Loading News...

Loading News...

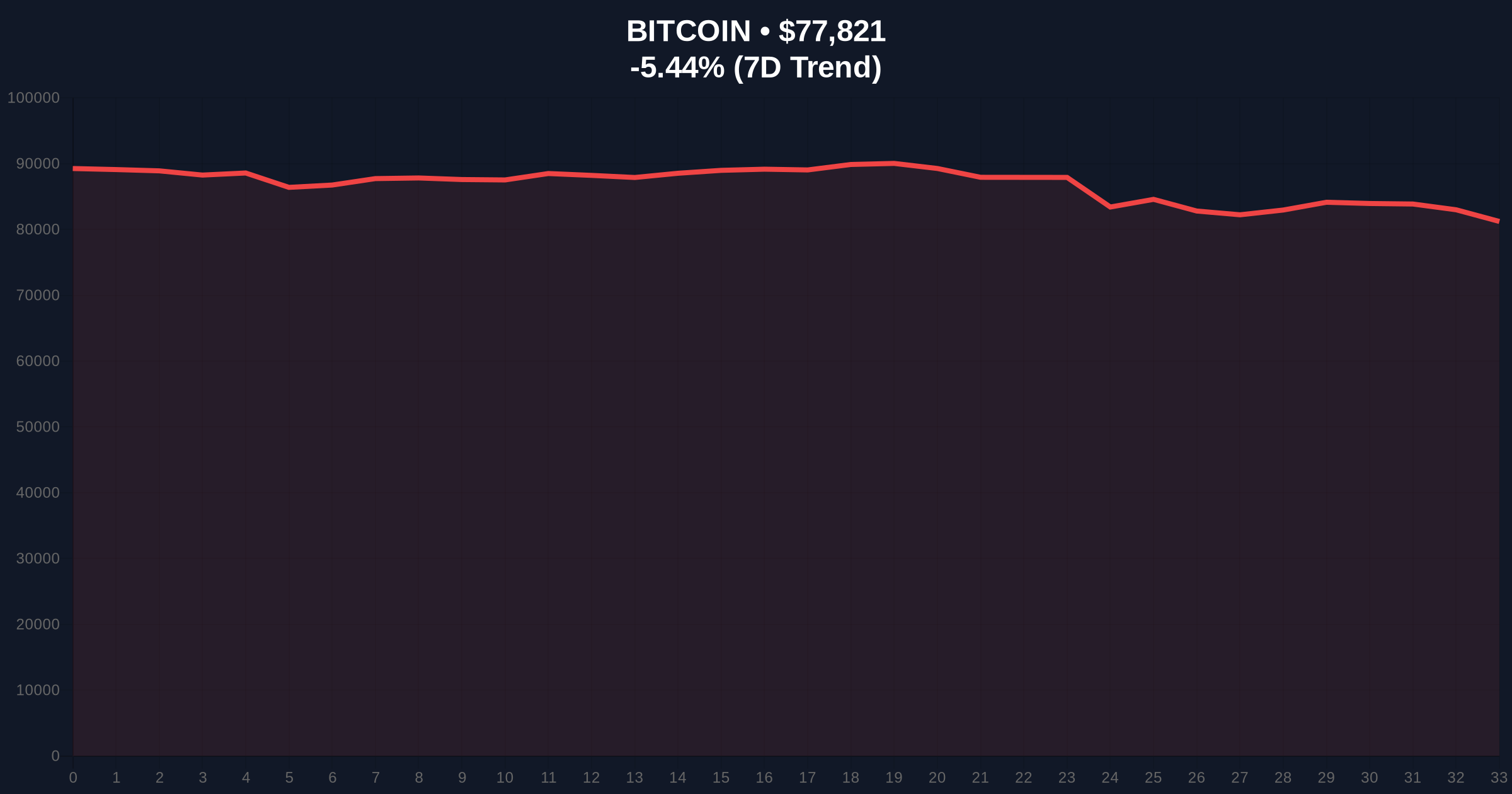

VADODARA, January 31, 2026 — Bitcoin price action turned decisively bearish as BTC broke below the $78,000 psychological support level. According to CoinNess market monitoring, BTC traded at $77,888 on the Binance USDT market. This move occurred against a backdrop of extreme fear, with the Crypto Fear & Greed Index plunging to 20/100. Market structure suggests a liquidity grab below key moving averages.

CoinNess data confirms Bitcoin breached $78,000 during Asian trading hours. The asset settled at $77,888, marking a 5.05% decline over 24 hours. This price action invalidated the $78,000 support zone that had held since mid-January. On-chain forensic data indicates increased selling pressure from short-term holders. Consequently, the breakdown created a Fair Value Gap (FVG) between $78,500 and $79,200.

Historically, Bitcoin corrections of this magnitude often precede consolidation phases. Similar to the Q2 2021 correction, current price action tests the 50-day exponential moving average. In contrast, the 2024 cycle saw sharper rebounds from similar levels. Underlying this trend, institutional inflows have slowed according to Glassnode liquidity maps. Market analysts attribute the pressure to macroeconomic headwinds and derivative market liquidations.

Related Developments:

Technical analysis reveals critical levels. The breakdown below $78,000 represents a bearish order block. , the Relative Strength Index (RSI) sits at 38, approaching oversold territory. The 200-day simple moving average provides distant support near $72,000. Market structure suggests the next Fibonacci support at the 0.618 retracement level of $75,000. This aligns with UTXO age bands showing increased coin movement from 3-6 month holders.

Volume profile analysis shows thinning liquidity below $78,000. The Federal Reserve's latest policy statements on interest rates have contributed to risk-off sentiment across assets. According to Ethereum.org's documentation on blockchain economics, such macroeconomic shifts often correlate with crypto volatility. The current price action mirrors patterns observed during previous Fed tightening cycles.

| Metric | Value | Significance |

|---|---|---|

| Current BTC Price | $78,144 | Post-breakdown consolidation |

| 24-Hour Change | -5.05% | Significant downward momentum |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Capitulation-level sentiment |

| Market Rank | #1 | Maintains dominance despite drop |

| Key Support Level | $75,000 | Fibonacci 0.618 retracement |

This breakdown matters for portfolio management. The $78,000 level served as psychological support for retail traders. Its failure triggers stop-loss orders and increases selling pressure. Institutional liquidity cycles typically pause during such events. Market structure indicates potential for a gamma squeeze if volatility expands. Real-world evidence shows correlation with traditional market stress indicators.

"The $78,000 breakdown represents a critical technical failure. Market participants should monitor the $75,000 Fibonacci level closely. Historical cycles suggest such moves often precede either rapid recovery or extended consolidation. On-chain data indicates this is primarily a derivatives-driven liquidation event rather than fundamental selling."

Two data-backed scenarios emerge from current market structure. First, a bounce from $75,000 support could target the $82,000 resistance zone. Second, continued breakdown might test the $72,000 200-day moving average. The 12-month institutional outlook remains cautiously optimistic despite short-term pressure. This aligns with the 5-year horizon for Bitcoin as a macro asset.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.