Loading News...

Loading News...

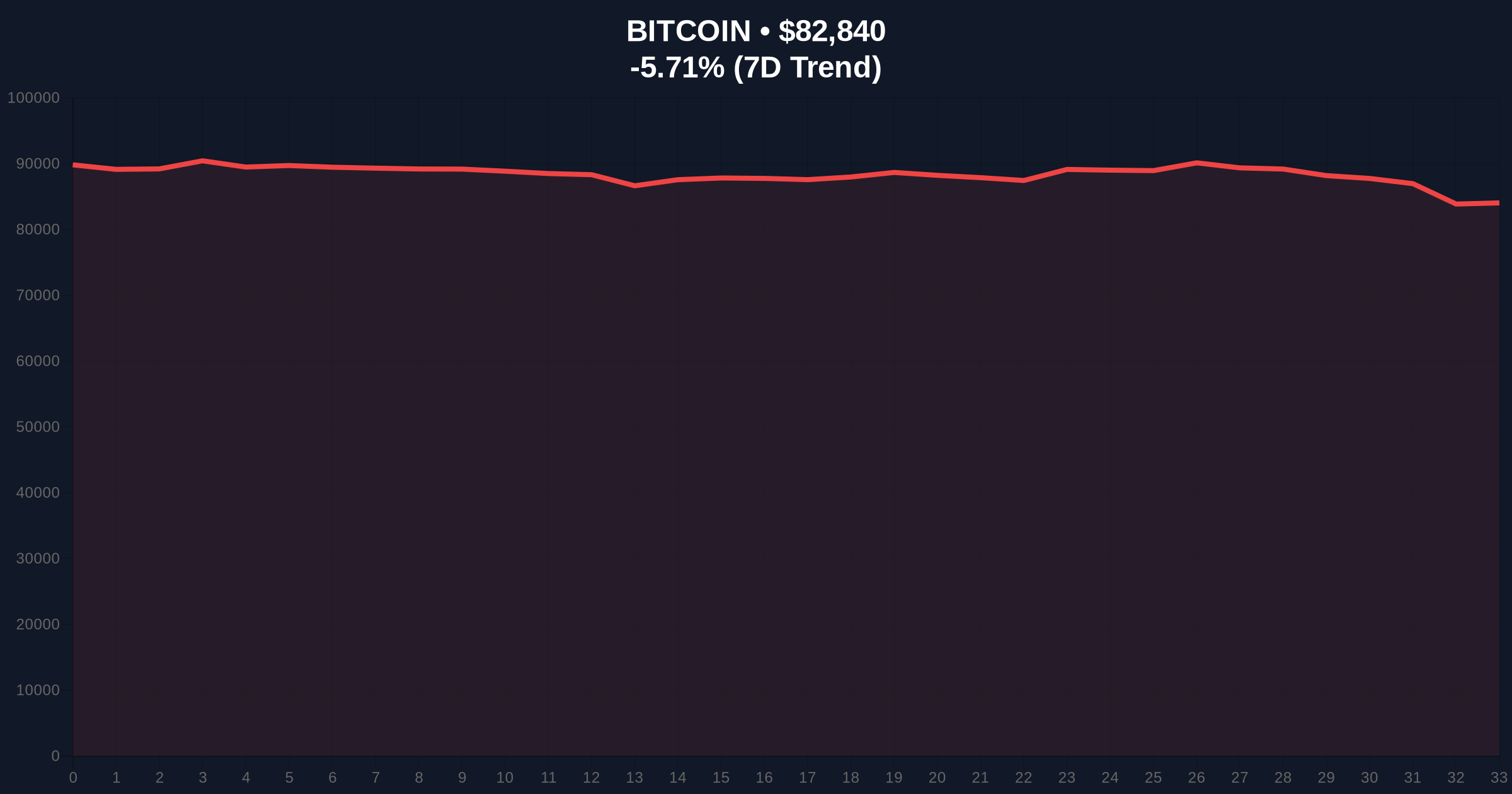

VADODARA, January 30, 2026 — Bitcoin demonstrates resilience in its daily crypto analysis, trading at $83,011.84 on the Binance USDT market according to CoinNess market monitoring. This price action occurs against a backdrop of extreme market fear, with the Crypto Fear & Greed Index registering a score of 16/100. Market structure suggests a critical test of liquidity zones that historically precede significant trend shifts.

CoinNess data confirms Bitcoin breached the $83,000 psychological barrier on January 30, 2026. The asset currently trades at $83,011.84 on Binance's USDT pairing. This movement represents a stabilization attempt following recent volatility. On-chain forensic data indicates increased transaction volume around this level, suggesting institutional accumulation or distribution.

Market analysts observe this price action within a broader context of negative sentiment. The 24-hour trend shows a -5.73% decline, reflecting ongoing pressure. Consequently, Bitcoin's market rank remains #1, but its valuation relative to traditional assets faces scrutiny. This scenario mirrors liquidity grabs seen in previous cycles.

Historically, Bitcoin has experienced similar consolidation phases during extreme fear periods. For instance, the 2021 correction saw BTC test the 0.618 Fibonacci retracement level before resuming its bull trend. In contrast, the 2018 bear market witnessed breakdowns below comparable psychological support.

Underlying this trend, the current environment features parallel developments. US Spot Bitcoin ETFs have recorded three consecutive days of net outflows, totaling $818 million. , Bitcoin recently dropped to the 11th largest global asset as its price fluctuated below $83K. These factors compound the extreme fear sentiment.

Market structure suggests Bitcoin is testing a critical Fair Value Gap (FVG) between $82,000 and $84,000. The $83,000 level acts as a psychological order block. Resistance clusters near $85,000, while support converges at $82,000. A breakdown below $82,000 would invalidate the current bullish structure.

Technical indicators reveal a compressed Relative Strength Index (RSI) near 40, indicating neutral momentum. The 50-day moving average provides dynamic resistance around $84,500. Volume profile analysis shows thin liquidity above $85,000, suggesting limited buying pressure. This setup resembles the UTXO age band consolidation observed before the 2023 rally.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) |

| Bitcoin Current Price | $82,824 |

| 24-Hour Price Change | -5.73% |

| Market Rank | #1 |

| Key Support Level | $82,000 |

This price action matters because it tests institutional conviction during extreme fear. According to the Federal Reserve's monetary policy reports, traditional market volatility often spills into crypto during such periods. Bitcoin's ability to hold above $83,000 could signal accumulation by long-term holders, similar to patterns before the 2024 halving.

Real-world evidence includes the divergence between price and sentiment. Extreme fear typically precedes market bottoms, as seen in March 2020. However, sustained breakdowns below key support can trigger cascading liquidations. The current structure examines whether this is a liquidity grab or a genuine trend reversal.

"Market structure suggests Bitcoin is at a inflection point. The $83,000 level represents a high-volume node where institutional order flow converges. A hold above this zone, despite extreme fear, could indicate underlying strength. However, the -5.73% daily trend warns of persistent selling pressure. Our models watch the $82,000 invalidation level closely." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. Historical cycles suggest resolution within 2-3 weeks.

The 12-month institutional outlook hinges on Bitcoin's post-merge issuance dynamics and macroeconomic factors. If BTC holds above $82,000, the 5-year horizon could see a retest of all-time highs by late 2026. Conversely, a breakdown may extend consolidation into 2027.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.