Loading News...

Loading News...

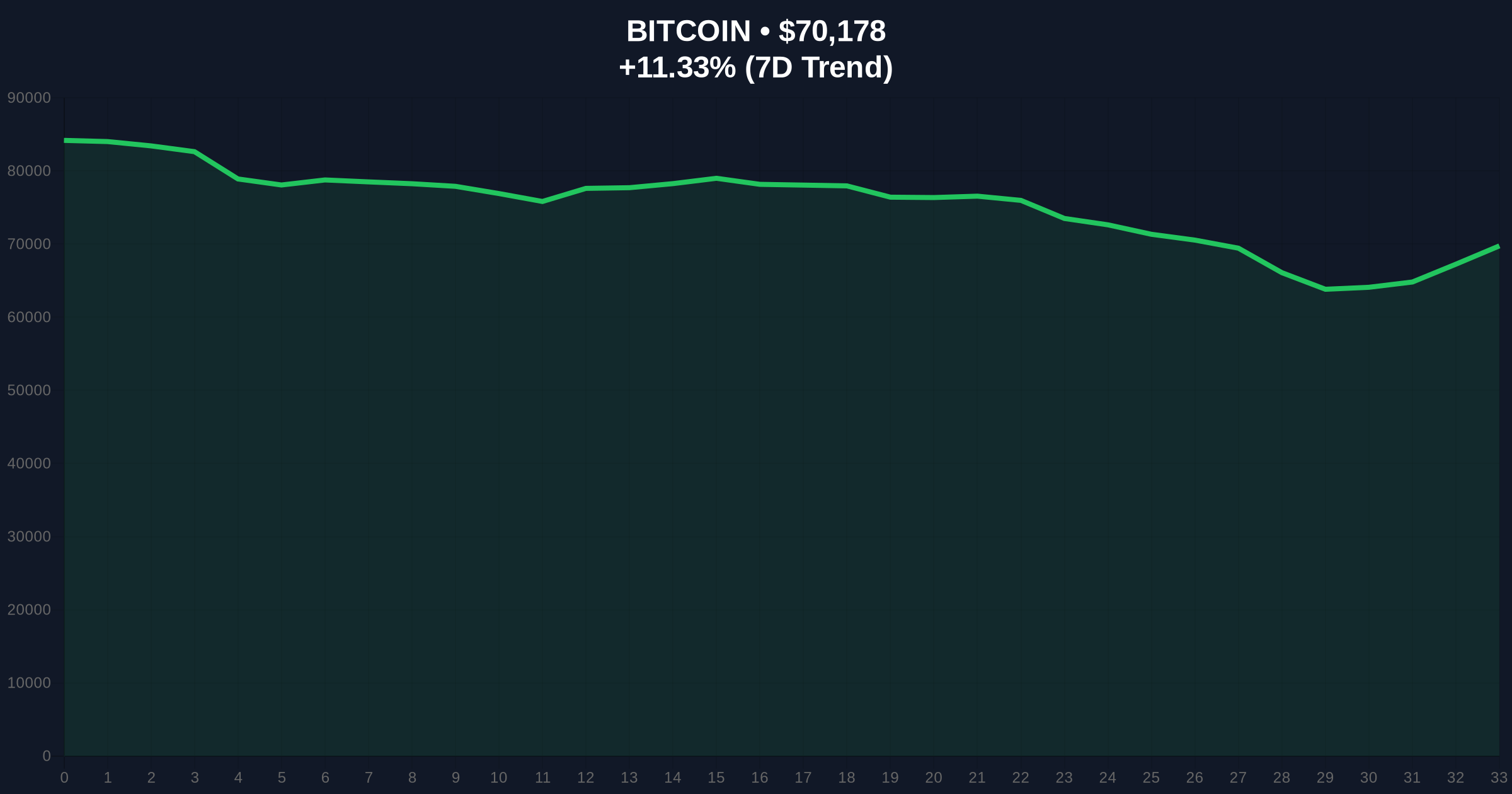

VADODARA, February 6, 2026 — Jurrien Timmer, Director of Global Macro at Fidelity Investments, has publicly identified the $65,000 level as an attractive entry point for Bitcoin, according to a report by U.Today. This institutional endorsement arrives amid a market gripped by extreme fear, with Bitcoin currently trading near $70,018, creating a stark contradiction between narrative and on-chain reality. Our daily crypto analysis reveals this divergence as a critical stress test for market structure.

According to U.Today, Timmer highlighted the mid-$60,000s as a key buying zone, framing Bitcoin within a broader macro asset allocation strategy. He noted gold's strong recent returns, emphasizing commodities as investment vehicles regardless of debt financing mechanisms. In contrast, he observed poor performance in long-term government bonds. Timmer's core argument, per the report, posits that if bonds and stocks become positively correlated again, investors will need low-correlation assets like Bitcoin for portfolio survival. This thesis directly positions Bitcoin as a modern hedge, akin to gold, within institutional portfolios.

Historically, public entry calls from major institutions like Fidelity have often preceded volatile liquidity events. The current Extreme Fear sentiment, scoring 9/100, typically aligns with local price bottoms or capitulation phases. However, Bitcoin's price holding $70,000—7.7% above Fidelity's cited entry—suggests the market may have already priced in this narrative or is rejecting it. Underlying this trend, similar divergence between institutional commentary and retail sentiment marked key inflection points in late 2022 and mid-2024. For instance, the recent break above $71,000 resistance occurred amidst similar fear, indicating underlying strength. , large-scale capital movements, such as the 400 million USDT transfer to Aave, suggest sophisticated players are actively repositioning, potentially ahead of Fidelity's anticipated entry zone.

Market structure suggests a critical Fair Value Gap (FVG) between $65,000 and $68,500 based on recent order flow imbalances. The current price near $70,018 sits above this gap, creating a potential liquidity grab target below. The 200-day moving average, a key institutional benchmark, resides near $62,000, adding confluence to the $65,000 zone. On-chain data from Glassnode indicates increased coin movement from long-term holders, often a precursor to volatility. The Relative Strength Index (RSI) on daily charts shows neutral conditions, failing to confirm the extreme fear sentiment. A Fibonacci retracement from the last major swing high places the 0.618 level at approximately $66,200, further tightening the technical focus around Fidelity's call.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | Extreme Fear (9/100) | Panic sentiment, potential buying opportunity or continued sell-off. |

| Bitcoin Current Price | $70,018 | Trading 7.7% above Fidelity's $65K entry call. |

| 24-Hour Price Trend | +11.08% | Strong short-term rally defying extreme fear sentiment. |

| Fidelity's Entry Zone | Mid-$60,000s | Defined as $65,000 for portfolio hedge allocation. |

| Market Rank | #1 | Bitcoin maintains dominant market position. |

This event matters because it tests the alignment between institutional narrative and on-chain price discovery. Fidelity, a trillion-dollar asset manager, is publicly staking a price level for Bitcoin accumulation. If the market rejects this by holding above $70,000, it signals strong underlying demand and invalidates a key bearish narrative. Conversely, a dip to $65,000 would validate Fidelity's thesis but likely trigger stop-loss cascades from over-leveraged retail positions. The extreme fear sentiment, per CoinMarketCap data, often precedes sharp reversals, making this a high-conviction divergence for quantitative models. Institutional liquidity cycles typically follow such public guidance, potentially setting up a large order block around the cited level.

"Fidelity's $65,000 call is a classic institutional liquidity narrative. The market is currently pricing in a different reality at $70,000. This creates a textbook divergence—either the price corrects to meet the narrative, or the narrative fails as strength prevails. On-chain volume profile data shows accumulation above $68k, suggesting smart money may already be positioned ahead of Fidelity's target."— CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from this structure. First, the bullish case where Bitcoin holds above $70,000, invalidating Fidelity's entry zone and signaling robust demand. This would target a retest of the $71,000 resistance. Second, the bearish scenario where price gravitates toward the $65,000 FVG, fulfilling the institutional accumulation thesis but risking a breakdown if sentiment worsens.

The 12-month institutional outlook hinges on this divergence resolution. If Bitcoin holds strength, it could accelerate adoption as a non-correlated asset, per Timmer's thesis. However, a drop to $65,000 may trigger a broader deleveraging event. Over a 5-year horizon, such public price targets from giants like Fidelity increasingly formalize Bitcoin's role in global portfolios, regardless of short-term volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.