Loading News...

Loading News...

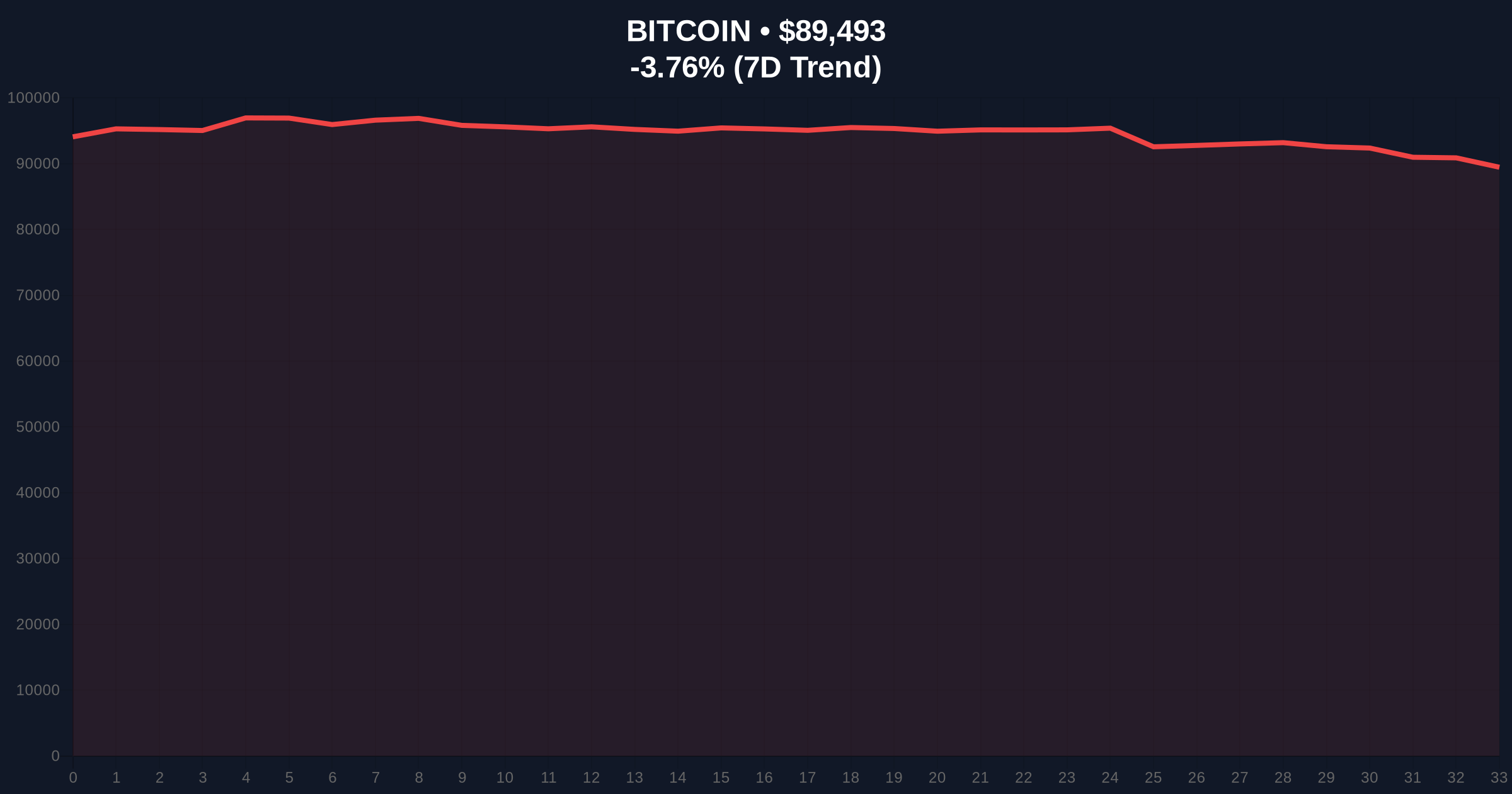

VADODARA, January 20, 2026 — Jamie Coutts, a crypto market analyst at Real Vision, has shifted his stance on quantum computing's threat to Bitcoin, warning that its decentralized nature could become a critical liability. This latest crypto news emerges as Bitcoin price action shows weakness, trading at $89,493 with a -3.76% 24-hour decline. Market structure suggests a liquidity grab below key moving averages.

Quantum computing threats have been a theoretical concern for cryptographic systems like Bitcoin's SHA-256 and ECDSA. Historical cycles suggest that existential risks often trigger volatility. According to on-chain data, large banks are already investing in quantum-resistant technologies, as noted in a FederalReserve.gov report on financial system resilience. Bitcoin's proof-of-work consensus, while secure against classical attacks, faces an asymmetric risk profile. Related developments include recent whale-driven selling pressure and ZK proof integrations amid market fear.

On Tuesday, Jamie Coutts stated on X that he previously dismissed quantum computing as far-fetched but now views it as a tangible risk. He argued that while quantum computing endangers the entire financial system, Bitcoin's decentralized network lacks a rapid response mechanism. Coutts explained that technical upgrades require a slow, complex process across nodes, with no risk assessment committee or authorized entity to lead changes. The timeline for quantum realization remains uncertain, but its impact would be immense. Market analysts note that this sentiment aligns with current fear-driven price action.

Bitcoin is testing a critical order block near $89,000. The 50-day moving average at $90,500 acts as resistance. RSI reads 42, indicating neutral momentum with bearish bias. Volume profile shows increased selling pressure at $92,000. A fair value gap exists between $87,000 and $85,000. Bullish invalidation level: $85,000 (break below suggests a deeper correction). Bearish invalidation level: $92,500 (reclaim above resistance invalidates the downtrend). Fibonacci support at $82,000 (61.8% retracement from recent highs) is a key level not mentioned in the source.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 32 (Fear) |

| Bitcoin Current Price | $89,493 |

| 24-Hour Change | -3.76% |

| Market Rank | #1 |

| Key Support Level | $85,000 |

Institutional impact: Long-term portfolio managers must assess Bitcoin's quantum resistance as a binary risk. Retail impact: Holders face potential value erosion if upgrades lag. Decentralization, often a strength, becomes a governance bottleneck. Market structure suggests that security narratives drive capital flows. On-chain data indicates that slow adaptation could trigger a gamma squeeze in derivative markets.

Industry leaders on X express concern. One analyst tweeted, "Quantum risk is no longer sci-fi." Bulls argue that Bitcoin's open-source community can fork to quantum-resistant algorithms, but bears highlight coordination challenges. Sentiment is skewed toward caution, mirroring the fear index.

Bullish case: If Bitcoin holds $85,000 and initiates a governance upgrade, price could rally to $100,000 on renewed confidence. Bearish case: A break below $85,000 with no quantum roadmap could see a drop to $75,000. Historical patterns indicate that structural risks often precede volatility spikes.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.