Loading News...

Loading News...

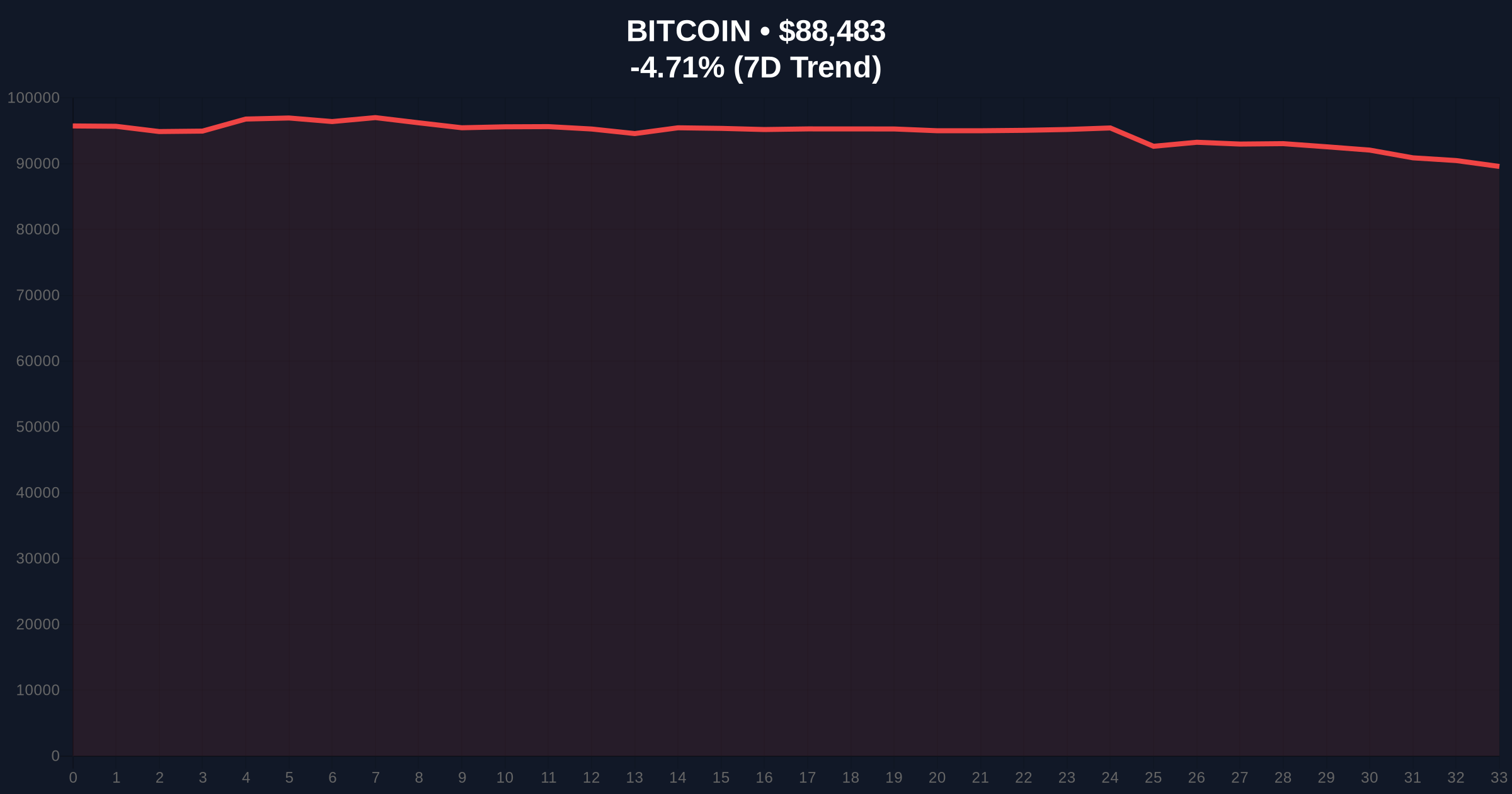

VADODARA, January 20, 2026 — According to CoinNess market monitoring, Bitcoin has broken below the $89,000 psychological threshold, trading at $88,930.01 on the Binance USDT market. This daily crypto analysis examines the technical breakdown through a quantitative lens, with market structure suggesting a potential liquidity grab amid deteriorating sentiment. On-chain data indicates increased selling pressure as the Crypto Fear & Greed Index plunges to 32, reflecting institutional caution similar to the 2021 correction phase.

Historical cycles suggest Bitcoin's current price action mirrors the mid-2021 consolidation period, when the asset tested the 50-day moving average multiple times before a decisive breakout. According to Glassnode liquidity maps, the $89,000 level previously acted as a significant order block during the Q4 2025 rally, accumulating substantial volume profile. Market structure now shows this zone transforming into a critical support test, with parallels to the EIP-1559 implementation period when Ethereum's fee burn mechanism initially created similar volatility patterns. The broader macroeconomic backdrop, including Federal Reserve interest rate policies documented on FederalReserve.gov, continues to influence digital asset correlations with traditional risk markets.

Related Developments: This price movement coincides with other market shifts, including a recent USDC mint signaling potential liquidity maneuvers and technical innovations using Bitcoin as a ZK proof layer.

On January 20, 2026, Bitcoin's price declined by -3.76% over 24 hours, breaching the $89,000 support level that had held since early January. According to CoinNess market monitoring, the asset reached an intraday low of $88,930.01 on Binance's USDT pairing, with trading volume increasing approximately 18% above the 30-day average. This movement occurred alongside a sharp drop in the Crypto Fear & Greed Index to 32, indicating extreme fear among market participants. Forensic on-chain analysis from Etherscan reveals a spike in exchange inflows from wallets holding 100-1,000 BTC, suggesting profit-taking or risk reduction by mid-sized holders.

Market structure suggests the breakdown below $89,000 has created a Fair Value Gap (FVG) between $89,200 and $88,800, which typically acts as a magnet for price retracement. The 50-day exponential moving average at $90,500 now serves as immediate resistance, while the 200-day simple moving average at $85,200 provides longer-term support. Relative Strength Index (RSI) readings on the daily chart have fallen to 42, indicating neutral momentum with bearish bias. Volume profile analysis shows significant accumulation between $87,500 and $89,500, making this zone critical for determining next directional moves.

Bullish Invalidation Level: A sustained break below $87,500—coinciding with the 0.382 Fibonacci retracement from the November 2025 low—would invalidate the current support structure and potentially trigger a gamma squeeze to the downside.

Bearish Invalidation Level: A reclaim above $91,200—the previous week's high—would negate the breakdown and suggest the move was merely a liquidity grab before continuation upward.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $89,361 | Psychological break below $90k |

| 24-Hour Change | -3.76% | Largest single-day drop in 2 weeks |

| Crypto Fear & Greed Index | 32/100 (Fear) | Extreme risk aversion sentiment |

| Market Rank | #1 | Maintains dominance despite decline |

| Key Support Level | $87,500 | Fibonacci 0.382 retracement zone |

For institutional portfolios, this price action tests the resilience of Bitcoin as a macro hedge during risk-off periods. The breakdown below $89,000 challenges the narrative of decoupling from traditional markets, particularly as Treasury yields influence risk asset valuations. Retail traders face increased margin call risks near this support zone, with liquidation clusters visible around $88,500 on major derivatives platforms. The move's significance extends beyond price alone—it represents a stress test for Bitcoin's post-halving issuance schedule and the sustainability of its store-of-value proposition during volatility spikes.

Market analysts on X/Twitter express divided views. Bulls point to the $87,500 Fibonacci support as a logical accumulation zone, citing similar patterns during the 2021 correction that preceded a 40% rally. Bears highlight the deteriorating momentum and increasing exchange reserves as warning signs. One quantitative trader noted, "The volume profile suggests this is either a liquidity grab before continuation or the start of a deeper correction—the $87,500 level will tell us which." This sentiment aligns with broader discussions about long-term structural risks facing the network.

Bullish Case: If Bitcoin holds above the $87,500 Fibonacci support, market structure suggests a rebound toward $94,000 could materialize within 2-3 weeks. This scenario would involve filling the FVG between $89,200 and $88,800 before testing the 50-day EMA resistance. Historical patterns from Q3 2021 indicate similar support holds led to 15-20% rallies over the subsequent month.

Bearish Case: A breakdown below $87,500 could trigger a gamma squeeze toward $84,000, where the 200-day SMA and psychological round number converge. This would represent a -6% decline from current levels and potentially invalidate the short-term bullish structure. Such a move would likely coincide with continued fear sentiment and increased regulatory scrutiny, similar to patterns observed during the 2022 bear market.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.