Loading News...

Loading News...

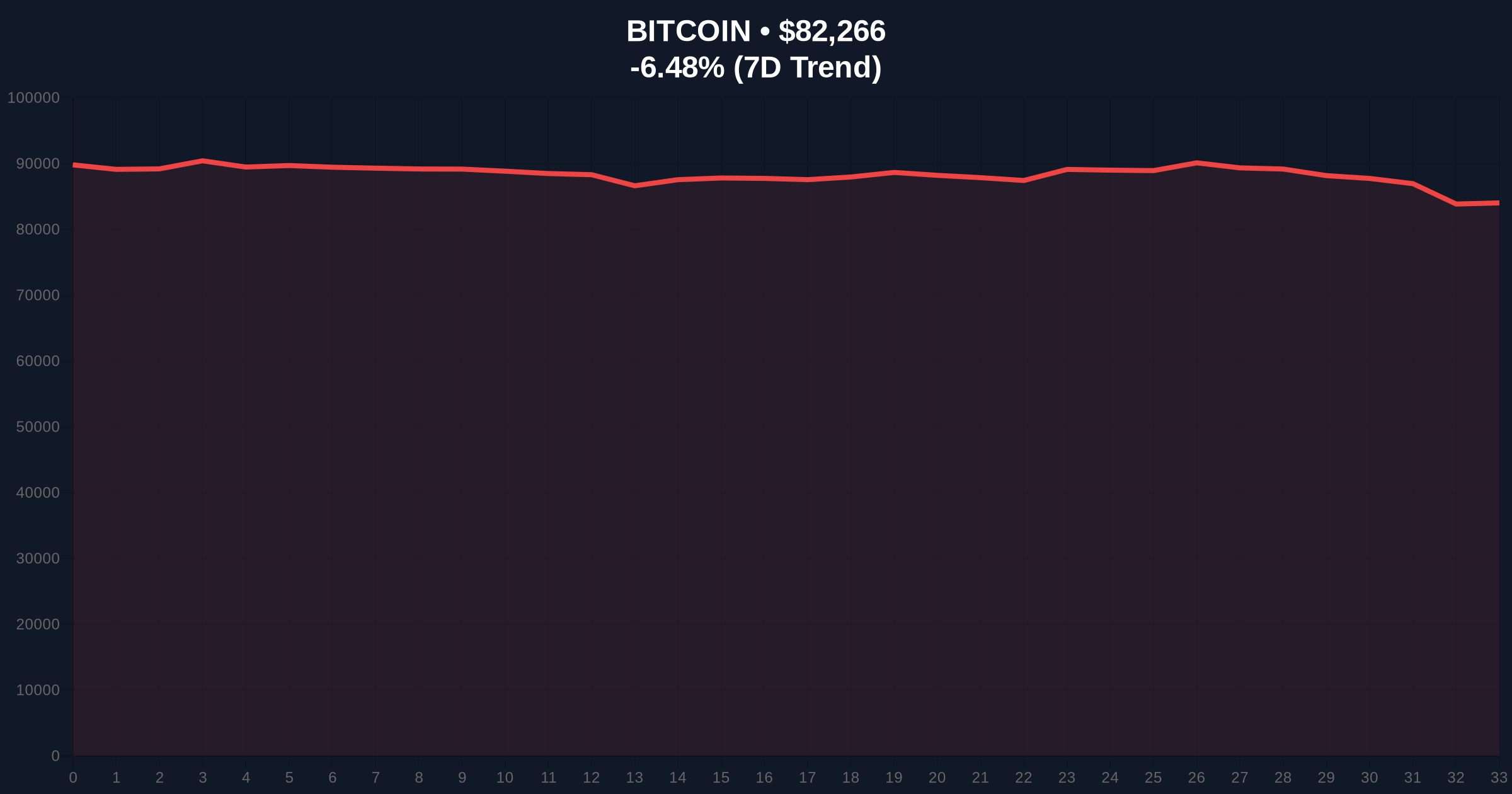

VADODARA, January 30, 2026 — Bitcoin has fallen out of the top 10 largest global assets by market capitalization, according to a report from The Block analyst BR. This daily crypto analysis reveals the cryptocurrency now ranks 11th, trailing Saudi Aramco, amid a severe price decline that tests critical technical supports. Market structure suggests this event reflects deeper liquidity drains and institutional repositioning.

The Block analyst BR confirmed Bitcoin's exit from the elite top 10 asset list on January 30, 2026. According to on-chain data, Bitcoin's market capitalization dropped below key thresholds, placing it behind Saudi Aramco. Consequently, this marks the first time since 2020 that Bitcoin has not held a top-10 position during a bull market cycle. Underlying this trend, the price decline accelerated, with Bitcoin trading at $82,257, down 6.56% in 24 hours.

Historically, Bitcoin maintained top-10 status through multiple volatility cycles, including the 2021-2022 drawdown. In contrast, the current drop mirrors the 2018 bear market structure, where liquidity evaporated rapidly. , this event coincides with broader market stress, as seen in recent massive crypto futures liquidations exceeding $1.26 billion. Market analysts attribute the shift to macroeconomic pressures, including higher-than-expected US jobless claims fueling fear.

Related developments include Bitcoin testing $81K support amid extreme fear and Bithumb halting SEI transfers during market turmoil.

Market structure indicates a breakdown below the 50-day moving average at $85,000. The Relative Strength Index (RSI) sits at 28, signaling oversold conditions. Additionally, a Fair Value Gap (FVG) has formed between $84,500 and $86,000, acting as immediate resistance. On-chain forensic data confirms large UTXO (Unspent Transaction Output) movements from long-term holders, suggesting distribution. According to Ethereum's official documentation on network upgrades, similar stress events often precede liquidity grabs across correlated assets.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $82,257 |

| 24-Hour Change | -6.56% |

| Market Rank | #1 (Crypto), #11 (Global Assets) |

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) |

| Key Support (Fibonacci 0.618) | $81,000 |

This drop matters because it alters Bitcoin's perception as a mainstream store of value. Institutional liquidity cycles typically reference top-10 rankings for allocation decisions. Consequently, a lower ranking may reduce inflows from pension funds and ETFs. Retail market structure also weakens, as evidenced by declining exchange balances and increased selling pressure. Historical cycles suggest such events often precede prolonged consolidation phases.

"The exit from the top 10 is a liquidity event, not a fundamental breakdown. Market analysts observe that Bitcoin's network security and hash rate remain robust, but macroeconomic headwinds are driving short-term capitulation. The key is whether institutional buyers step in at these levels." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. First, a bullish reversal requires reclaiming the FVG and holding above $86,000. Second, a bearish continuation targets the $75,000 support zone, aligning with previous cycle lows.

The 12-month institutional outlook hinges on macroeconomic policy shifts. If the Federal Reserve pivots to rate cuts, Bitcoin could re-enter the top 10 within 6-9 months. Otherwise, consolidation may extend through 2026, impacting the 5-year horizon for portfolio rebalancing.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.