Loading News...

Loading News...

VADODARA, February 6, 2026 — Whale Alert reported a massive 600,000,000 USDT transfer from Binance to an unknown wallet, valued at approximately $599 million. This daily crypto analysis examines the transaction's implications for market structure and liquidity dynamics during a period of extreme fear. On-chain data indicates this move may represent a strategic liquidity grab or institutional repositioning, challenging the narrative of simple whale accumulation.

According to Whale Alert, the transaction occurred on February 6, 2026, moving 600 million USDT from Binance to an unidentified wallet. The transfer's value nears $599 million, making it one of the largest single movements of stablecoin liquidity this year. Market structure suggests such sizeable outflows from a major exchange like Binance often precede volatility events or institutional maneuvers.

Blockchain forensic tools, such as those provided by Etherscan, typically track these movements, but the destination wallet's anonymity complicates analysis. This opacity raises questions about whether the transfer serves as collateral for derivatives, a hedge against market downturns, or preparation for a large-scale asset acquisition. The timing coincides with BNB's sharp decline of -10.54% in 24 hours, adding layers to the narrative.

Historically, large stablecoin transfers from exchanges to private wallets have correlated with market bottoms or tops, acting as liquidity signals. For instance, similar moves in 2021 often preceded Bitcoin rallies, as whales accumulated off-exchange. In contrast, the current environment features extreme fear, with the Crypto Fear & Greed Index at 9/100, suggesting this transfer might instead reflect risk-off behavior or deleveraging.

Underlying this trend, recent market developments show heightened stress. Related articles highlight Bitcoin capitulation indicators hitting two-year highs and implied volatility nearing FTX collapse levels. , Bitcoin breaking below $64,000 support weakens overall structure, potentially influencing whale strategies like this USDT move.

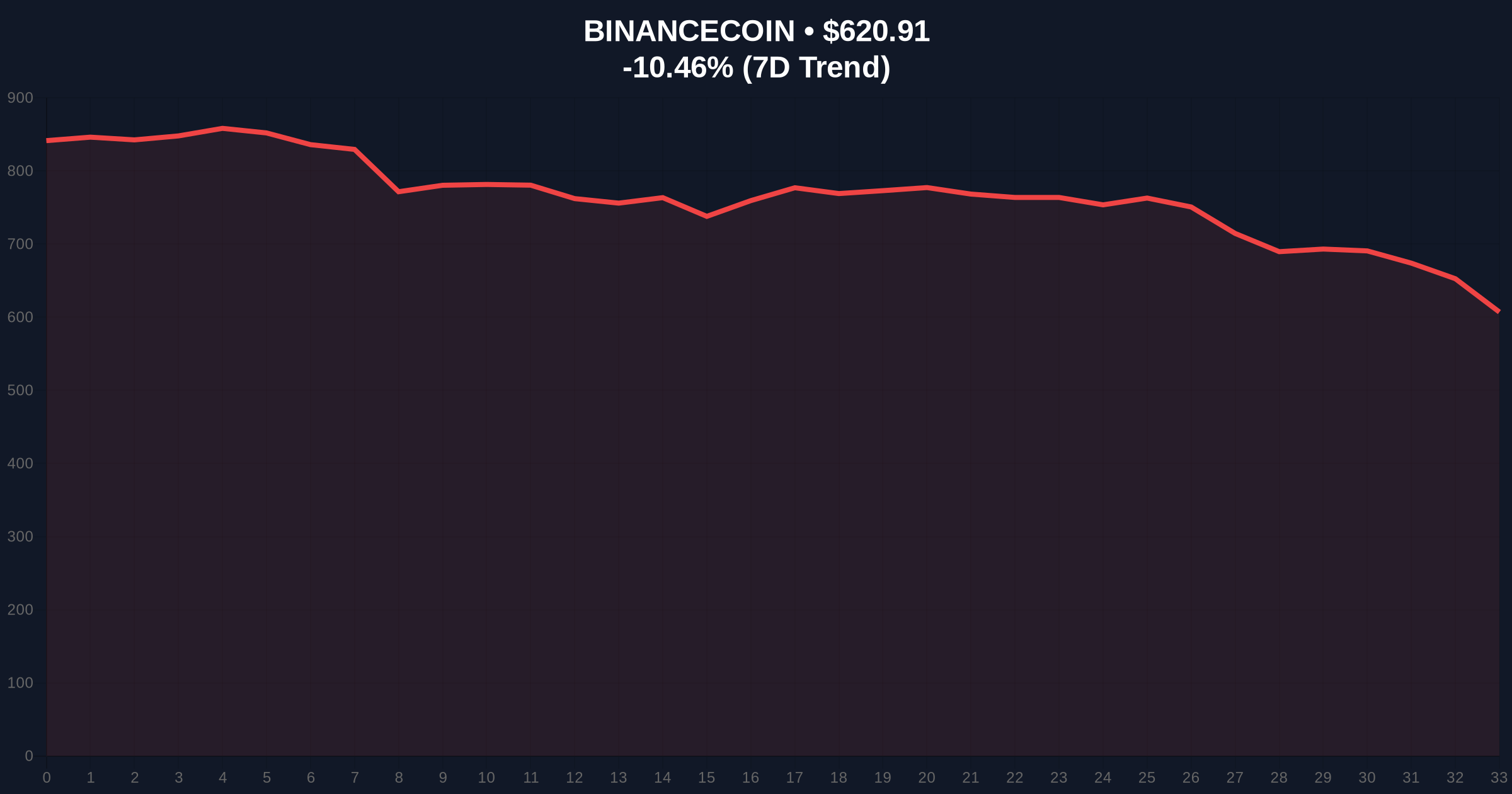

Market structure suggests the transfer creates a Fair Value Gap (FVG) in liquidity profiles, potentially affecting BNB's price action. BNB currently trades at $620.4, with its 24-hour trend down -10.54%. Technical analysis indicates key support at the Fibonacci 0.618 retracement level near $600, a zone that must hold to prevent further declines. The Relative Strength Index (RSI) for BNB likely approaches oversold territory, but extreme fear can prolong sell-offs.

Volume Profile data from platforms like Glassnode shows reduced exchange reserves post-transfer, which may tighten liquidity and amplify volatility. This aligns with broader market weakness, where UTXO age bands indicate older coins moving, signaling potential distribution. The transfer's size suggests it could act as an Order Block, setting up future price reactions if the wallet reactivates.

| Metric | Value |

|---|---|

| USDT Transfer Amount | 600,000,000 USDT |

| Transaction Value | $599 million |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| BNB Current Price | $620.4 |

| BNB 24h Trend | -10.54% |

This transfer matters because it impacts institutional liquidity cycles and retail market structure. A $599 million movement represents significant capital that could destabilize markets if deployed aggressively. On-chain data indicates stablecoin flows often lead price action; thus, this event may foreshadow a volatility spike or trend reversal. The extreme fear environment amplifies risks, as noted in resources like the Ethereum Foundation's market insights on liquidity dynamics.

, the transfer challenges the bullish narrative of whale accumulation. Instead, it might signal precautionary measures amid capitulation signs, such as those seen in Vitalik Buterin's recent ETH Aave deposit. Retail traders should monitor for follow-on transactions, as large stablecoin holdings off-exchange can pressure prices if converted to volatile assets.

Market structure suggests this USDT transfer is not merely accumulation but a liquidity hedge. In extreme fear conditions, institutions often move stablecoins to private wallets to avoid exchange risks or prepare for margin calls. The unknown destination adds opacity, but historical cycles show such moves frequently precede market inflection points.

Based on current market structure, two data-backed technical scenarios emerge. First, if the transfer supports accumulation, it could stabilize prices near key supports. Second, if it reflects deleveraging, further downside may unfold. Analysts suggest watching BNB's reaction at $620 and Bitcoin's performance relative to its recent breakdown.

For the 12-month institutional outlook, this event the importance of liquidity management in volatile cycles. If extreme fear persists, similar transfers may increase, affecting the 5-year horizon by reshaping how whales navigate downturns. Market participants should prioritize risk metrics over hype-driven narratives.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.