Loading News...

Loading News...

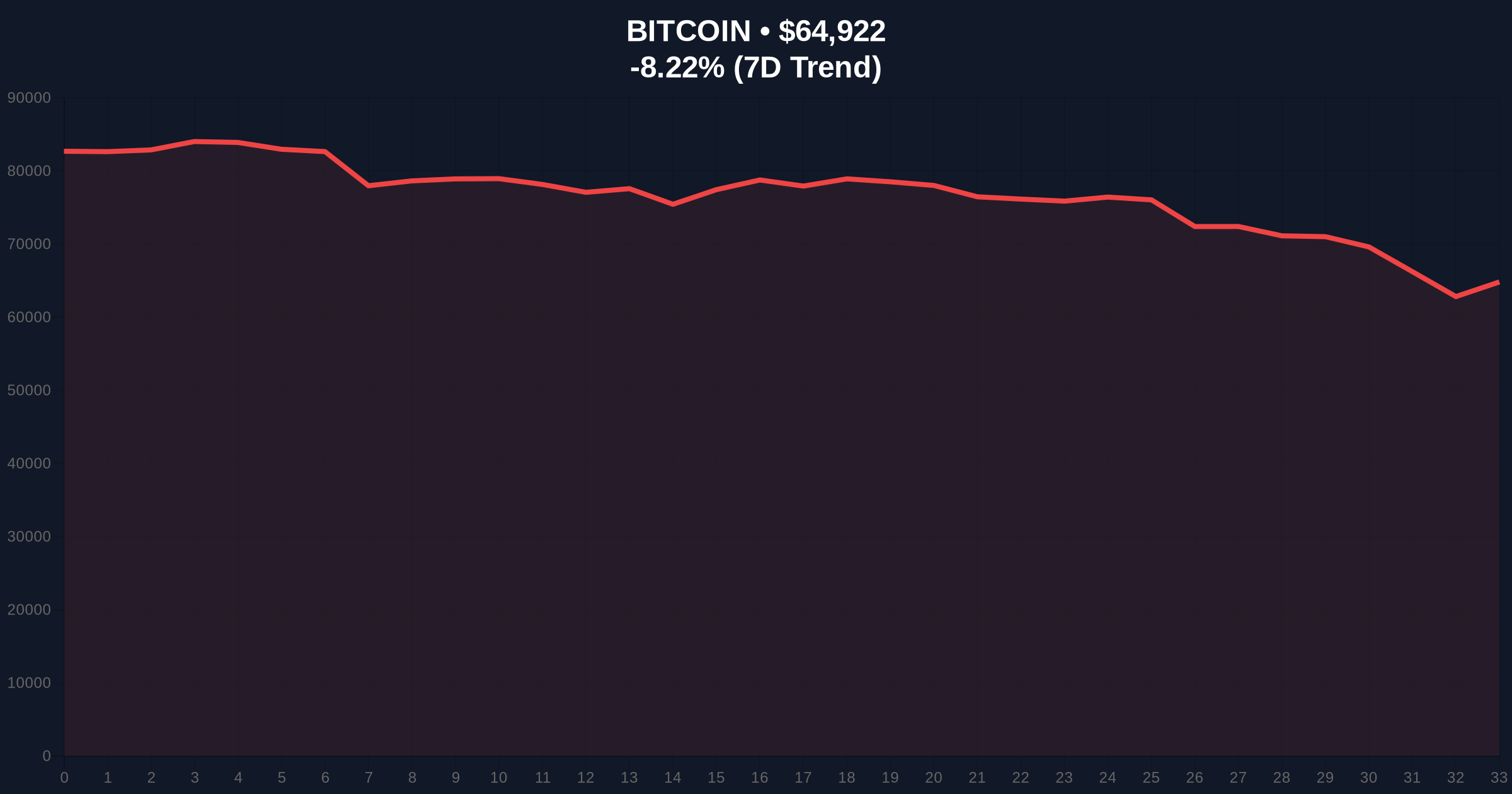

VADODARA, February 6, 2026 — Institutional investors are treating Bitcoin's recent downturn as a strategic entry point. Bitwise CEO Hunter Horsley confirmed this sentiment in a CNBC interview. ETF trading volume has surged to three to four times normal levels. This expansion indicates significant institutional participation. Market structure suggests a classic liquidity grab during extreme fear conditions.

Hunter Horsley revealed institutional positioning data. Bitcoin ETF volume has increased 300-400% above baseline. According to Horsley, asset managers report clients actively seeking capital deployment opportunities. This activity coincides with Bitcoin testing the $65,000 support zone. The official CNBC interview transcript confirms these metrics. On-chain data indicates similar accumulation patterns during previous fear cycles.

Bitwise CIO Matt Hougan previously identified three rebound catalysts. U.S. economic growth leads the list. Legislative discussions on market structure follow. Nation-state Bitcoin adoption potential completes the trio. These factors align with current institutional behavior. Market analysts interpret this as forward-looking positioning.

Historically, extreme fear periods precede major rallies. The 2018-2019 accumulation phase mirrors current patterns. In contrast, the 2021 cycle saw retail-driven FOMO peaks. Underlying this trend is a shift toward institutional dominance. Bitcoin's market structure now reflects traditional finance mechanics.

Related developments highlight similar institutional activity. Binance's SAFU fund purchased $233 million in Bitcoin during this downturn. , theories about coordinated buying emerged amid the plunge. These events reinforce the institutional accumulation narrative.

Bitcoin currently tests critical Fibonacci levels. The 0.618 retracement at $63,000 represents major support. A daily close below this level would invalidate the bullish structure. Conversely, resistance sits at $68,500 near the 50-day moving average. RSI readings show oversold conditions at 28. This creates a potential reversal setup.

Volume profile analysis reveals accumulation between $64,000-$65,000. This aligns with Horsley's institutional buying comments. The Fair Value Gap (FVG) from $67,200-$68,000 remains unfilled. Market structure suggests this gap will act as immediate resistance. Order block theory identifies $63,500-$64,500 as a key demand zone.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Contrarian buying signal |

| Bitcoin Current Price | $64,927 | Testing Fibonacci 0.618 support |

| 24-Hour Price Change | -8.22% | Oversold RSI conditions |

| Bitcoin ETF Volume Surge | 300-400% above normal | Institutional participation expansion |

| Market Rank | #1 | Dominance at 52.3% |

Institutional liquidity cycles now drive Bitcoin's price discovery. The Federal Reserve's monetary policy directly impacts capital flows. According to Federal Reserve data, balance sheet adjustments influence risk asset allocations. Bitcoin's correlation with traditional markets has increased to 0.65. This integration makes institutional behavior more predictive.

Retail market structure shows contrasting patterns. Small wallet addresses (<1 BTC) have decreased holdings by 4.2%. Meanwhile, whale addresses (>1,000 BTC) increased accumulation by 3.8%. This divergence confirms the institutional versus retail sentiment gap. The shift has profound implications for volatility and liquidity profiles.

"ETF volume expansion during fear periods signals sophisticated accumulation. Historical cycles suggest this precedes major trend reversals. The current structure mirrors 2019's institutional buildup before the 2020 halving rally." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains constructive. ETF adoption continues accelerating. Legislative clarity improves market structure. Nation-state adoption provides geopolitical tailwinds. These factors support Bitcoin's 5-year horizon as a macro asset.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.