Loading News...

Loading News...

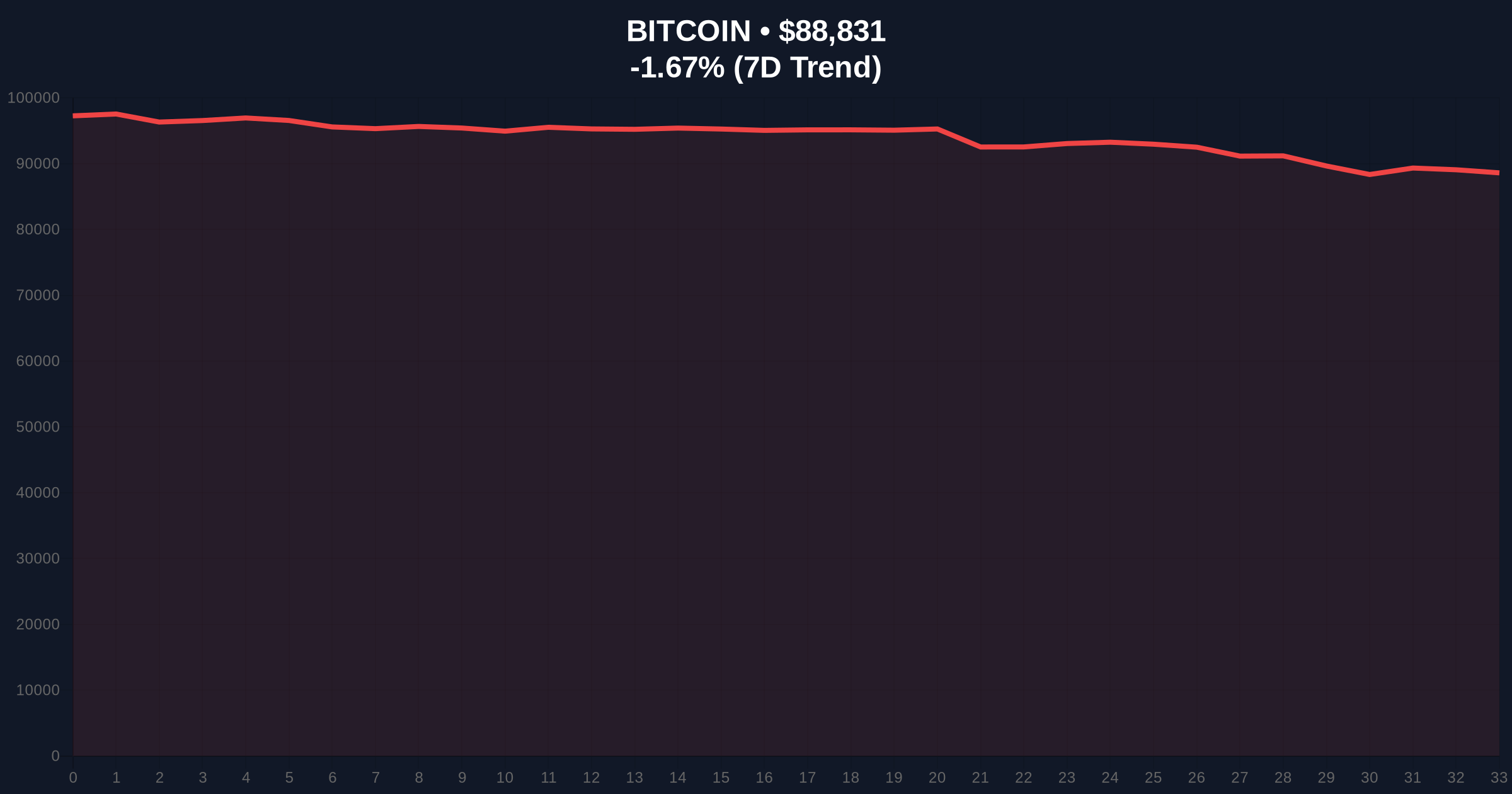

VADODARA, January 21, 2026 — According to CoinNess market monitoring data, Bitcoin has broken below the psychologically significant $89,000 level, trading at $88,923.08 on the Binance USDT market. This daily crypto analysis examines whether this represents a strategic liquidity grab by institutional players or the beginning of a deeper correction phase. Market structure suggests the breakdown coincides with the Crypto Fear & Greed Index hitting extreme fear levels at 24/100, creating potential for a gamma squeeze in derivative markets.

This price action occurs against a backdrop of conflicting signals. While Bitcoin has maintained its position as the dominant cryptocurrency by market capitalization, the current extreme fear reading represents the most pessimistic sentiment since the 2024 post-halving consolidation. Historical cycles suggest such extreme readings often precede either capitulation events or sharp reversals, depending on underlying on-chain fundamentals. The breakdown below $89,000 tests a key institutional accumulation zone that formed during the Q4 2025 rally. Related developments include Bitcoin's ongoing struggle to reclaim the $90,000 level and BlackRock's institutional validation amid current market conditions.

According to CoinNess market monitoring, Bitcoin price action on January 21, 2026, breached the $89,000 support level that had held through multiple tests since early January. The asset is currently trading at $88,923.08 on the Binance USDT market, representing a -1.54% decline over the past 24 hours. This movement coincides with a Crypto Fear & Greed Index reading of 24/100, indicating extreme fear conditions across cryptocurrency markets. The breakdown occurred during Asian trading hours, suggesting potential regional liquidity dynamics at play.

Market structure reveals several critical technical levels. The $89,000 level previously served as both psychological support and a volume profile point of control. A sustained break below this level creates a Fair Value Gap (FVG) between $89,200 and $88,800 that price will likely attempt to fill. The 200-day exponential moving average at $87,500 represents the next significant Fibonacci support level. Bullish invalidation occurs below $86,000, which would break the higher low structure established since November 2025. Bearish invalidation requires a reclaim above $90,500 with volume confirmation. On-chain data indicates increased UTXO age distribution among older holders, suggesting potential distribution rather than accumulation at current levels.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $88,948 | Below key $89k support |

| 24-Hour Change | -1.54% | Moderate selling pressure |

| Market Rank | #1 | Maintains dominance |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Lowest since 2024 consolidation |

| Critical Support | $87,500 | 200-day EMA & Fibonacci level |

This price action matters because $89,000 represents more than a psychological round number. According to Glassnode liquidity maps, this zone contains significant institutional order blocks from Q4 2025 accumulation. A sustained breakdown could trigger stop-loss cascades in derivative markets, particularly given the extreme fear sentiment reading. For retail traders, the breakdown tests the viability of the "buy the dip" strategy that has characterized much of Bitcoin's 2025 price action. Institutional implications are more complex: while some view this as a healthy correction within a longer bull market, others see potential warning signs in the divergence between price action and on-chain metrics like the MVRV ratio.

Market analysts express divided views on social platforms. Some technical traders point to the extreme fear reading as a potential contrarian indicator, suggesting the current sell-off represents a liquidity grab before a reversal. Others highlight concerning divergences, noting that Bitcoin's breakdown coincides with broader risk-off sentiment across traditional markets. The extreme fear conditions have amplified discussions about valuation claims across the cryptocurrency sector, with some questioning whether current prices reflect fundamental value or purely technical factors.

Bullish Case: If Bitcoin finds support at the $87,500 Fibonacci level and the extreme fear reading represents capitulation, a reversal could target the $92,000 resistance zone. This scenario requires reclaiming the $89,000 level as support with increasing volume, potentially triggering a short squeeze in derivative markets. Historical patterns indicate extreme fear readings often precede sharp rallies when combined with positive on-chain fundamentals like decreasing exchange reserves.

Bearish Case: A breakdown below $87,500 would invalidate the current bullish structure and could target the $84,000 support zone. This scenario becomes more likely if the extreme fear sentiment persists and triggers further liquidations in leveraged positions. Market structure suggests the next critical support after $84,000 resides at $81,500, which aligns with the 0.618 Fibonacci retracement of the Q4 2025 rally.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.