Loading News...

Loading News...

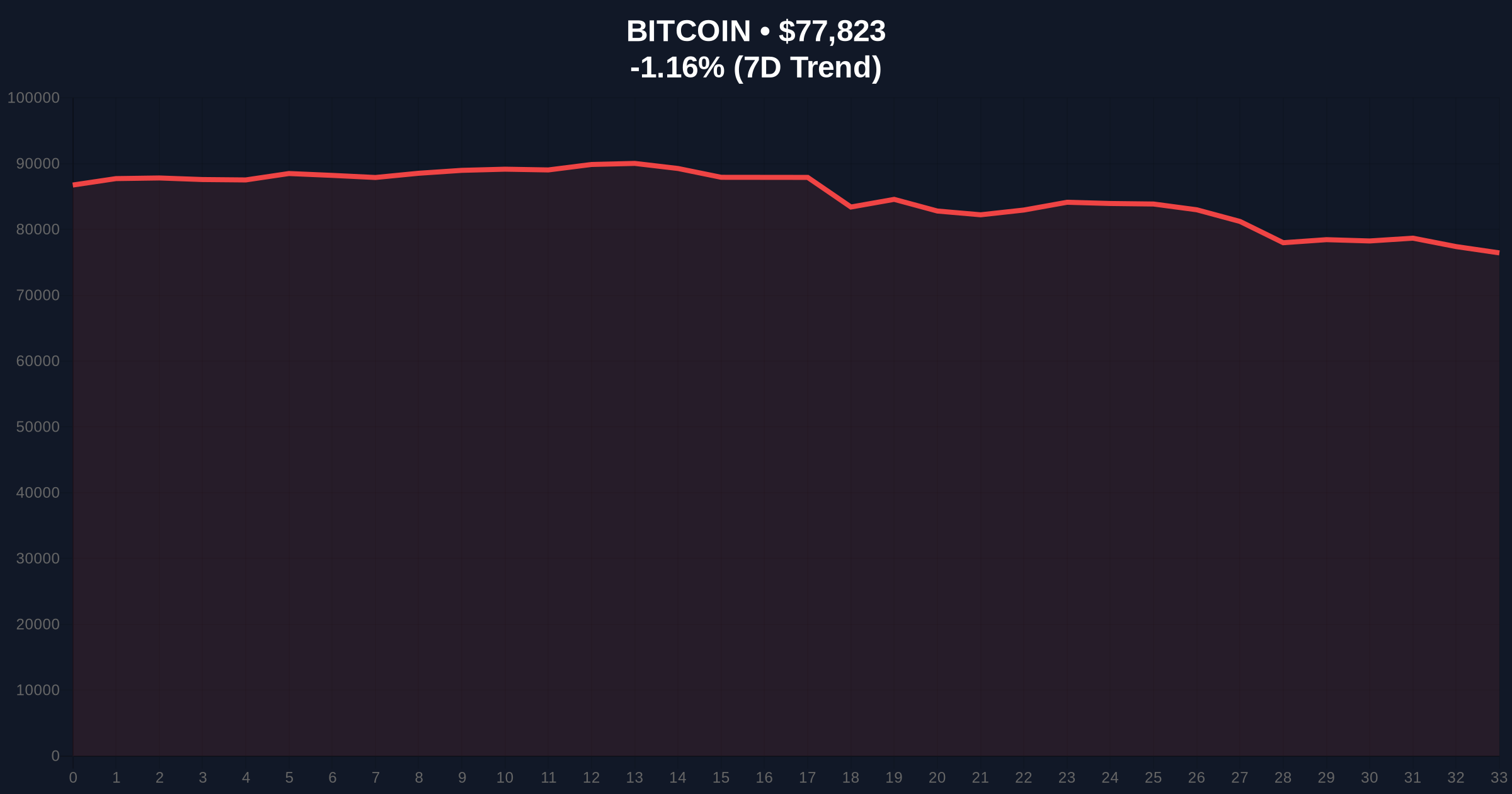

VADODARA, February 2, 2026 — Bitcoin has declined to the $78,000 level, marking a significant test of market structure as new capital inflows stagnate and early holders engage in profit-taking. According to on-chain data from CryptoQuant, Bitcoin's realized capitalization has flatlined, indicating a lack of fresh institutional or retail capital entering the market. Consequently, the Bitcoin price action now hinges on whether key support levels can hold against selling pressure from long-term holders.

Ki Young Ju, CEO of CryptoQuant, provided critical analysis to CoinDesk. He noted that Bitcoin's realized capitalization—a metric tracking the aggregate cost basis of all coins—has stopped growing. This stagnation signals that new money is no longer flowing into Bitcoin at previous rates. Underlying this trend, early holders who accumulated Bitcoin during lower price cycles are now realizing substantial unrealized profits. These profits stem largely from the 2024-2025 rally driven by spot ETF approvals and corporate acquisitions like MicroStrategy's.

MicroStrategy holds 712,647 BTC at an average purchase price of $76,040. According to data from BitcoinTreasuries, the firm is currently up approximately 2.35% on its investment. On February 2, BTC briefly touched $75,700, dipping below MicroStrategy's average cost basis. It subsequently recovered to trade at $77,900, up 1.19% from the previous session. Ki Young Ju predicted that Bitcoin is unlikely to experience a severe crash unless MicroStrategy engages in large-scale selling of its holdings.

Historically, Bitcoin bull markets require sustained capital inflows to maintain upward momentum. The current stall mirrors patterns observed in late 2021 when realized capitalization plateaued before the market correction. In contrast, the 2023-2024 rally saw consistent growth in realized cap, driven by ETF inflows and institutional adoption. , profit-taking by early investors is a normal market mechanism during price discovery phases.

Market structure suggests that the current Extreme Fear sentiment, with a score of 14/100, often precedes significant liquidity events. This environment creates potential Fair Value Gaps (FVGs) that algorithmic traders may target. For context, similar sentiment readings in 2022 preceded sharp rallies as weak hands were flushed out. You can read more about current sentiment dynamics in our analysis of Bitcoin holding above $78,000 amid extreme fear.

The technical reveals critical support and resistance zones. The immediate support cluster exists between $75,700 (MicroStrategy's cost basis) and the psychological $75,000 level. A break below this zone would invalidate the current bullish structure and likely trigger stop-loss orders. Resistance sits at the recent high near $82,000, which aligns with the 0.618 Fibonacci retracement level from the 2025 peak.

On-chain metrics from Glassnode indicate that the Spent Output Profit Ratio (SOPR) has spiked, confirming profit-taking activity. Additionally, the Market Value to Realized Value (MVRV) ratio remains elevated, suggesting that many holders are still in profit. This creates overhead supply pressure as investors look to realize gains. The 200-day moving average, currently near $72,000, provides a longer-term support reference. For deeper technical insights, refer to Ethereum's official documentation on proof-of-stake consensus mechanisms, which influence broader crypto market liquidity.

| Metric | Value | Insight |

|---|---|---|

| Current BTC Price | $77,777 | Testing key support zone |

| 24-Hour Change | -1.22% | Minor correction amid selling pressure |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically a contrarian signal |

| MicroStrategy Avg Cost | $76,040 | Critical support reference |

| MicroStrategy Holdings | 712,647 BTC | ~$55.4B at current prices |

This capital flow dynamic matters because it tests the sustainability of Bitcoin's institutional adoption narrative. Spot ETF inflows provided a liquidity backbone for the 2024-2025 rally. Their stagnation now shifts focus to organic demand and holder behavior. Early investors realizing profits could create a supply overhang that suppresses prices until new buyers emerge. Consequently, market participants must monitor whether this profit-taking represents a healthy redistribution or the early stages of a larger correction.

Institutional liquidity cycles typically follow a pattern of accumulation, distribution, and reaccumulation. The current phase appears to be distribution by early holders. Retail market structure, as measured by exchange inflows and outflows, shows increased movement to exchanges—a precursor to selling. This aligns with the broader trend of CME Bitcoin futures gaps influencing price discovery.

"The stagnation in Bitcoin's realized capitalization is the most telling metric right now. It indicates that the easy money from ETF inflows has been absorbed, and we're now in a phase where price discovery depends on holder conviction and new fundamental catalysts. The MicroStrategy cost basis at $76,040 acts as a magnet for price action—a break below could trigger algorithmic selling, while holding above it reinforces the institutional support narrative." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bullish scenario requires Bitcoin to hold above the $75,700 support and reclaim $80,000 to invalidate the bearish momentum. The bearish scenario involves a breakdown below MicroStrategy's cost basis, targeting the next support near $72,000 (200-day MA).

The 12-month institutional outlook remains cautiously optimistic, assuming no large-scale selling from major holders like MicroStrategy. However, the 5-year horizon depends on broader adoption metrics, regulatory clarity, and macroeconomic conditions. The current price action serves as a stress test for Bitcoin's maturity as an institutional asset class.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.