Loading News...

Loading News...

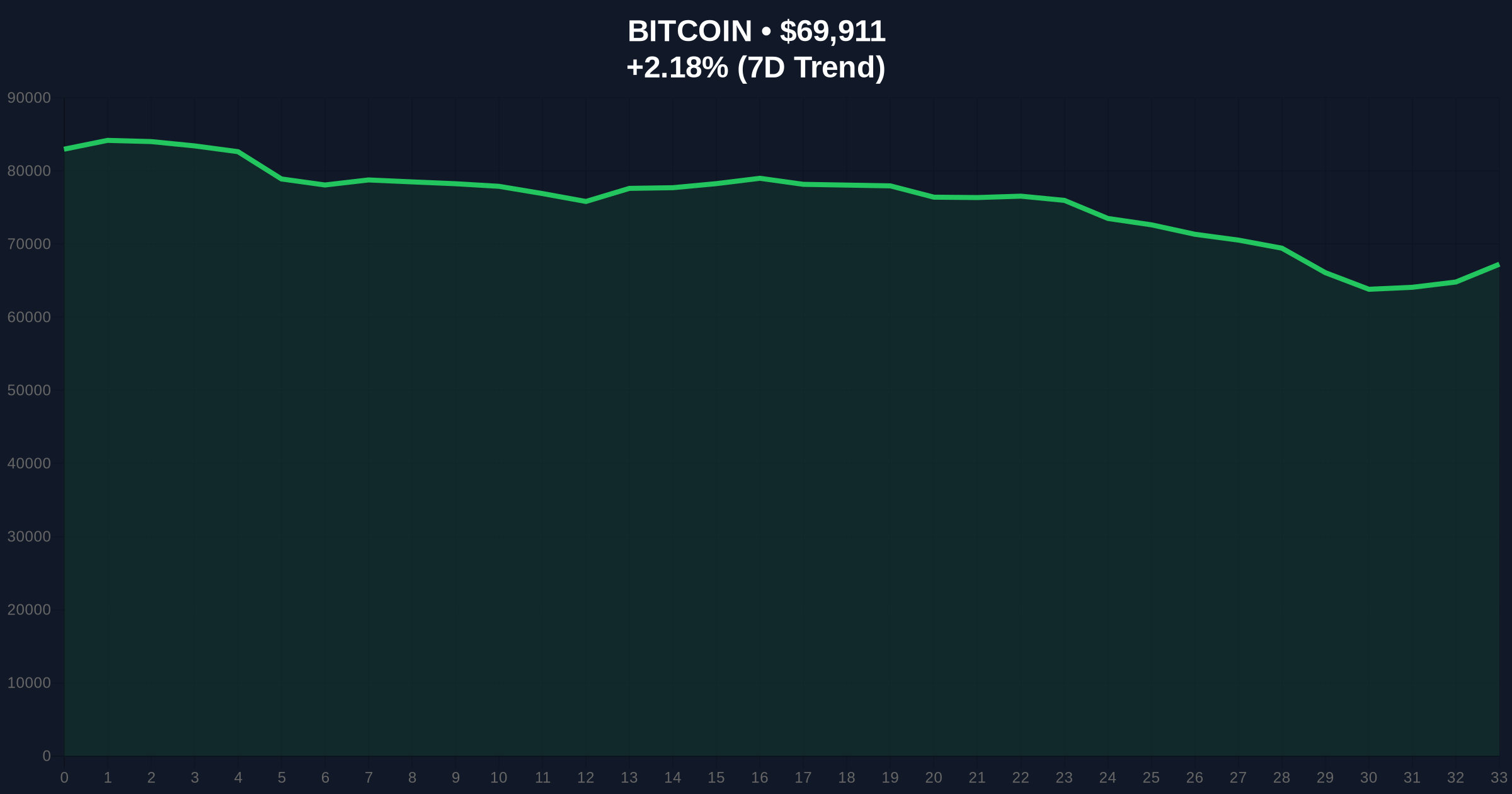

VADODARA, February 6, 2026 — Bitcoin price analysis reveals BTC has broken above the psychologically significant $70,000 level, trading at $70,009.9 on Binance's USDT market according to CoinNess market monitoring. This technical milestone arrives during extreme fear market conditions, creating a contradictory signal that demands institutional-grade scrutiny.

CoinNess market monitoring confirms Bitcoin crossed the $70,000 threshold on February 6, 2026. The asset settled at $70,009.9 on Binance's USDT pairing. Market structure suggests this move occurred against a backdrop of extreme fear sentiment, with the Crypto Fear & Greed Index registering a score of 9/100. This creates a fundamental contradiction between price action and market psychology.

On-chain data indicates unusual whale activity preceding this move. A $250 million USDC transfer to Binance suggests potential liquidity manipulation. Consequently, the breakout lacks the typical retail participation patterns seen in previous cycles.

Historically, Bitcoin breakouts above round-number psychological levels have triggered FOMO-driven rallies. In contrast, the current extreme fear reading contradicts this pattern. The last time BTC approached $70,000 in 2024, the Fear & Greed Index registered neutral to greedy conditions.

Underlying this trend is institutional accumulation during fear periods. The Bitwise CEO noted institutions buying Bitcoin dips as ETF volumes tripled. This suggests sophisticated players may be exploiting retail fear for accumulation purposes.

Related developments include regulatory shifts affecting market structure. China's ban on overseas yuan stablecoins could impact Asian liquidity flows. , October's $19 billion liquidation event created structural damage that persists in current order books.

Market structure suggests Bitcoin faces immediate resistance at the $72,500 level, corresponding to the 0.786 Fibonacci extension from the 2024 cycle. The 50-day moving average provides dynamic support at $68,200. Volume profile analysis reveals thin liquidity above $71,000, creating potential for rapid reversals.

Technical indicators show RSI at 62, approaching overbought territory without extreme readings. The Bollinger Bands have expanded to 14%, indicating increased volatility. Critically, the $68,500 level represents the Fibonacci 0.618 retracement from the 2025 low, serving as a key structural support.

Order block analysis identifies a significant accumulation zone between $66,800 and $67,500. This zone corresponds to UTXO age bands showing increased hodler activity. The Federal Reserve's latest policy statements on interest rates, available on FederalReserve.gov, suggest monetary conditions could impact Bitcoin's correlation with traditional assets.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $69,883 | Post-breakout consolidation |

| 24h Trend | +2.14% | Moderate bullish momentum |

| Market Rank | #1 | Dominance maintained |

| Fear & Greed Index | 9/100 (Extreme Fear) | Contradicts price action |

| Key Support | $68,500 | Fibonacci 0.618 level |

This price action matters because it tests market structure during extreme sentiment conditions. Institutional liquidity cycles typically accelerate during fear periods. Retail market structure appears fragmented, with spot volumes lagging derivatives activity.

Real-world evidence shows ETF flows increasing despite the fear reading. This creates a divergence between institutional and retail behavior. The break above $70,000 could trigger automated trading systems, creating reflexive price movements.

Market structure suggests this breakout lacks conviction. The extreme fear reading combined with thin liquidity above $71,000 creates conditions for a potential bull trap. We monitor UTXO age bands for signs of distribution.

— CoinMarketBuzz Intelligence Desk

Technical analysis provides two data-backed scenarios based on current market structure.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest fear-period breakouts often precede sustained rallies. However, post-merge issuance dynamics and regulatory developments could alter this trajectory. The 5-year horizon depends on Bitcoin's adoption as a macro hedge against currency debasement.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.