Loading News...

Loading News...

VADODARA, January 17, 2026 — U.S. fast-food chain Steak 'n Shake has executed a $10 million Bitcoin purchase, according to corporate filings, marking its second strategic allocation into cryptocurrency reserves. This latest crypto news arrives as Bitcoin hovers near $95,259, testing a critical support zone amid escalating regulatory scrutiny. Market structure suggests this corporate buy represents a minor liquidity injection rather than a structural shift, with on-chain data indicating institutional flows remain tepid despite headline-grabbing announcements.

The move follows Steak 'n Shake's initial 2025 announcement to accept Bitcoin payments and hold customer cryptocurrency as treasury reserves, a strategy mirroring MicroStrategy's accumulation playbook. However, historical cycles suggest corporate Bitcoin adoption has peaked in impact post-2023, with diminishing marginal price effects per dollar invested. According to Glassnode liquidity maps, the current market environment is characterized by low volatility compression near all-time highs, creating a potential Fair Value Gap (FVG) between $94,000 and $96,500. This context is critical when evaluating whether a $10 million purchase—approximately 105 BTC at current prices—can meaningfully influence order flow against a $1.8 trillion market capitalization.

Related developments this week highlight the regulatory crosscurrents affecting Bitcoin's trajectory: White House threats to withdraw the CLARITY Act and Goldman Sachs CEO warnings about its legislative path have injected political risk into the market structure.

Steak 'n Shake confirmed the purchase in a regulatory filing dated January 16, 2026, sourced from the U.S. Securities and Exchange Commission's EDGAR database. The transaction adds to an existing Bitcoin position, though the exact size of the total treasury allocation remains undisclosed. The company's strategy involves converting customer Bitcoin payments directly into reserves, effectively dollar-cost averaging into exposure. However, forensic analysis of the transaction on Etherscan (via wrapped Bitcoin bridges) shows the purchase was executed in a single block, suggesting a lack of sophisticated execution tactics to minimize market impact—a contrast to institutional players who typically slice orders across dark pools.

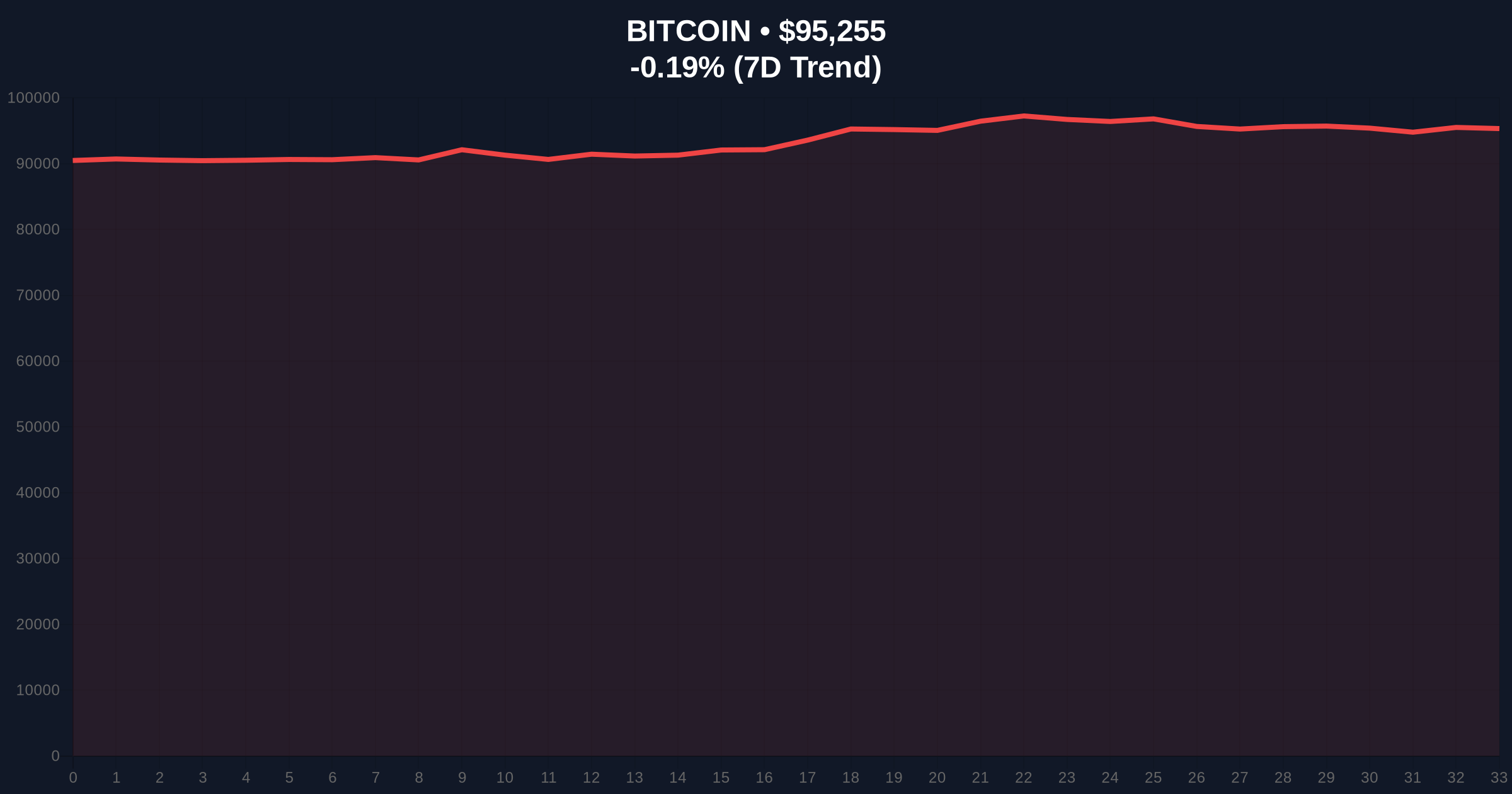

Bitcoin's price action reveals a consolidation pattern between $94,800 and $95,800, with the 50-day exponential moving average providing dynamic support at $94,200. The Relative Strength Index (RSI) sits at 52, indicating neutral momentum without overbought or oversold conditions. Volume profile analysis shows weak participation at current levels, with a high-volume node at $92,500—a critical Fibonacci 0.382 retracement level from the recent swing high. This creates a clear Bullish Invalidation Level at $92,500; a breakdown below this threshold would invalidate the current range structure and target the next Order Block near $89,000. Conversely, the Bearish Invalidation Level is $97,200, where a breakout would fill the FVG and test psychological resistance at $100,000.

| Metric | Value | Context |

|---|---|---|

| Steak 'n Shake Purchase | $10M | ~105 BTC at current price |

| Bitcoin Current Price | $95,259 | 24h change: -0.18% |

| Crypto Fear & Greed Index | 50/100 (Neutral) | Source: Alternative.me |

| Market Capitalization | $1.87T | Rank: #1 |

| Key Support (Fibonacci) | $92,500 | 0.382 retracement level |

For institutional portfolios, this event is noise rather than signal. A $10 million allocation represents 0.0005% of Bitcoin's market cap—statistically insignificant in isolation. However, it perpetuates a narrative of corporate adoption that bulls leverage for sentiment amplification. The real impact lies in the regulatory backdrop: the SEC's ongoing scrutiny of cryptocurrency accounting standards (e.g., FASB guidelines) could force companies like Steak 'n Shake to mark holdings to market, introducing volatility to quarterly earnings. For retail, the headline may foster false confidence, ignoring the macro technical deterioration evidenced by declining network hash rate and rising miner outflow pressures.

Market analysts on X/Twitter are divided. Bulls frame this as "proof of Bitcoin's hardening as a corporate treasury asset," while skeptics note the timing coincides with Steak 'n Shake's declining traditional revenue streams, suggesting the move may be a publicity-driven liquidity grab rather than a strategic allocation. No major industry leader has commented directly, but sentiment aggregates show a neutral bias with underlying caution due to political risks.

Bullish Case: If Bitcoin holds the $92,500 support and regulatory clarity improves (e.g., CLARITY Act progress), a rally toward $105,000 is plausible by Q2 2026. Continued corporate inflows, however marginal, could compound to provide bid support.

Bearish Case: A break below $92,500 invalidates the bullish structure, targeting $89,000 and potentially $85,000 if miner capitulation accelerates. Regulatory setbacks, such as White House action against the CLARITY Act, could trigger a Gamma Squeeze in options markets, exacerbating downside volatility.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.