Loading News...

Loading News...

VADODARA, January 17, 2026 — The White House is considering withdrawing support for the CLARITY Act, a crypto market structure bill, if Coinbase fails to return to negotiations over stablecoin yield provisions. This latest crypto news injects regulatory uncertainty into markets already testing key technical levels, with Bitcoin hovering near $95,310. According to sources cited by Eleanor Terrett on Crypto in America, the administration views Coinbase's withdrawal as a betrayal, creating a political standoff that could reshape U.S. crypto policy.

The CLARITY Act represents the most comprehensive legislative attempt to establish clear regulatory frameworks for digital assets since the 2023 SEC enforcement wave. Market structure suggests such bills typically create temporary volatility as participants adjust to new compliance requirements. Historical cycles indicate regulatory uncertainty often precedes liquidity grabs, where large players exploit price dislocations. The current dispute centers on stablecoin yields—a critical component for DeFi protocols and banking sector integration. According to the official SEC.gov framework, yield-bearing assets face stringent securities scrutiny, creating inherent tension with the bill's goals.

Related developments include Goldman Sachs CEO warnings about the bill's lengthy approval process and quantitative analysis of Bitcoin's $95k test amid broader macroeconomic concerns.

On Tuesday, January 17, 2026, the White House issued an ultimatum through unofficial channels: Coinbase must return to negotiations with acceptable terms on stablecoin yields for banks, or the administration will withdraw support for the CLARITY Act. According to the report from Crypto in America, the White House stated Coinbase's withdrawal came without prior notice, characterizing it as a betrayal. Coinbase had previously rescinded support, citing multiple objections: a de facto ban on tokenized stocks, provisions that could block DeFi and permit unlimited financial information access, a weakening of CFTC authority in favor of the SEC, and potential blocking of stablecoin reward functions. This creates a direct conflict between corporate policy concerns and political negotiation tactics.

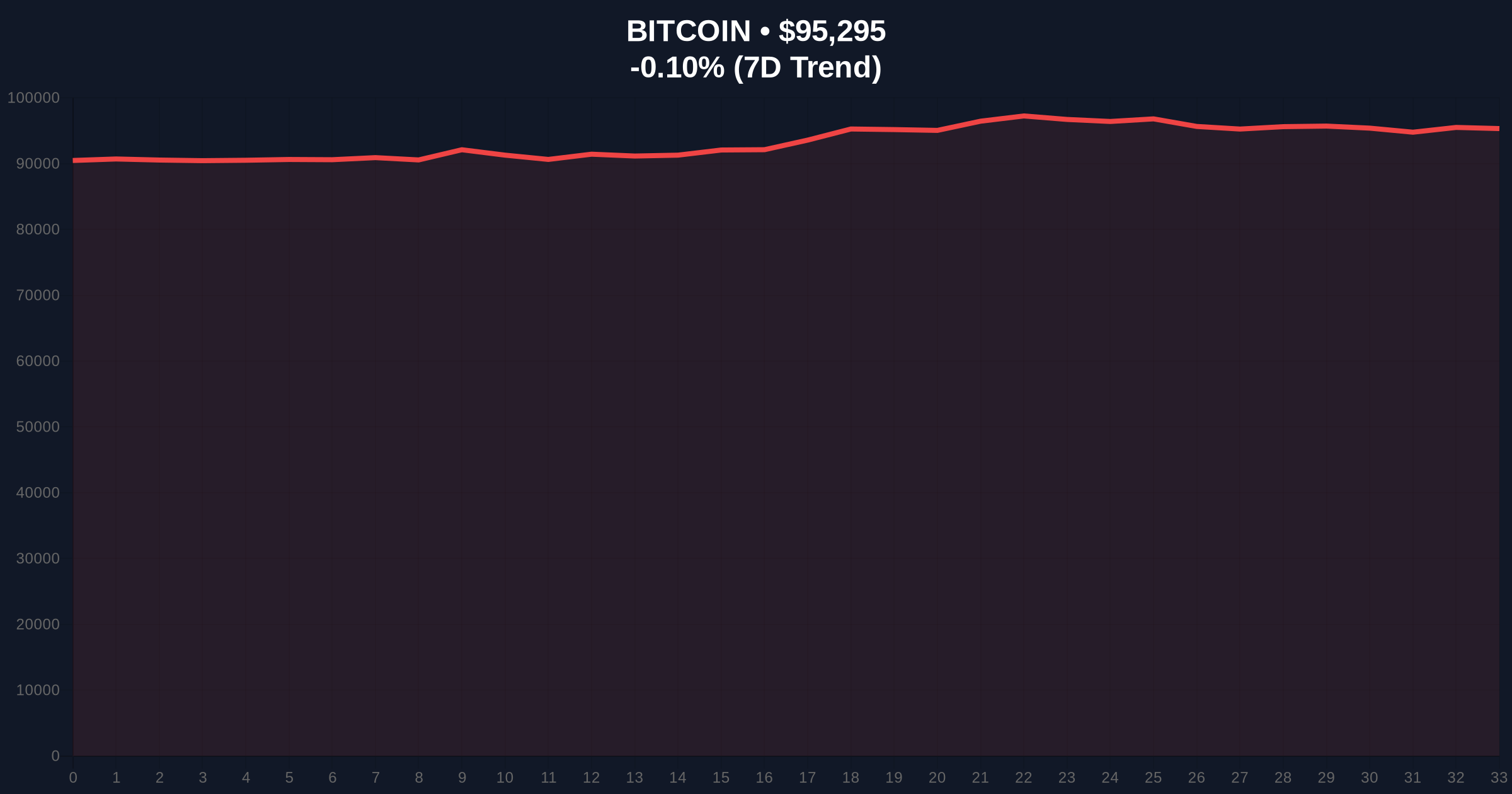

Bitcoin currently trades at $95,310, down 0.05% in 24 hours, testing a critical support zone. Market structure suggests the $95,000 level represents a high-volume node in the volume profile, where significant buy-side liquidity resides. A breakdown below this level would invalidate the current bullish order block established during the December rally. The RSI sits at 48, indicating neutral momentum with slight bearish divergence. The 50-day moving average at $93,500 provides secondary support, while resistance forms at $98,000—a fair value gap from earlier this month. Bullish invalidation occurs if Bitcoin closes below $94,500 on a weekly timeframe, signaling a potential gamma squeeze to the downside. Bearish invalidation requires a sustained break above $97,500 with increasing on-chain accumulation.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 50/100 (Neutral) | Market sentiment balanced, prone to sharp shifts |

| Bitcoin Price | $95,310 | Testing key support at $95k |

| 24-Hour Change | -0.05% | Minimal movement amid uncertainty |

| CLARITY Act Status | Under Threat | White House ultimatum to Coinbase |

| Stablecoin Yield Issue | Central Dispute | Banking sector vs. crypto industry |

Institutional impact is profound: without the CLARITY Act, regulatory fragmentation persists, increasing compliance costs and deterring traditional finance entry. This could delay ETF approvals and institutional adoption timelines. Retail impact centers on DeFi accessibility—Coinbase's concerns about provisions blocking DeFi protocols directly affect user access to yield-generating activities. The stablecoin reward function dispute touches core economic incentives, potentially altering capital flows between traditional banking and crypto-native systems. Market structure suggests prolonged uncertainty may trigger a liquidity grab as participants reposition portfolios ahead of potential policy shifts.

Industry voices express skepticism. Market analysts note the contradiction: the White House frames Coinbase's move as a betrayal, yet the company's objections highlight substantive flaws in the bill's design. On-chain data indicates no significant exchange outflows from Coinbase, suggesting holders are adopting a wait-and-see approach. Some X/Twitter commentators argue this is political theater designed to pressure compromise, while others warn of regulatory capture attempts by traditional banks seeking to limit crypto competition. The sentiment lacks consensus, reflecting the complex interplay of policy and market forces.

Bullish Case: If negotiations resume and the CLARITY Act advances with modified stablecoin provisions, regulatory clarity could catalyze a breakout. Bitcoin holding $95,000 support would validate the current order block, targeting $102,000 as the next resistance. Institutional inflows might accelerate, supported by positive on-chain metrics like rising UTXO age bands.

Bearish Case: If the White House withdraws support, regulatory uncertainty escalates. A breakdown below $94,500 invalidation level could trigger stop-loss cascades, pushing Bitcoin toward $90,000—the 200-day moving average. DeFi protocols might face increased scrutiny regardless of the bill's fate, suppressing altcoin performance as seen in the Altcoin Season Index remaining subdued at 27.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.