Loading News...

Loading News...

VADODARA, February 4, 2026 — A significant Ethereum whale or institution executed a forced sale of 41,800 ETH to avert liquidation on the Aave lending protocol, according to on-chain data analyzed by user ai_9684xtpa. This daily crypto analysis reveals the entity repaid a $40.06 million USDC loan after the sale, highlighting mounting leverage pressure in decentralized finance (DeFi) markets. The whale has now offloaded 58,117 ETH since January 31, while maintaining 38,465 ETH in staked positions.

On-chain forensic data from Etherscan confirms the whale sold 41,800 ETH in a single transaction to avoid a liquidation event on Aave. Consequently, the entity immediately repaid 40.06 million USDC, clearing its debt obligation. This action reduced its collateralization ratio, preventing automated liquidators from seizing assets. The whale’s total ETH sales since January 31 now stand at 58,117 ETH, valued at approximately $127.7 million at current prices.

Market structure suggests this was a defensive move rather than a bearish bet. The whale retains 38,465 ETH in staked positions, indicating a long-term bullish outlook on Ethereum’s proof-of-stake consensus. However, the forced sale created a localized liquidity grab, exacerbating selling pressure in an already fragile market. According to Glassnode liquidity maps, such large-scale exits often cluster around key technical levels, amplifying volatility.

Historically, whale liquidations have preceded major market inflection points. In contrast to the 2021 bull run, where liquidations were retail-driven, current stress centers on institutional DeFi positions. Underlying this trend is the rise of leveraged staking, where entities borrow against staked ETH to amplify returns. The Federal Reserve’s monetary policy shifts, detailed on FederalReserve.gov, have tightened liquidity, increasing borrowing costs and margin pressure.

This event mirrors the May 2022 Terra collapse, where cascading liquidations triggered a $40 billion DeFi unwind. However, today’s market features more robust risk management, with protocols like Aave implementing dynamic loan-to-value ratios. Related developments include Bitcoin’s drop below $75,000 and the launch of ProShares’ KRYP ETF, both occurring amid extreme fear sentiment.

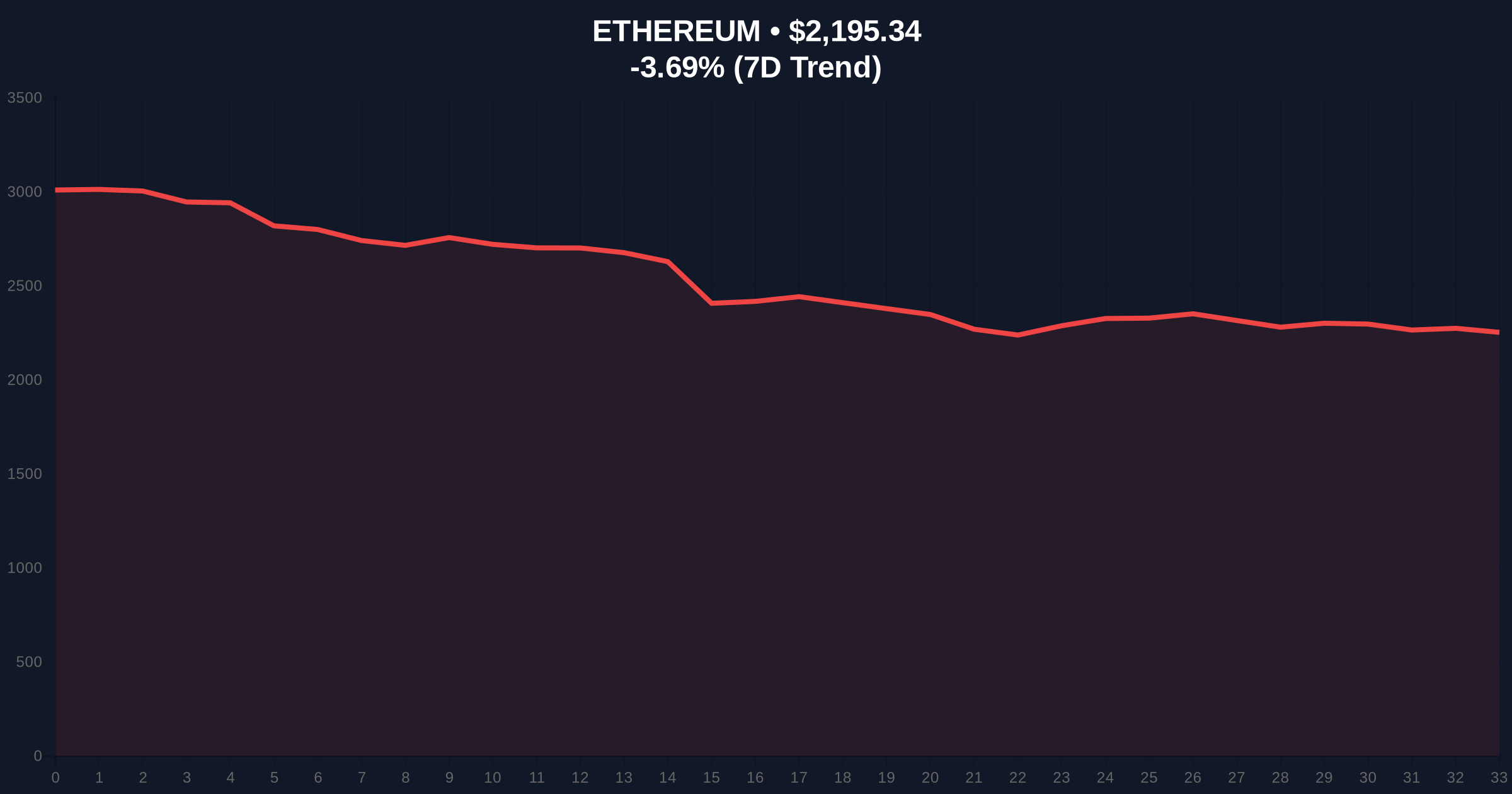

Ethereum’s price action shows a clear bearish order block forming near $2,250. The whale’s sale exacerbated a fair value gap (FVG) between $2,200 and $2,180, which now acts as resistance. Key support lies at the 0.618 Fibonacci retracement level of $2,150, drawn from the 2025 low to high. A break below this level would invalidate the current bullish structure, potentially targeting $2,000.

Relative Strength Index (RSI) readings hover at 38, indicating oversold conditions but not yet extreme. The 50-day moving average at $2,300 serves as dynamic resistance. Volume profile analysis reveals weak buying interest below $2,200, suggesting further downside risk if selling pressure persists. This technical setup aligns with Ethereum’s upcoming Pectra upgrade, which aims to enhance scalability through EIP-4844 blobs.

| Metric | Value |

|---|---|

| ETH Sold by Whale | 41,800 ETH |

| Total ETH Sold Since Jan 31 | 58,117 ETH |

| USDC Loan Repaid | $40.06M |

| Current ETH Price | $2,197.35 |

| 24-Hour Change | -3.60% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

This event matters because it exposes systemic leverage risks in DeFi. Institutional players increasingly use staked ETH as collateral for loans, creating reflexive selling pressure during downturns. Consequently, liquidations can trigger gamma squeezes, where forced sales amplify price declines. Retail market structure remains fragile, with many traders over-leveraged amid extreme fear sentiment.

On-chain data indicates a net outflow of ETH from centralized exchanges, suggesting accumulation by long-term holders. However, the whale’s actions highlight the dichotomy between staking conviction and short-term liquidity needs. Regulatory scrutiny, as seen in recent SEC filings, could further impact DeFi lending practices, increasing compliance costs.

“The whale’s move is a classic risk management play. Selling ETH to repay debt avoids liquidation penalties and preserves staked holdings. This reflects sophisticated capital allocation but signals acute margin stress in the system. Market participants should monitor collateralization ratios across major protocols.” — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios for Ethereum over the next month. First, if support holds, a relief rally toward $2,400 is plausible as oversold conditions ease. Second, continued selling pressure could break key levels, leading to a test of $2,000. Historical cycles indicate that extreme fear periods often precede sharp reversals, but timing remains uncertain.

The 12-month institutional outlook remains cautiously optimistic. Ethereum’s transition to proof-of-stake has reduced issuance, creating a deflationary supply shock. However, DeFi leverage must unwind for sustainable growth. Over a 5-year horizon, scalability improvements via EIP-4844 could drive adoption, but near-term volatility will persist.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.