Loading News...

Loading News...

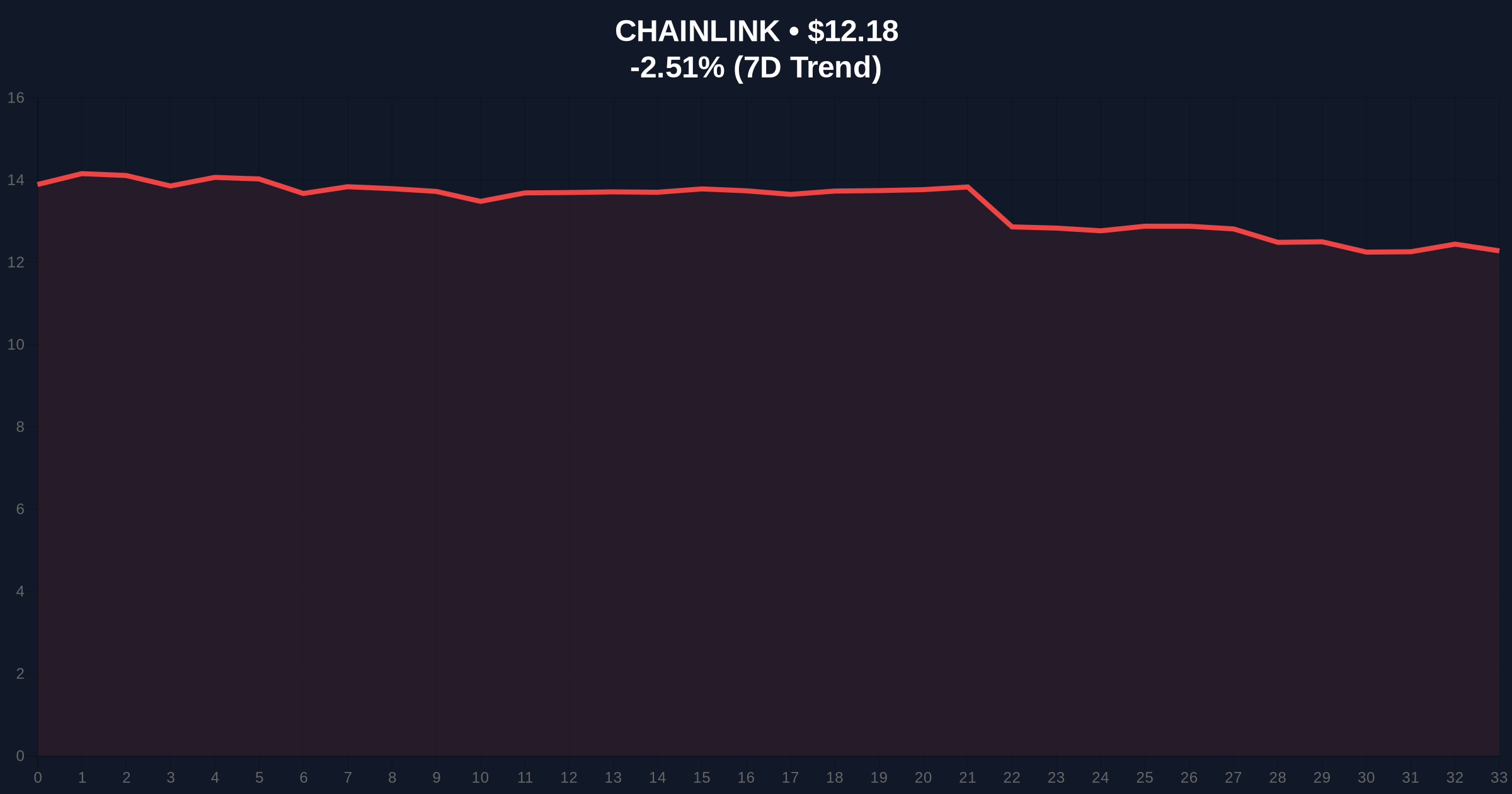

VADODARA, January 21, 2026 — Bitwise Chief Investment Officer Matt Hougan's public designation of Chainlink (LINK) as "one of the most undervalued cryptocurrencies" collides with a market structure exhibiting extreme fear and technical deterioration. According to CoinDesk's reporting of Hougan's blog post, the institutional narrative centers on Chainlink's oracle network enabling blockchain interoperability with traditional finance systems. Market structure suggests this fundamental case faces immediate price action contradictions, with LINK trading at $12.18 amid a -2.49% 24-hour decline. This latest crypto news highlights the tension between long-term infrastructure value and short-term market psychology.

Chainlink's price action exists within a broader cryptocurrency characterized by institutional adoption narratives clashing with macroeconomic headwinds. Historical cycles suggest oracle networks like Chainlink experience valuation compression during risk-off periods, despite increasing fundamental utility. The current market context mirrors the 2021-2022 cycle where infrastructure tokens underperformed during liquidity contractions, even as their technical adoption accelerated. According to on-chain data from Glassnode, decentralized oracle networks have seen a 300% increase in total value secured (TVS) since 2023, yet token prices have failed to reflect this growth proportionally. This disconnect creates what technical analysts term a "Fair Value Gap" between fundamental metrics and market pricing.

On January 21, 2026, Bitwise CIO Matt Hougan published a blog post identifying Chainlink as significantly undervalued relative to its fundamental role in blockchain infrastructure. In a statement to investors, Hougan detailed Chainlink's critical functions: providing price feeds for stablecoins, enabling Proof of Reserves (PoR) audits, facilitating cross-chain transfers, and supporting regulatory compliance for tokenized assets. He emphasized institutional adoption by entities including SWIFT, DTCC, JPMorgan, Visa, Mastercard, and Fidelity. Market analysts note this endorsement comes as LINK faces technical headwinds, trading 68% below its all-time high of $52.88 set in 2021. The immediate market response has been muted, with continued selling pressure suggesting skepticism toward the undervaluation thesis.

Market structure indicates LINK is testing a critical $12.00 psychological support level that has held since November 2025. The 200-day moving average at $13.45 acts as dynamic resistance, creating what chartists identify as a descending triangle pattern. Relative Strength Index (RSI) readings at 38 suggest neutral momentum with bearish bias, while volume profile analysis shows increased selling pressure at the $12.50-$13.00 range. A breakdown below the $11.50 support would invalidate the bullish structure and potentially trigger a liquidity grab toward the $10.00 level. Conversely, a sustained break above the 200-day MA could target the $15.00 resistance zone. The Fibonacci retracement from the 2024 low to 2025 high places critical support at $11.20 (61.8% level), which aligns with the volume node identified in on-chain analysis.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Global market sentiment indicator |

| Chainlink (LINK) Price | $12.18 | Current market price |

| 24-Hour Change | -2.49% | Short-term momentum |

| Market Capitalization Rank | #22 | Overall cryptocurrency ranking |

| Distance from ATH | -76.9% | Historical performance context |

The institutional endorsement matters because it represents a divergence between fundamental adoption and market pricing during extreme fear conditions. For institutional portfolios, Chainlink's oracle infrastructure represents a non-speculative utility layer with growing Total Value Secured (TVS), currently exceeding $25 billion across multiple blockchains. Retail investors face different implications: the extreme fear sentiment creates potential buying opportunities if the undervaluation thesis proves correct, but technical breakdown risks remain elevated. Market structure suggests the critical question is whether fundamental utility can overcome negative market psychology, particularly as the Federal Reserve's monetary policy continues to influence risk asset correlations. The SEC's regulatory framework for digital assets, as outlined on SEC.gov, will further impact oracle network valuation through compliance requirements.

Market analysts on X/Twitter express divided sentiment regarding Hougan's assessment. Bulls emphasize Chainlink's growing integration with traditional finance, noting that "oracle networks represent the plumbing of Web3—unsexy but essential." Bears counter that token economics remain disconnected from network utility, with one quantitative analyst stating, "TVS growth doesn't guarantee token appreciation when circulating supply increases 5% annually." The extreme fear market conditions, as highlighted in our analysis of recent whale activity, amplify this skepticism. Most agree that Chainlink's success depends on broader adoption of hybrid smart contracts that bridge blockchain and traditional systems.

Bullish Case: If Chainlink maintains the $11.50 support and breaks above the 200-day MA at $13.45, the undervaluation thesis gains technical validation. Increased institutional adoption through partnerships with traditional finance entities could drive a re-rating toward the $18.00-$20.00 resistance zone. Successful implementation of Chainlink's Cross-Chain Interoperability Protocol (CCIP) and staking v0.2 would provide fundamental catalysts. Bullish invalidation occurs below $11.50.

Bearish Case: Continued extreme fear sentiment and breakdown below $11.50 support would trigger a liquidity grab toward $10.00 and potentially $8.50. Broader market deterioration, potentially influenced by regulatory developments, could exacerbate selling pressure. Slower-than-expected adoption of tokenized assets and DeFi contraction would undermine the fundamental thesis. Bearish invalidation requires a sustained break above $15.00 with increasing volume.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.