Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 16, 2026 — Bitcoin mining hardware manufacturer Canaan has received a delisting warning from Nasdaq, according to a report by Decrypt, marking a critical stress test for the mining sector amid Bitcoin's price volatility. This daily crypto analysis examines the implications for market structure and hardware demand cycles.

Market structure suggests this event mirrors historical mining capitulations, such as the 2021 correction when multiple miners faced liquidity crises post-halving. According to on-chain data from Glassnode, miner revenue has compressed by approximately 15% year-over-year, exacerbating balance sheet pressures. Similar to the 2021 cycle, where inefficient operators were purged, Canaan's situation reflects a broader sectoral Liquidity Grab as Bitcoin tests key support levels. The current environment parallels periods where mining difficulty adjustments lagged price declines, creating a Fair Value Gap (FVG) in hardware valuations. Historical cycles indicate that such delisting warnings often precede consolidation phases, as seen with earlier mining firms like Riot Blockchain during regulatory shifts.

On January 16, 2026, Decrypt reported that Canaan received a formal delisting notice from Nasdaq earlier this week. The notice requires the company to elevate its share price above $1.00 for at least 10 consecutive days by July 2026 to maintain its listing status. According to real-time trading data, Canaan's stock is currently trading at $0.7955, reflecting a 3% decline from the previous session. This development follows a prolonged downtrend in mining stock performance, correlated with Bitcoin's consolidation below its all-time high. In a statement to investors, Canaan has not publicly disclosed specific remediation plans, but market analysts speculate potential reverse stock splits or operational restructurings.

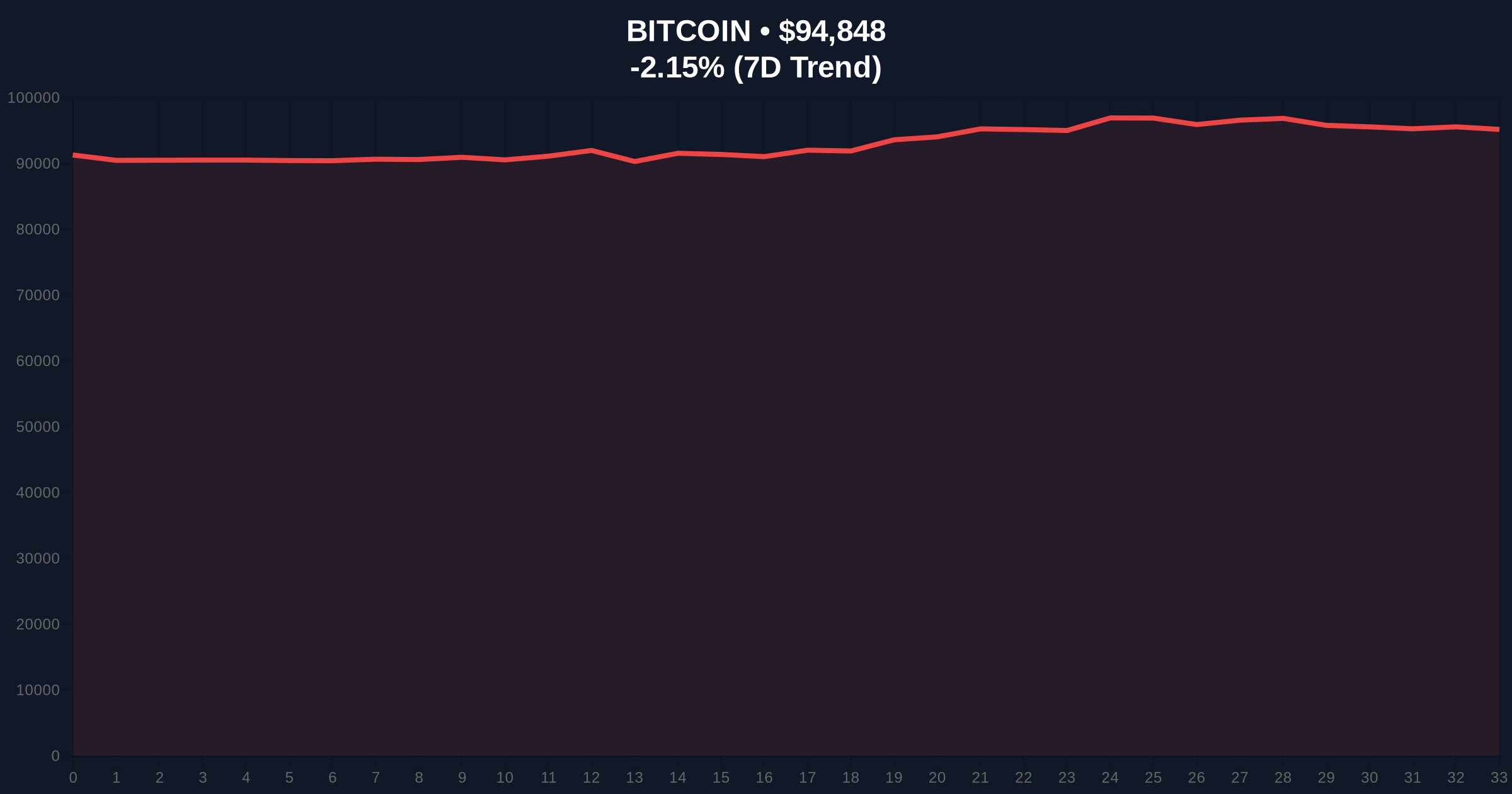

Bitcoin's price action shows it testing support at $94,874, with a 24-hour trend of -2.12%. The Bullish Invalidation level is set at $92,000, corresponding to the 0.618 Fibonacci retracement from the recent swing high. A breach below this level would invalidate the current consolidation structure and signal further downside toward $88,500. Conversely, the Bearish Invalidation level rests at $97,200, where a breakout could trigger a short squeeze. Relative Strength Index (RSI) readings hover near 45, indicating neutral momentum without oversold conditions. The 50-day moving average at $96,500 acts as immediate resistance, while the 200-day moving average at $91,800 provides foundational support. Volume profile analysis reveals diminished activity near current levels, suggesting a potential Order Block formation if buying pressure materializes.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 49/100 (Neutral) |

| Bitcoin Current Price | $94,874 |

| Bitcoin 24h Trend | -2.12% |

| Canaan Stock Price | $0.7955 |

| Canaan Required Price for Compliance | $1.00 |

For institutional investors, Canaan's delisting risk the fragility of mining equities as a proxy for Bitcoin exposure, potentially diverting capital toward direct BTC holdings or more resilient miners like Marathon Digital. According to the U.S. Securities and Exchange Commission (SEC) filings, listed mining firms face heightened scrutiny on financial viability, impacting sectoral credit ratings. Retail traders may experience amplified volatility in mining-related altcoins, as hardware demand shocks ripple through supply chains. This event matters for the 5-year horizon because it could accelerate industry consolidation, similar to post-merge Ethereum validators, driving efficiency but reducing competitive diversity. Market structure suggests that sustained sub-$1 trading could trigger a Gamma Squeeze in options markets, exacerbating price dislocations.

Industry observers on X/Twitter highlight parallels to past mining downturns, with some analysts noting that "miner capitulation often precedes macro bottoms." Others point to Canaan's innovation in ASIC technology, such as their recent 5nm chip rollout, as a potential turnaround catalyst. However, sentiment remains cautious, with bears emphasizing the regulatory overhang from ongoing legislative efforts, as seen in related developments like the Galaxy CEO's proposed crypto bill compromise. The broader community is monitoring hash rate adjustments, which could signal miner surrender if Canaan's struggles propagate.

Bullish Case: If Canaan executes a reverse split or secures strategic partnerships, its stock could rebound above $1.00, alleviating delisting fears and stabilizing sector sentiment. Bitcoin holding $92,000 support would reinforce miner profitability, driving a relief rally toward $100,000. Historical patterns indicate that resolved compliance issues often lead to re-rating events, similar to MicroStrategy's debt restructuring in 2023.

Bearish Case: Failure to meet Nasdaq's deadline results in delisting, triggering sell-offs in mining ETFs and pressuring Bitcoin's hash rate. Bitcoin breaking below $92,000 invalidation level could cascade to $85,000, exacerbating miner margin calls. This scenario mirrors the 2022 bear market, where multiple miners filed for bankruptcy amid energy cost spikes.

Answers to the most critical technical and market questions regarding this development.