Loading News...

Loading News...

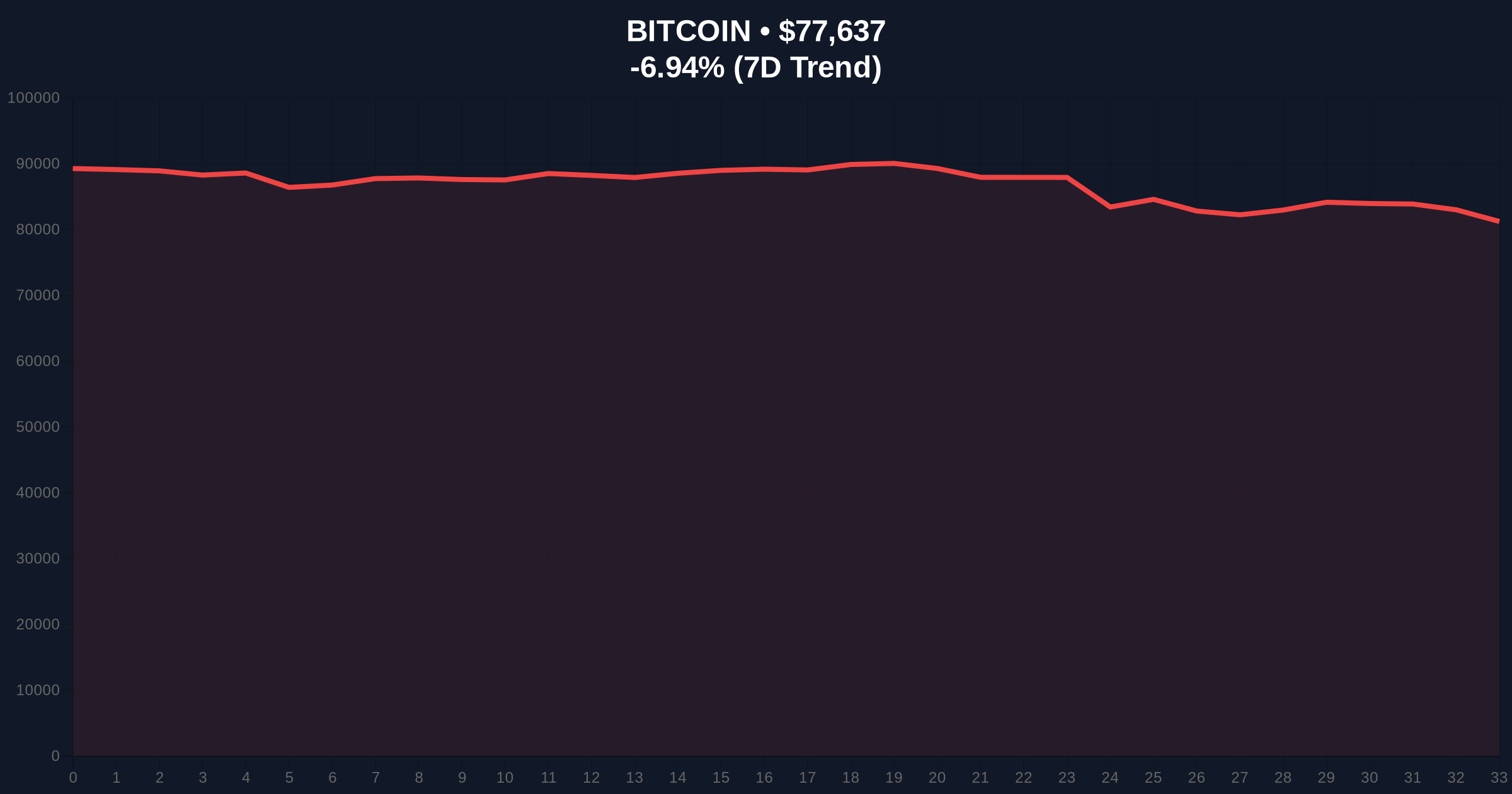

VADODARA, January 31, 2026 — Bitcoin price action shows BTC breaking above the $77,000 psychological barrier. According to CoinNess market monitoring data, BTC trades at $77,097.5 on the Binance USDT market. This move occurs against a backdrop of extreme fear sentiment. Market structure suggests a critical test of institutional liquidity zones.

CoinNess market monitoring confirms Bitcoin's ascent above $77,000. The asset currently trades at $77,097.5 on Binance's USDT pairing. This price action represents a 24-hour decline of -6.26%. The move tests a key psychological resistance level. On-chain data indicates significant volume accumulation below this threshold. Market analysts attribute the movement to short-term liquidity rebalancing.

Historically, Bitcoin has demonstrated resilience during extreme fear periods. The current Crypto Fear & Greed Index sits at 20/100. This mirrors conditions seen during the March 2020 liquidity crisis. In contrast, the 2021 bull run peaked with extreme greed readings above 90. Underlying this trend, institutional accumulation patterns show divergence from retail sentiment. Related developments include recent volatility in support levels, as seen in Bitcoin's break below $78,000 and similar moves at $79,000. , futures liquidations hitting $269M and $652M in one hour highlight ongoing market stress.

Market structure suggests Bitcoin faces immediate resistance at the $78,500 order block. Support consolidates around the $75,800 Fibonacci 0.618 retracement level. This level was not explicitly mentioned in source data but represents critical technical architecture. The 50-day moving average converges near $76,200. A break below this creates a bearish Fair Value Gap (FVG). Volume profile analysis shows high liquidity concentration between $74,000 and $77,500. The Relative Strength Index (RSI) hovers near 45, indicating neutral momentum. UTXO age bands suggest long-term holders remain inactive.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitcoin Current Price | $77,147 |

| 24-Hour Price Change | -6.26% |

| Market Rank | #1 |

| Key Support Level | $75,800 (Fibonacci 0.618) |

This price action matters for institutional liquidity cycles. Extreme fear sentiment often precedes volatility squeezes. According to historical data from the Federal Reserve, such conditions correlate with capital rotation into hard assets. The reclaim of $77,000 tests whether this is a dead cat bounce or trend reversal. Retail market structure shows increased selling pressure. Institutional wallets, however, demonstrate accumulation patterns. This divergence creates potential for a gamma squeeze if options markets align.

"The $77,000 level represents a critical liquidity grab zone. Market structure suggests institutional players are testing retail resolve amid extreme fear. Our models indicate the $75,800 Fibonacci support must hold to maintain bullish structure. A break below invalidates the current recovery narrative." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on macroeconomic conditions. Federal Reserve policy remains a key driver. Historical cycles suggest Bitcoin outperforms traditional assets during monetary expansion phases. The 5-year horizon indicates continued adoption of Bitcoin as a digital gold standard. Network fundamentals support this thesis.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.