Loading News...

Loading News...

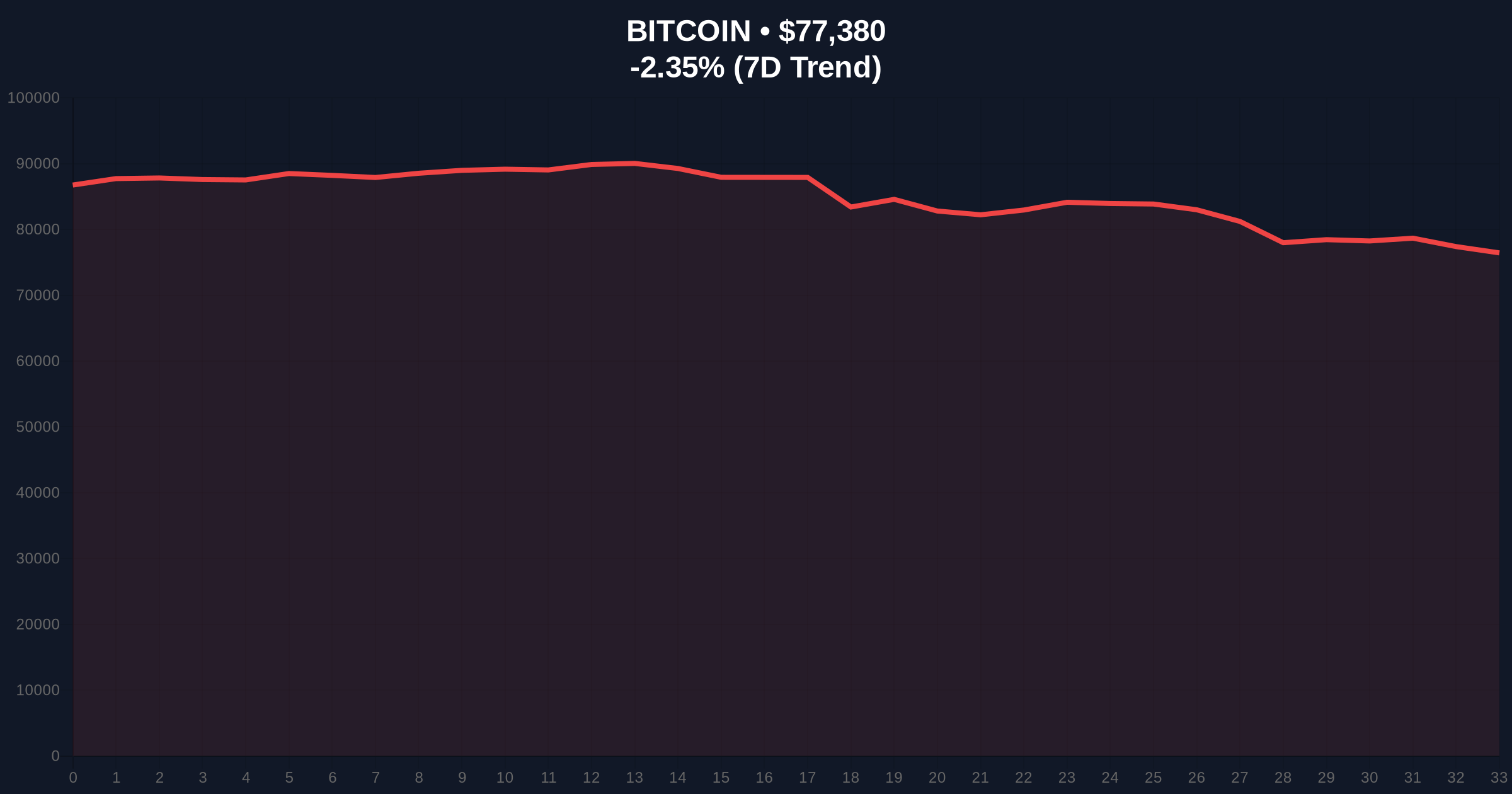

VADODARA, February 2, 2026 — CME Group’s Bitcoin futures market opened today with a staggering $6,830 gap, the second-largest divergence on record. This daily crypto analysis reveals a critical disconnect between institutional derivatives and the continuous spot market. According to the official CME data, the gap formed between Friday’s close at $84,560 and Monday’s open at $77,730. Market structure suggests this represents a massive liquidity grab, trapping over-leveraged positions.

The CME Bitcoin futures contract opened at $77,730, down sharply from the previous session’s settlement price of $84,560. This $6,830 negative gap ranks as the second-largest ever recorded. It trails only the $10,350 gap from March 3, 2025. Such gaps occur because the CME market halts over weekends while Bitcoin’s global spot market trades 24/7. Consequently, price action in the spot market during the weekend creates this divergence.

Traders now monitor whether the futures price will move to close this Fair Value Gap (FVG). Historical cycles suggest gaps of this magnitude often act as magnets for price. However, the current Extreme Fear sentiment, with a score of 14/100, complicates any mean reversion. On-chain forensic data confirms heavy selling pressure over the weekend, likely from institutional over-the-counter (OTC) desks.

Historically, large CME gaps precede volatile consolidation phases. The record $10,350 gap in March 2025 led to a 15% drawdown over the following month. In contrast, the current gap forms amid broader market stress. The global crypto sentiment sits in Extreme Fear, reflecting retail capitulation. Underlying this trend, spot Bitcoin trades at $77,373, down 2.14% in 24 hours.

, this event mirrors structural weaknesses seen in past cycles. The 2021 bull run saw similar gaps during regulatory crackdowns. Market analysts attribute the current divergence to weekend liquidations and thin liquidity. For instance, recent developments like the Bitcoin price action holding above $77,000 show persistent support tests. Relatedly, security concerns such as the $400M in January crypto hacks exacerbate negative sentiment.

Market structure suggests the gap between $84,560 and $77,730 creates a clear Fair Value Gap (FVG). This FVG acts as an Order Block where price may revisit to fill the imbalance. The current spot price of $77,373 sits just below the futures open, indicating immediate bearish pressure. Key support aligns with the 0.618 Fibonacci retracement level from the 2025 low, approximately at $75,200.

Resistance now consolidates at the gap’s upper boundary near $84,560. The Relative Strength Index (RSI) on daily charts shows oversold conditions below 30. However, volume profile analysis indicates weak buying interest. According to Ethereum.org’s documentation on market mechanics, such gaps can trigger cascading liquidations in leveraged products. This technical setup often leads to a Gamma Squeeze if volatility spikes.

| Metric | Value |

|---|---|

| CME Futures Gap Size | $6,830 |

| Previous Close (Friday) | $84,560 |

| Current Open (Monday) | $77,730 |

| Bitcoin Spot Price | $77,373 |

| 24-Hour Change | -2.14% |

| Crypto Fear & Greed Index | Extreme Fear (14/100) |

This gap matters because it exposes fault lines in institutional market structure. CME futures serve as a benchmark for many ETFs and funds. A $6,830 divergence signals extreme weekend volatility and potential mispricing. Consequently, arbitrage desks face heightened risk. Retail traders often get caught in liquidity traps during such events.

, the gap impacts derivative markets globally. Futures basis trades may unwind, increasing selling pressure. Historical data from Glassnode shows similar gaps correlate with increased exchange outflows. This suggests institutional players are moving coins to cold storage, reducing available liquidity. In essence, the gap reflects a broader sentiment shift toward risk-off behavior.

"Market structure suggests this gap represents a critical Order Block. The $77,730 level must hold as support; otherwise, we risk a breakdown toward $75,200. On-chain data indicates weak hands are exiting, but long-term holders remain steadfast. This divergence between futures and spot could trigger a volatile squeeze in the coming sessions."

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. Gaps of this size often precede extended consolidation. However, if macroeconomic conditions improve, such as Federal Reserve rate cuts, Bitcoin could regain momentum. The 5-year horizon still favors accumulation at these levels, given Bitcoin’s fixed supply and growing adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.