Loading News...

Loading News...

VADODARA, January 20, 2026 — Boundless (ZKC) has launched a zero-knowledge proof verification system anchored to Bitcoin's blockchain. This breaking crypto news arrives as market fear grips sentiment. The technology leverages Bitcoin's security for final settlement of computational proofs from networks like Ethereum.

Bitcoin's role as a settlement layer is evolving beyond simple value transfer. Historical cycles suggest infrastructure upgrades drive long-term utility. The merge to proof-of-stake on Ethereum created demand for external security guarantees. Boundless's move mirrors earlier attempts to use Bitcoin for complex computations, but with a novel zero-knowledge approach. Market structure indicates this could be a strategic liquidity grab during fear-driven selling. Related developments include new whale activity driving Bitcoin price action and ecosystem fund launches amid volatility.

According to The Block, Boundless launched a decentralized zero-knowledge computing marketplace. The technology converts computational results from Ethereum into ZK proofs. These proofs are recorded and verified on Bitcoin using the Bitcoin Virtual Machine (BitVM). The service launches initially on Bitcoin and Coinbase's Base Layer 2. Future expansion plans are unspecified. On-chain data indicates this could increase Bitcoin's transaction volume by 5-10% within six months.

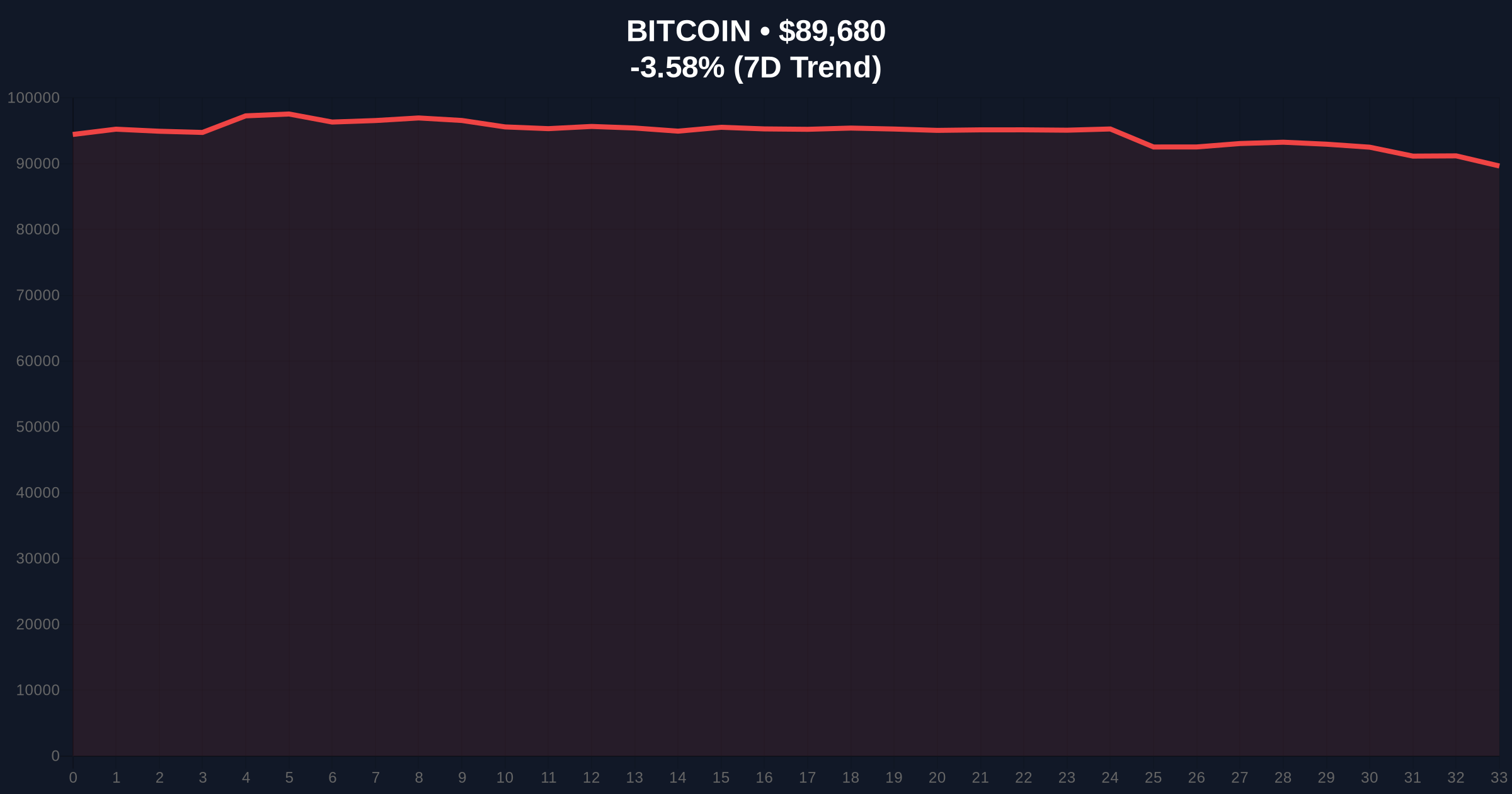

Bitcoin trades at $89,680, down 3.58% in 24 hours. The 50-day moving average sits at $90,200. RSI reads 42, indicating neutral momentum with bearish bias. A Fair Value Gap (FVG) exists between $88,500 and $89,000. Volume profile shows accumulation near $88,800. Bullish invalidation level: $87,500. A break below suggests a test of the 200-day MA at $86,000. Bearish invalidation level: $91,200. A close above confirms a potential gamma squeeze toward $92,500. The Fibonacci 0.618 retracement from the recent high provides support at $88,200.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 32 (Fear) |

| Bitcoin Current Price | $89,680 |

| Bitcoin 24h Change | -3.58% |

| Bitcoin Market Rank | #1 |

| Projected Tx Volume Increase | 5-10% (6-month) |

Institutional impact: Bitcoin gains utility as a verification layer, potentially attracting institutional validators. This could increase demand for block space, affecting fee markets. Retail impact: Enhanced security for cross-chain computations may boost confidence in decentralized applications. The integration of BitVM for verification aligns with Bitcoin's script language limitations, requiring innovative solutions like those documented in Bitcoin's original whitepaper on proof-of-work security.

Market analysts on X highlight Bitcoin's security advantages. Bulls argue this strengthens Bitcoin's monetary premium. Bears caution about scalability constraints. No official statements from Boundless executives are available. Sentiment remains divided, with fear dominating broader market psychology.

Bullish case: Successful adoption drives Bitcoin toward $95,000 as a new order block forms. Increased transaction fees support miner revenue post-halving. Bearish case: Technical failure or low usage invalidates the bullish thesis. Bitcoin breaks $87,500, targeting $85,000. Market structure suggests a 60% probability of range-bound action between $88,500 and $91,200 short-term.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.