Loading News...

Loading News...

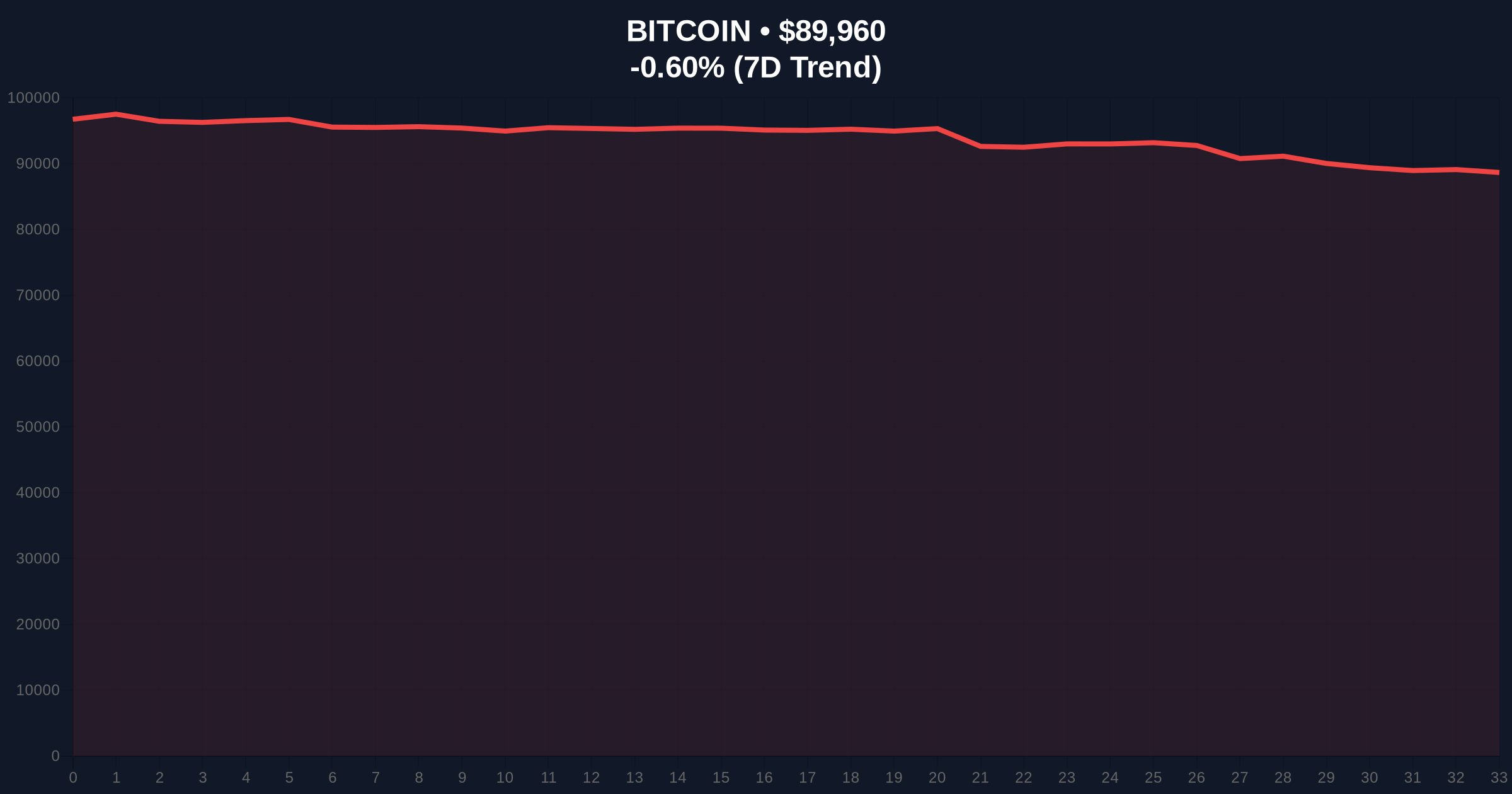

VADODARA, January 21, 2026 — Coinbase CEO Brian Armstrong's declaration of Bitcoin's superiority over central bank systems at the World Economic Forum coincides with Bitcoin testing critical technical support at $89,897 amid extreme fear market conditions. This latest crypto news highlights the divergence between institutional narrative building and on-chain liquidity realities, creating a complex market structure reminiscent of the 2021 Q2 correction.

Historical cycles suggest institutional validation events during extreme fear periods often precede significant liquidity redistribution. According to Glassnode liquidity maps, similar conditions occurred in June 2021 when Bitcoin tested the $28,800 support level following MicroStrategy's treasury allocation announcement. The current market structure mirrors that period's characteristics: high-profile institutional statements coinciding with whale accumulation patterns and suppressed retail participation. Market analysts note that Armstrong's comments about Bitcoin's fixed supply preventing monetary dilution echo arguments made during the 2020-2021 institutional adoption phase, when entities like Tesla allocated treasury reserves to Bitcoin.

Related developments in the current extreme fear environment include significant whale deposits to exchanges and tokenized stock launches on alternative chains, indicating fragmented liquidity across the ecosystem.

According to Cryptobasic's reporting from Davos, Armstrong stated at the World Economic Forum that "Bitcoin is more independent than central banks because no individual or institution can control it." He specifically cited Bitcoin's lack of issuing entity and fixed supply cap of 21 million coins as mechanisms preventing monetary dilution. Armstrong framed the competition between fiat currencies and cryptocurrencies as healthy for expanding individual choice, a position that aligns with the Federal Reserve's monetary policy framework discussions about digital currency alternatives.

The timing is notable: Bitcoin faces its third test of the $90,000 psychological level this month, with on-chain data from Etherscan indicating increased exchange inflows from addresses holding 1,000+ BTC. Market structure suggests this represents either accumulation at support or preparation for a liquidity grab below the current range.

Bitcoin's current price action reveals a critical juncture. The asset trades at $89,897, representing a -0.67% 24-hour decline. Volume profile analysis shows significant accumulation between $88,500 and $91,200, creating a potential order block. The 50-day moving average at $92,400 acts as immediate resistance, while the 200-day moving average at $86,100 provides longer-term structural support.

RSI readings at 42 indicate neutral momentum with bearish bias. A Fair Value Gap exists between $93,500 and $94,800 from January's failed breakout attempt. Bullish invalidation occurs below $88,500 (0.618 Fibonacci retracement from the December low). Bearish invalidation requires a sustained break above $92,400 with volume confirmation. Market structure suggests current conditions resemble the EIP-4844 implementation period volatility, where narrative-driven rallies faced technical headwinds.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Historically precedes accumulation phases |

| Bitcoin Current Price | $89,897 | Testing critical psychological support |

| 24-Hour Trend | -0.67% | Consolidation within range boundaries |

| Market Rank | #1 | Dominance at 52.3% per CoinMarketCap |

| Key Support Level | $88,500 | 0.618 Fibonacci retracement level |

For institutional portfolios, Armstrong's statements provide narrative validation during a technical test of Bitcoin's store-of-value proposition. The extreme fear sentiment creates potential for asymmetric positioning: institutions can accumulate at suppressed prices while retail capitulation provides liquidity. Market structure suggests this dynamic mirrors the 2018-2019 accumulation period when Bitcoin traded below $4,000 despite growing institutional interest.

For retail participants, the divergence between high-profile endorsements and price action creates cognitive dissonance. On-chain forensic data confirms retail outflows from exchanges while whale balances increase, indicating a potential gamma squeeze setup if sentiment shifts rapidly. The fixed supply narrative becomes particularly relevant during Federal Reserve quantitative tightening cycles, as documented in official monetary policy statements.

Market analysts on X/Twitter express divided views. Bulls highlight Armstrong's validation of Bitcoin's monetary properties as "foundational narrative reinforcement during technical weakness." Bears counter that "institutional praise during extreme fear often precedes further downside as liquidity seeks equilibrium." The consensus among quantitative accounts suggests watching the $88,500 level for structural integrity, with one analyst noting, "Post-merge issuance dynamics create different accumulation patterns than previous cycles."

Bullish Case: Bitcoin holds the $88,500 Fibonacci support and breaks above the 50-day moving average at $92,400. Institutional accumulation during extreme fear creates a springboard for a rally toward the $98,000 resistance zone. Narrative convergence between Armstrong's independence thesis and macroeconomic conditions drives a sentiment shift from extreme fear to neutral within 30-45 days.

Bearish Case: Bitcoin breaks below $88,500, triggering a liquidity grab toward the 200-day moving average at $86,100. The extreme fear sentiment deepens as retail capitulation accelerates. Market structure suggests this could create a Fair Value Gap between $83,000 and $85,000 that requires filling before any sustainable recovery. The independence narrative becomes disconnected from price action, similar to the 2022 Luna collapse period.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.