Loading News...

Loading News...

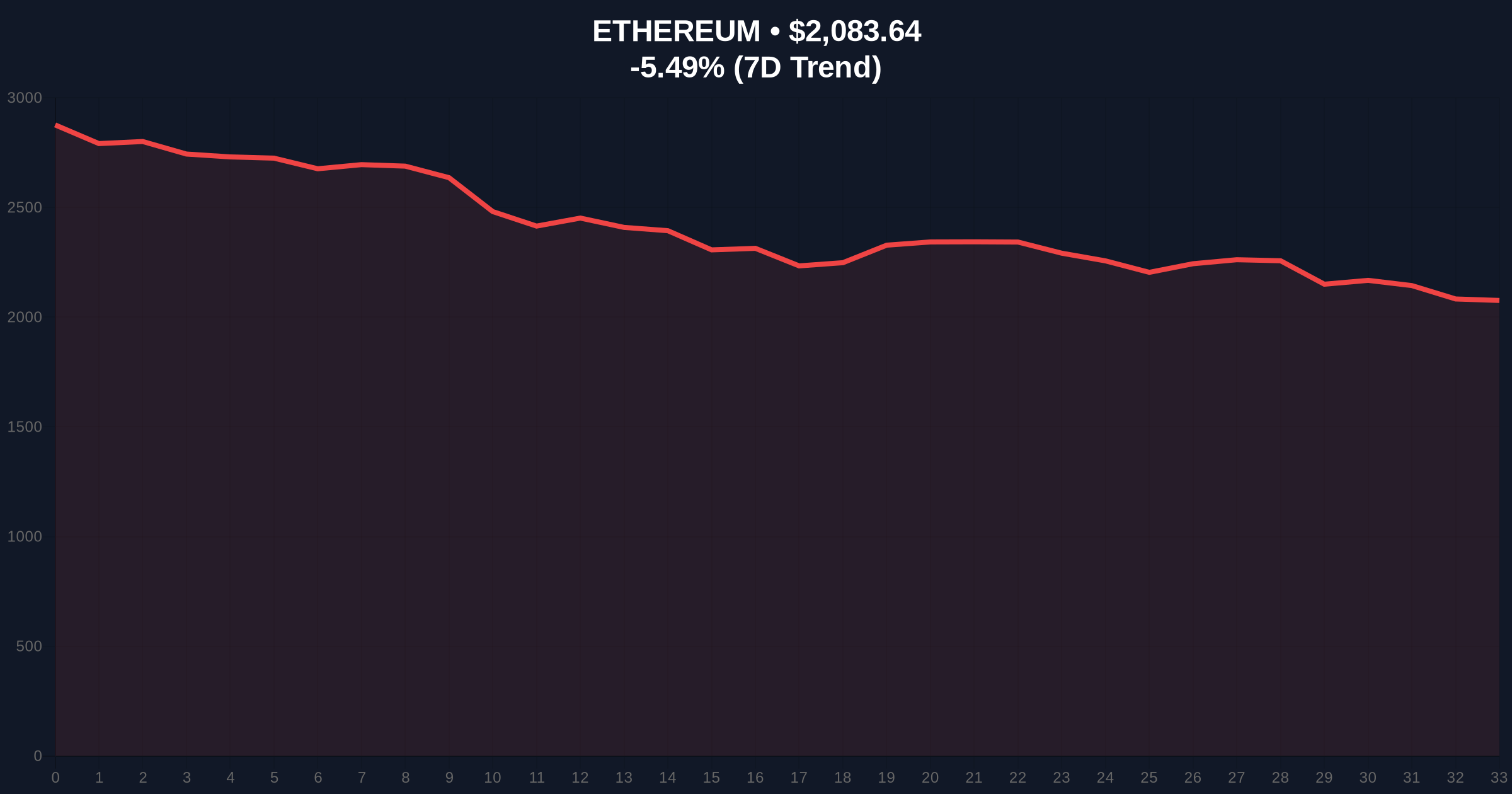

VADODARA, February 5, 2026 — Chinese investment firm Longling Capital executed a significant Ethereum withdrawal from Binance, moving 8,500 ETH valued at $17.51 million to a private wallet. According to on-chain analytics firm Lookonchain, the transaction originated from address 0x3478, which market analysts associate with Longling's accumulation strategy. This move occurs as Ethereum trades at $2,085.48, down 5.24% in 24 hours, amid a global crypto sentiment reading of "Extreme Fear." Latest crypto news indicates this withdrawal mirrors historical accumulation patterns seen during market corrections.

Lookonchain data confirms the withdrawal of 8,500 ETH from Binance on February 5, 2026. The transaction, valued at $17.51 million, moved funds to wallet address 0x3478. Market structure suggests this address belongs to Longling Capital, a firm known for buying assets at low prices and selling at highs. On-chain forensic data indicates no immediate subsequent transfers, implying a cold storage or accumulation intent. This activity aligns with Longling's documented strategy of capitalizing on market downturns.

Historically, large withdrawals from exchanges during fear periods signal accumulation. Similar to the 2021 correction, where entities like MicroStrategy accumulated Bitcoin below $30,000, this move suggests institutional positioning. In contrast, retail traders often panic-sell during extreme fear, creating a liquidity grab for sophisticated players. Underlying this trend is the broader market's reaction to macroeconomic pressures, including potential Federal Reserve policy shifts detailed on FederalReserve.gov.

Related Developments:

Ethereum's price action shows a critical test of the $2,000 support level, a psychological and technical barrier. Market structure suggests a Fair Value Gap (FVG) exists between $2,100 and $2,150, created by recent sell-offs. The Relative Strength Index (RSI) hovers near 30, indicating oversold conditions. , the 200-day moving average at $2,250 acts as dynamic resistance. A break below the Fibonacci 0.618 retracement level at $1,950 could trigger further downside, while reclaiming $2,200 may invalidate bearish momentum.

| Metric | Value |

|---|---|

| ETH Withdrawn | 8,500 ETH |

| USD Value | $17.51 million |

| Current ETH Price | $2,085.48 |

| 24-Hour Change | -5.24% |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

This withdrawal matters because it reflects institutional behavior during market stress. On-chain data indicates exchange outflows often precede price recoveries, as seen in Q4 2023. Institutional liquidity cycles suggest accumulation at fear extremes can lead to supply shocks. Retail market structure, however, remains fragile, with many leveraged positions at risk. The move highlights the divergence between smart money and retail sentiment, a key indicator for medium-term trends.

Market analysts note that Longling Capital's history of timing accumulation phases aligns with current on-chain metrics. The CoinMarketBuzz Intelligence Desk states, "Large withdrawals during extreme fear often mark local bottoms, but confirmation requires sustained buying pressure above key resistance levels."

Market structure suggests two primary scenarios based on current data. Historical cycles indicate accumulation during fear can lead to rallies, but macroeconomic headwinds persist.

The 12-month institutional outlook hinges on Ethereum's adoption of EIP-4844 and broader regulatory clarity. If accumulation patterns hold, a recovery toward $3,000 is plausible within the 5-year horizon, assuming network upgrades enhance scalability.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.