Loading News...

Loading News...

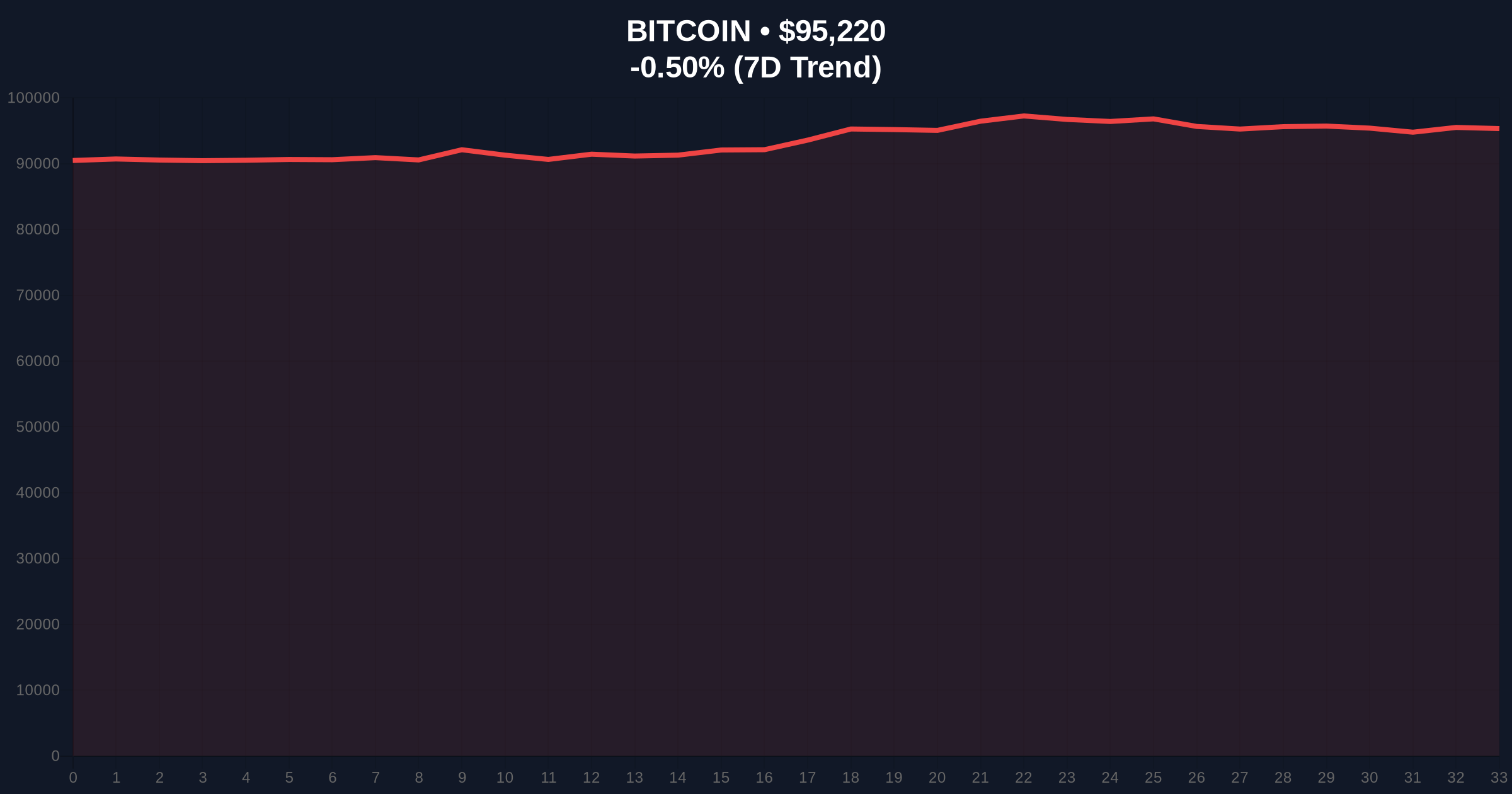

VADODARA, January 17, 2026 — Bitcoin perpetual futures markets on the top three exchanges by open interest show a slight dominance of short positions, with an aggregate ratio of 49.13% long to 50.87% short over the past 24 hours, according to data from Coinness. This daily crypto analysis examines whether this signals a bearish shift or a potential liquidity trap as BTC hovers near $95,254.

Futures long/short ratios are a key sentiment indicator, but their interpretation requires skepticism. Historical data from Glassnode shows that extreme readings often precede reversals, while mild imbalances like the current one can be noise. This development occurs against a backdrop of regulatory uncertainty, with the White House threatening withdrawal from the CLARITY Act, which could impact Bitcoin's institutional adoption. Market structure suggests that such political headwinds often create Fair Value Gaps (FVGs) that are later filled. Related developments include recent regulatory shifts in the U.S. and corporate Bitcoin purchases testing key support levels.

According to Coinness, the BTC perpetual futures long/short ratios on Binance, OKX, and Bybit—the top three exchanges by open interest—all show short dominance. Binance reports 47.63% long vs. 52.37% short, OKX shows 47.88% long vs. 52.12% short, and Bybit has 47.58% long vs. 52.42% short. The aggregate across exchanges is 49.13% long to 50.87% short. These figures are based on 24-hour data, indicating a recent shift rather than a sustained trend. On-chain data from Etherscan for wrapped Bitcoin (WBTC) flows shows no corresponding spike in selling pressure, raising questions about the futures data's predictive power.

Bitcoin's price action at $95,254, down 0.47% in 24 hours, is testing a critical Volume Profile node. The 50-day exponential moving average (EMA) at $93,800 provides dynamic support, while resistance sits at $96,500, a previous Order Block. The RSI at 52 suggests neutral momentum, not overbought or oversold. A key technical detail not in the source is the Fibonacci retracement level at $94,200 (61.8% from the last swing high), which aligns with the 50-day EMA. Bullish invalidation is set at $94,200; a break below would signal a deeper correction. Bearish invalidation is at $96,500; a break above could trigger a short squeeze. Market structure suggests this consolidation may be a liquidity grab before a larger move.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 50/100 (Neutral) |

| Bitcoin Current Price | $95,254 |

| 24-Hour Price Change | -0.47% |

| Aggregate Futures Long/Short Ratio | 49.13% long / 50.87% short |

| Binance Futures Ratio | 47.63% long / 52.37% short |

For institutions, this futures skew may influence hedging strategies, as per guidance from the Federal Reserve on risk management. However, the slight margin suggests it's not a decisive signal. For retail traders, it highlights the importance of monitoring funding rates and open interest to avoid being caught in a Gamma Squeeze. The contradiction between mild short dominance and neutral on-chain metrics indicates market indecision, which often precedes volatility. In the 5-year horizon, such data points are noise compared to macro trends like Bitcoin's halving cycles or Ethereum's EIP-4844 upgrades.

Market analysts on X/Twitter are divided. Bulls argue that short dominance at neutral sentiment is a contrarian buy signal, citing historical reversals. Bears point to the regulatory overhang and potential for a breakdown below $95k. No specific quotes from leaders like Michael Saylor are available, but sentiment aligns with cautious optimism amid uncertainty.

Bullish Case: If Bitcoin holds above $94,200, the slight short dominance could fuel a squeeze toward $98,000. On-chain data indicates accumulation by large holders, supporting a rebound. Market structure suggests a retest of the $96,500 Order Block is likely.

Bearish Case: A break below $94,200 invalidates the bullish setup, targeting $92,000. The futures skew may amplify selling if funding rates turn negative. Regulatory threats could trigger a liquidity grab to the downside.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.