precedent for rebounds beginning at this Z-score threshold. Consequently, the current condition suggests Bitcoin is positioned for a potential bullish turn, with price appreciation likely to exceed that of gold in the near term. This aligns with broader market observations, such as those from the Federal Reserve's economic data, which show persistent inflation pressures that historically benefit hard assets like Bitcoin and gold.

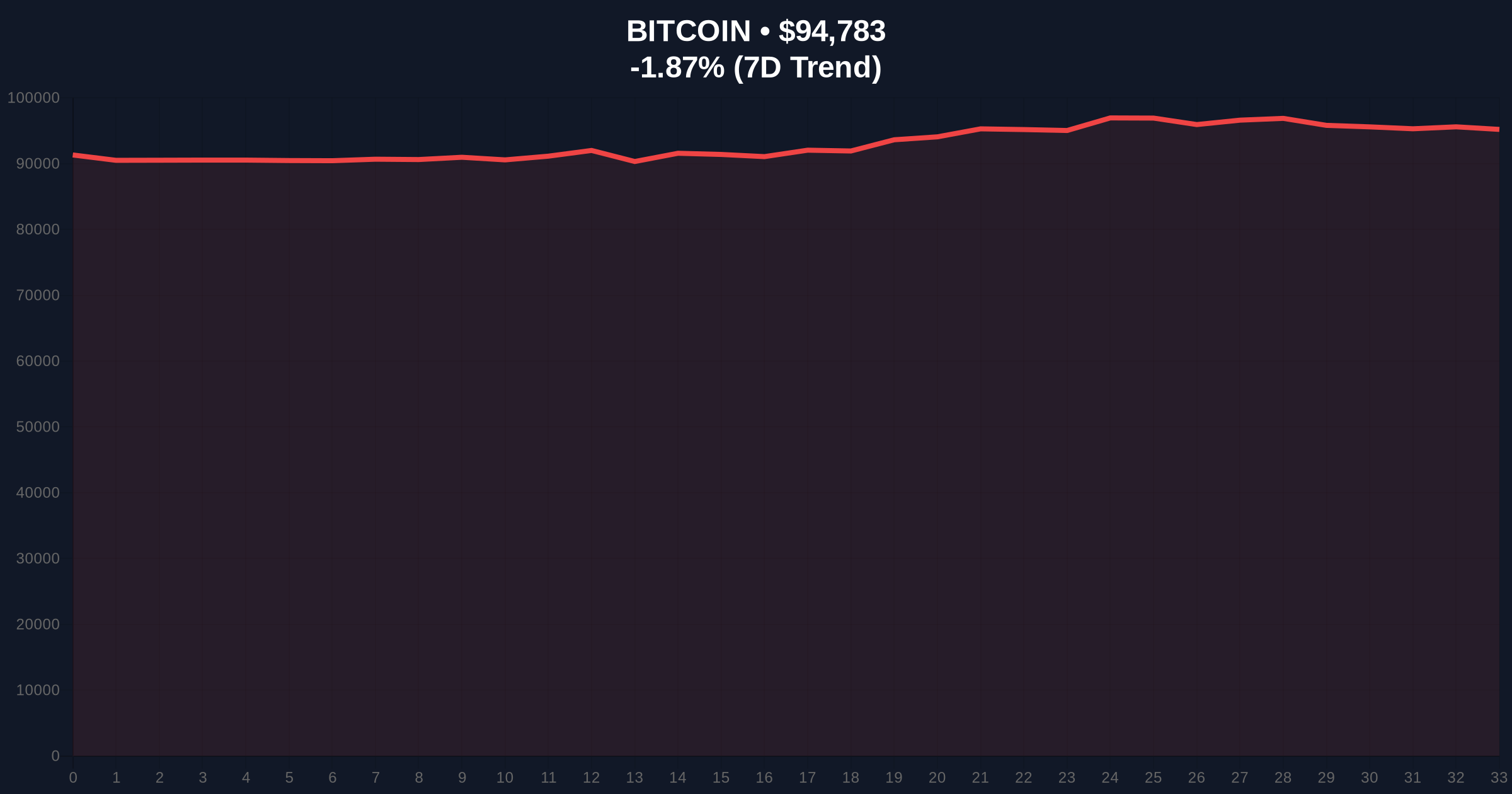

Bitcoin's current price of $94,816 reflects a 24-hour decline of -1.77%, but this minor pullback masks the underlying structural strength indicated by the gold ratio Z-score. Volume profile analysis reveals significant buy-side liquidity accumulation around the $92,000 to $95,000 range, forming a potential order block. The Relative Strength Index (RSI) on daily charts sits at 45, suggesting neutral momentum without overbought or oversold extremes. A critical Fibonacci support level at $90,000, derived from the 0.618 retracement of the previous rally, serves as the bullish invalidation point; a break below this level would negate the undervaluation thesis. Conversely, resistance is established at $100,000, a psychological and technical barrier that acts as the bearish invalidation level—a sustained move above this could trigger a gamma squeeze in options markets. Market structure suggests that the current consolidation is a liquidity grab before a potential trend reversal.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin/Gold Z-score | < -2 | Extreme undervaluation signal |

| Bitcoin Current Price | $94,816 | 24h trend: -1.77% |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Market sentiment balanced |

| Historical Surge (Late 2022) | +150% | Precedent after similar signal |

| Market Rank | #1 | Dominance maintained |

This development matters because it provides a data-driven, non-emotional signal for institutional and retail investors. For institutions, the Z-score offers a quantitative framework to allocate capital into Bitcoin as a hedge against gold's potential underperformance, especially given regulatory clarity advancements like the pending Ethereum Pectra upgrade's EIP-7702, which could enhance network efficiency. For retail, it highlights a high-probability entry point based on historical mean reversion patterns. The implication extends beyond price action; if Bitcoin decouples from gold and appreciates faster, it could reinforce its narrative as a superior store of value, attracting further capital inflows. This is particularly relevant in a macro environment where traditional assets face pressure from geopolitical tensions and monetary policy shifts.

Market analysts on X/Twitter have noted the Z-score signal, with bulls emphasizing the historical precedent as a reason for accumulation. One quantitative trader stated, "The Bitcoin-gold ratio at a Z-score below -2 is a statistical anomaly that rarely persists; mean reversion favors Bitcoin outperformance." Bears, however, caution that macroeconomic headwinds, such as potential interest rate hikes, could delay any rally. Overall, sentiment remains cautiously optimistic, with many awaiting a break above the $100,000 resistance to confirm the bullish thesis. This aligns with broader industry discussions, such as those around Galaxy CEO's crypto bill compromise facing industry opposition as Bitcoin tests $95k.

Bullish Case: If the Z-score mean reversion holds, Bitcoin could rally toward $120,000 by mid-2026, outpacing gold as historical patterns repeat. This scenario assumes a break above the $100,000 resistance, triggering a fair value gap (FVG) that accelerates upward momentum. On-chain data indicates accumulation by whales, supporting this outlook.Bearish Case: A failure to hold the $90,000 support level would invalidate the undervaluation signal, potentially leading to a drop to $85,000 as sell-side liquidity is tapped. This could occur if macroeconomic conditions worsen, such as a hawkish Federal Reserve policy shift, causing correlated declines across risk assets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.