Loading News...

Loading News...

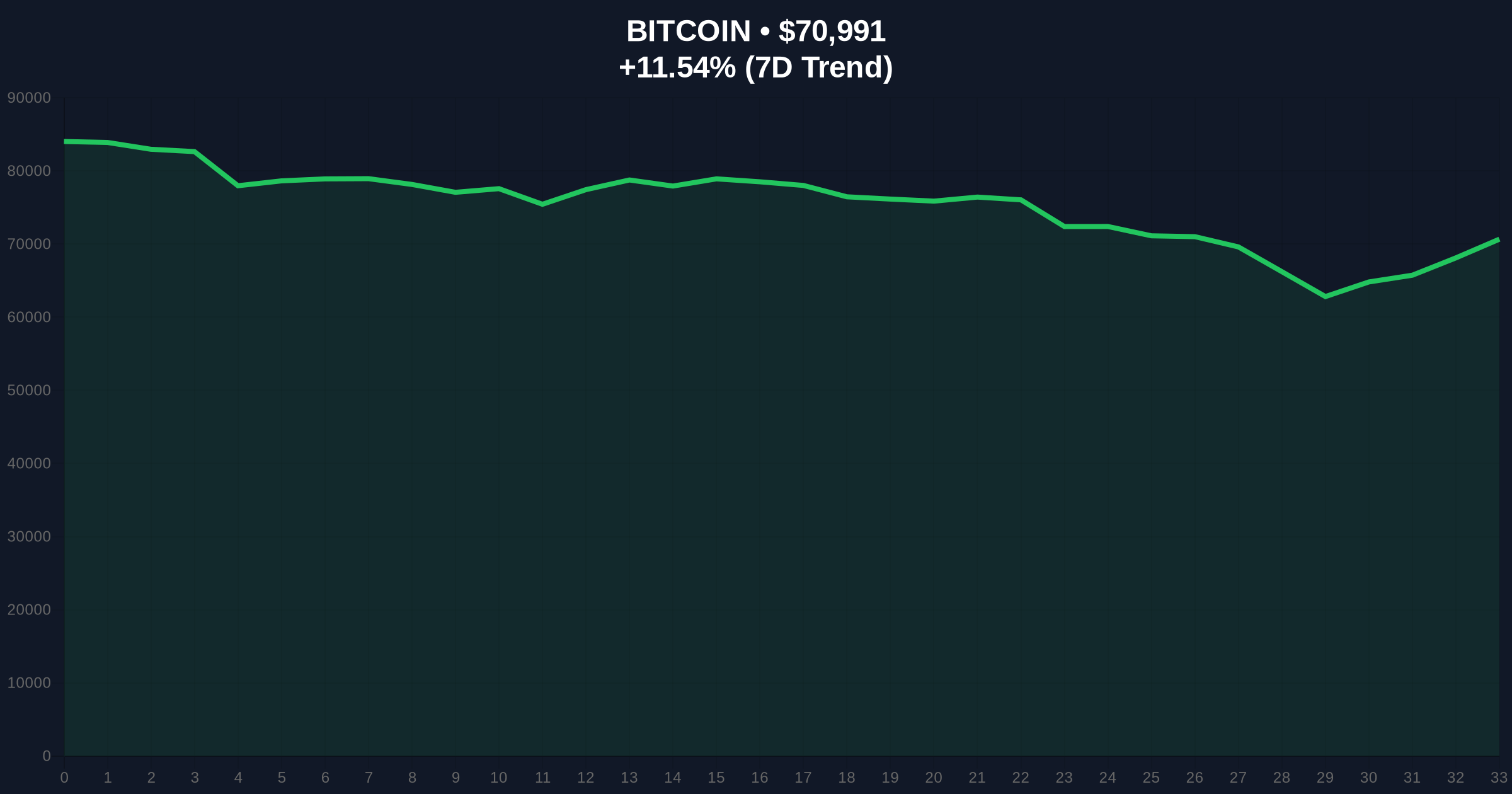

VADODARA, February 6, 2026 — Bitcoin has surged above the $71,000 psychological threshold, according to CoinNess market monitoring data, creating a stark contradiction with prevailing market sentiment. This daily crypto analysis reveals BTC trading at $71,000 on the Binance USDT market, marking an 11.30% 24-hour gain that directly challenges the Extreme Fear reading dominating global crypto sentiment.

CoinNess market monitoring confirms Bitcoin breached the $71,000 level on February 6, 2026. The asset currently trades at $70,841 with a 24-hour trend of +11.30%, maintaining its #1 market rank. This price action directly contradicts the Crypto Fear & Greed Index, which registers an Extreme Fear score of 9 out of 100. Market structure suggests this divergence represents either a sophisticated liquidity grab or a genuine sentiment reversal in its early stages.

Historically, Extreme Fear readings often coincide with local price bottoms, not breakouts above key psychological levels. In contrast, the current scenario presents a rare technical anomaly. Underlying this trend, institutional players appear to be positioning against retail sentiment. For instance, Fidelity's recent $65,000 Bitcoin entry call directly conflicts with the prevailing fear, suggesting professional capital sees value where retail sees risk.

, related developments show similar institutional counter-trend behavior. Longling Capital withdrew $17.5 million in ETH from Binance amid this fear, while Robinhood's listing of Spot SKR has been analyzed as a potential liquidity grab. These actions collectively paint a picture of strategic accumulation during periods of maximum pessimism.

On-chain data indicates the move above $71,000 has created a significant Fair Value Gap (FVG) between $69,200 and $70,500. This FVG now acts as immediate support. The Fibonacci 0.618 retracement level from the 2025 cycle high sits at $68,500, forming a critical Order Block. Volume Profile analysis shows thinning volume on the ascent, raising questions about sustainability. The Relative Strength Index (RSI) on daily timeframes approaches overbought territory near 68, suggesting potential near-term exhaustion.

Market structure suggests the 200-day moving average at $67,800 provides the ultimate structural support. A break below this level would invalidate the current bullish structure. According to technical documentation from authoritative sources like Ethereum.org on market mechanics, such divergences between price and sentiment often precede volatile expansions.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (Score: 9/100) |

| Bitcoin Current Price | $70,841 |

| 24-Hour Price Change | +11.30% |

| Market Rank | #1 |

| Key Technical Support (Fibonacci 0.618) | $68,500 |

This price-sentiment divergence matters because it tests the efficiency of the fear-based market narrative. Institutional liquidity cycles often exploit such extremes. Retail market structure, currently dominated by fear, faces a potential squeeze if institutional buying pressure continues. The 5-year horizon suggests that breaking key levels amid universal pessimism can mark cycle inflection points, similar to the post-merge issuance dynamics that reshaped Ethereum's economic model.

Market structure suggests this is either a classic bear trap or the early phase of a sentiment reversal. The Extreme Fear reading at 9/100 against an 11% daily gain creates a statistical anomaly that demands forensic attention. We are monitoring UTXO age bands for signs of long-term holder accumulation, which would confirm the institutional thesis.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on whether this move represents smart money accumulation or a retail-driven short squeeze. Historical cycles suggest that breaking key psychological barriers during Extreme Fear often leads to accelerated rallies once sentiment flips, but the immediate risk of a liquidity-driven reversal remains elevated.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.