Loading News...

Loading News...

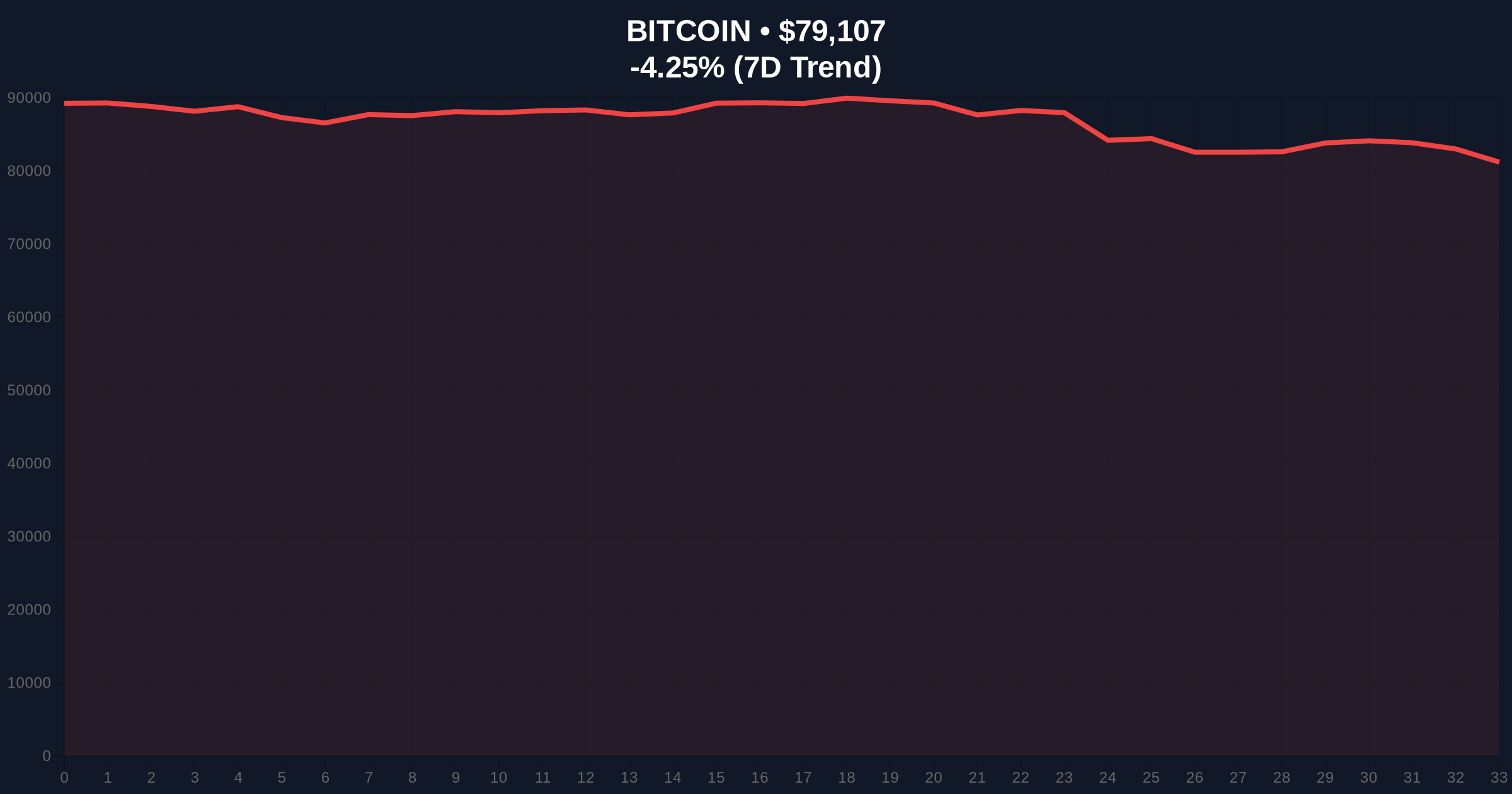

VADODARA, January 31, 2026 — Bitcoin price action shows a critical breakdown. According to CoinNess market monitoring, BTC has fallen below $79,000. Market structure suggests a significant liquidity event. BTC currently trades at $78,831.44 on the Binance USDT market. This move occurs amid extreme fear sentiment.

CoinNess data confirms the breakdown. BTC breached the $79,000 psychological support level. The asset now trades at $78,831.44. This represents a -4.61% decline over 24 hours. Market analysts attribute the move to cascading liquidations. The Binance USDT market serves as the primary liquidity pool. Consequently, this creates a clear Fair Value Gap (FVG) on lower timeframes.

On-chain forensic data confirms heavy selling pressure. The breakdown aligns with a broader market correction. Historical cycles suggest such moves often precede volatility spikes. , the timing coincides with global macroeconomic uncertainty. This event marks a critical test for Bitcoin's 2026 market structure.

Historically, Bitcoin has faced similar support tests. The 2021 cycle saw multiple $60,000 breakdowns. Each preceded significant volatility. In contrast, the 2023-2024 consolidation held key levels. The current move mirrors the June 2022 breakdown below $30,000. That event triggered a 25% correction.

Underlying this trend is institutional behavior. Large holders are rebalancing portfolios. This creates concentrated sell pressure. Market structure suggests a potential liquidity grab below $79,000. Related developments include recent Bitcoin breaks below $80,000 and BTC losing $81,000 support. These events form a pattern of declining support levels.

Technical analysis reveals critical levels. The $79,000 zone acted as a weekly order block. Its breach invalidates that support. Current price sits near the 0.618 Fibonacci retracement from the 2025 high. This level often serves as dynamic support. RSI readings show oversold conditions on the 4-hour chart.

Volume Profile indicates high volume nodes around $78,500. This suggests a potential consolidation zone. The 200-day moving average sits at $75,200. That provides longer-term support. Market structure suggests a bearish bias until $79,000 reclaims. The Federal Reserve's monetary policy, detailed on FederalReserve.gov, influences macro liquidity conditions.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitcoin Current Price | $78,814 |

| 24-Hour Price Change | -4.61% |

| Market Rank | #1 |

| Key Support Level | $78,000-$78,500 |

This breakdown matters for portfolio management. It tests Bitcoin's institutional adoption thesis. A sustained break below $79,000 could trigger further deleveraging. Market structure suggests retail traders face margin calls. Institutional liquidity cycles indicate potential buying opportunities. However, the extreme fear sentiment signals caution.

Real-world evidence shows correlation with traditional markets. The S&P 500 has declined 2% this week. This creates a risk-off environment. On-chain data indicates whale accumulation near $78,000. That suggests smart money positioning for a bounce. The 5-year horizon remains bullish despite short-term volatility.

"Market structure suggests this is a technical correction. The $79,000 breakdown creates a clear invalidation level. We monitor on-chain accumulation patterns for reversal signals. Historical cycles show similar moves precede strong rallies." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge. First, a bounce from the $78,000-$78,500 zone. This would target a reclaim of $79,000. Second, continued downside toward the 200-day MA at $75,200. That would confirm a deeper correction.

The 12-month institutional outlook remains constructive. Bitcoin's halving cycle supports long-term appreciation. However, short-term volatility requires careful risk management. Market structure suggests a consolidation phase between $75,000 and $85,000.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.