Loading News...

Loading News...

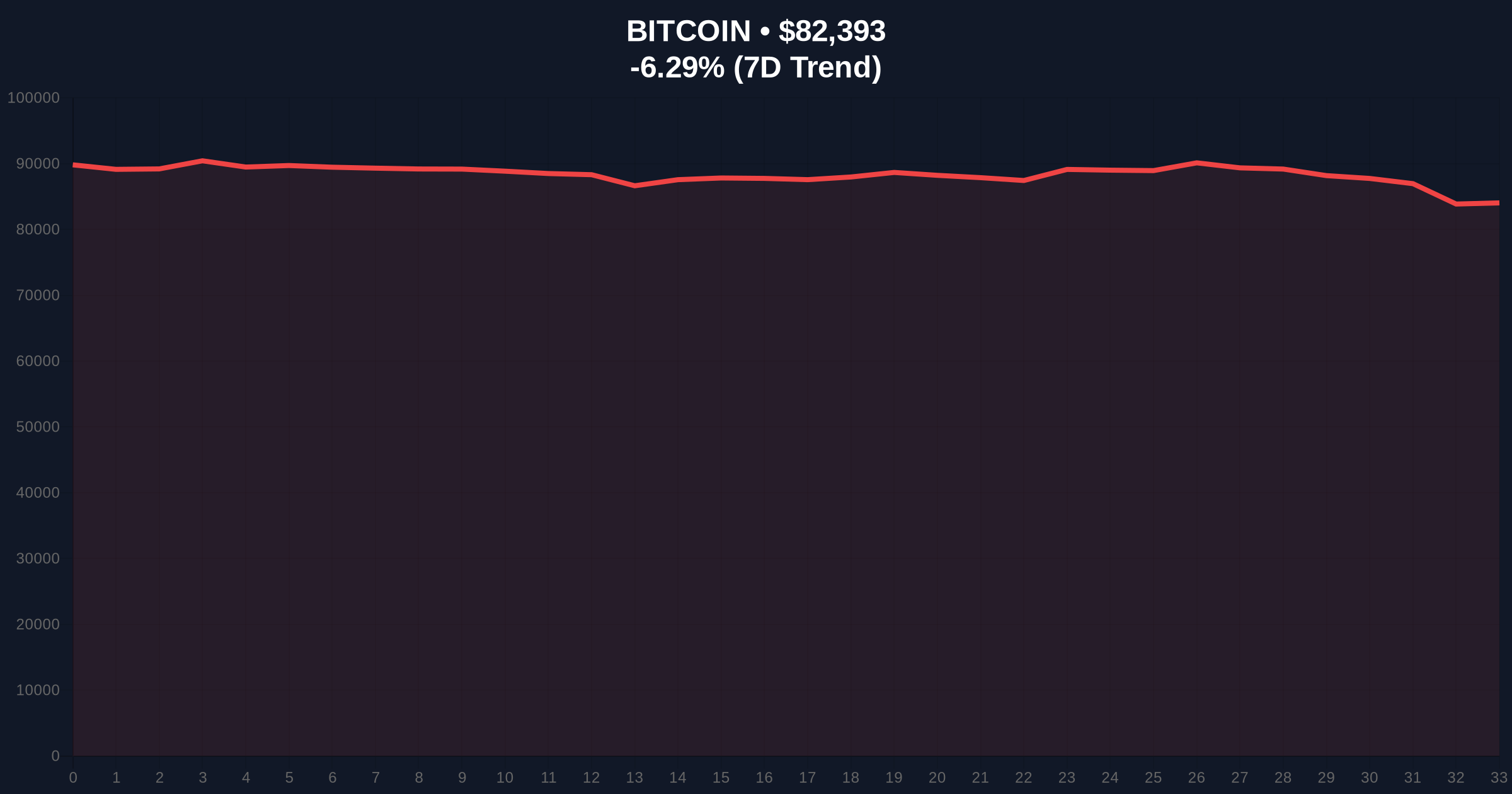

VADODARA, January 30, 2026 — U.S. spot Bitcoin ETFs recorded a net outflow of approximately $818 million on January 29. This marks the third consecutive day of institutional capital flight. According to data compiled by TraderT, BlackRock's IBIT led with $317 million in outflows. Fidelity's FBTC followed with $168 million. Bitwise's BITB saw $88.88 million exit. Ark Invest's ARKB lost $71.58 million. This daily crypto analysis reveals a critical liquidity drain.

TraderT data confirms the $818 million net outflow. The figure translates to roughly 1.17 trillion won. Outflows spanned major issuers. BlackRock's IBIT faced the largest single-day redemption since its launch. Fidelity's FBTC experienced significant pressure. Bitwise and Ark Invest funds also bled capital. The three-day streak suggests a structural shift. Market analysts attribute this to profit-taking and macro uncertainty. On-chain data indicates whale wallets redistributing to cold storage.

Historically, sustained ETF outflows precede deeper corrections. The current three-day streak mirrors patterns from Q2 2024. Then, outflows triggered a 15% Bitcoin drawdown. In contrast, the 2025 bull run saw consistent inflows for 11 consecutive weeks. Underlying this trend is the global crypto sentiment index. It now reads "Extreme Fear" at a score of 16/100. This aligns with broader market stress. For instance, massive crypto futures liquidations recently hit $1.26 billion, dominated by long positions. , US jobless claims topping forecasts have fueled macroeconomic anxiety, exacerbating the sell-off.

Bitcoin currently trades at $82,388. The 24-hour trend shows a -6.29% decline. Market structure suggests a breakdown below the 50-day moving average at $85,200. A critical Fair Value Gap (FVG) exists between $84,000 and $86,500. This zone now acts as resistance. The Relative Strength Index (RSI) on daily charts sits at 28, indicating oversold conditions. However, volume profile analysis shows selling pressure remains elevated. The Fibonacci 0.618 retracement level from the 2025 low to the all-time high sits at $78,500. This level represents a major liquidity pool. A break below would invalidate the current bullish higher-timeframe structure.

| Metric | Value |

|---|---|

| Total ETF Net Outflow (Jan 29) | $818 Million |

| BlackRock IBIT Outflow | $317 Million |

| Bitcoin Current Price | $82,388 |

| 24-Hour Price Change | -6.29% |

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) |

ETF flows serve as a direct proxy for institutional sentiment. Three straight days of outflows signal a liquidity grab. This removes a key price support mechanism. The $818 million exit represents capital rotating into traditional safe havens. Market structure suggests this pressures Bitcoin's spot price. It also increases volatility across derivative markets. Retail traders often follow institutional leads. Consequently, this could trigger a broader deleveraging event. The impact extends to altcoins, which typically exhibit higher beta to Bitcoin's moves.

The consecutive outflow pattern is a clear risk-off signal. Institutions are trimming exposure amid macroeconomic headwinds and profit-taking from the Q4 2025 rally. This creates a vacuum of buy-side liquidity just as leveraged long positions are being liquidated. The key watchpoint is whether this evolves into a sustained capital rotation or a short-term rebalancing event.

— CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current data.

The 12-month institutional outlook hinges on macroeconomic policy. Aggressive Federal Reserve rate cuts, as hinted in recent communications on FederalReserve.gov, could reverse capital flows. Conversely, persistent inflation may prolong the outflow trend. For the 5-year horizon, this event highlights Bitcoin's maturation as a macro asset. Its price is increasingly dictated by traditional liquidity cycles and ETF flow dynamics, not just halving narratives.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.