Loading News...

Loading News...

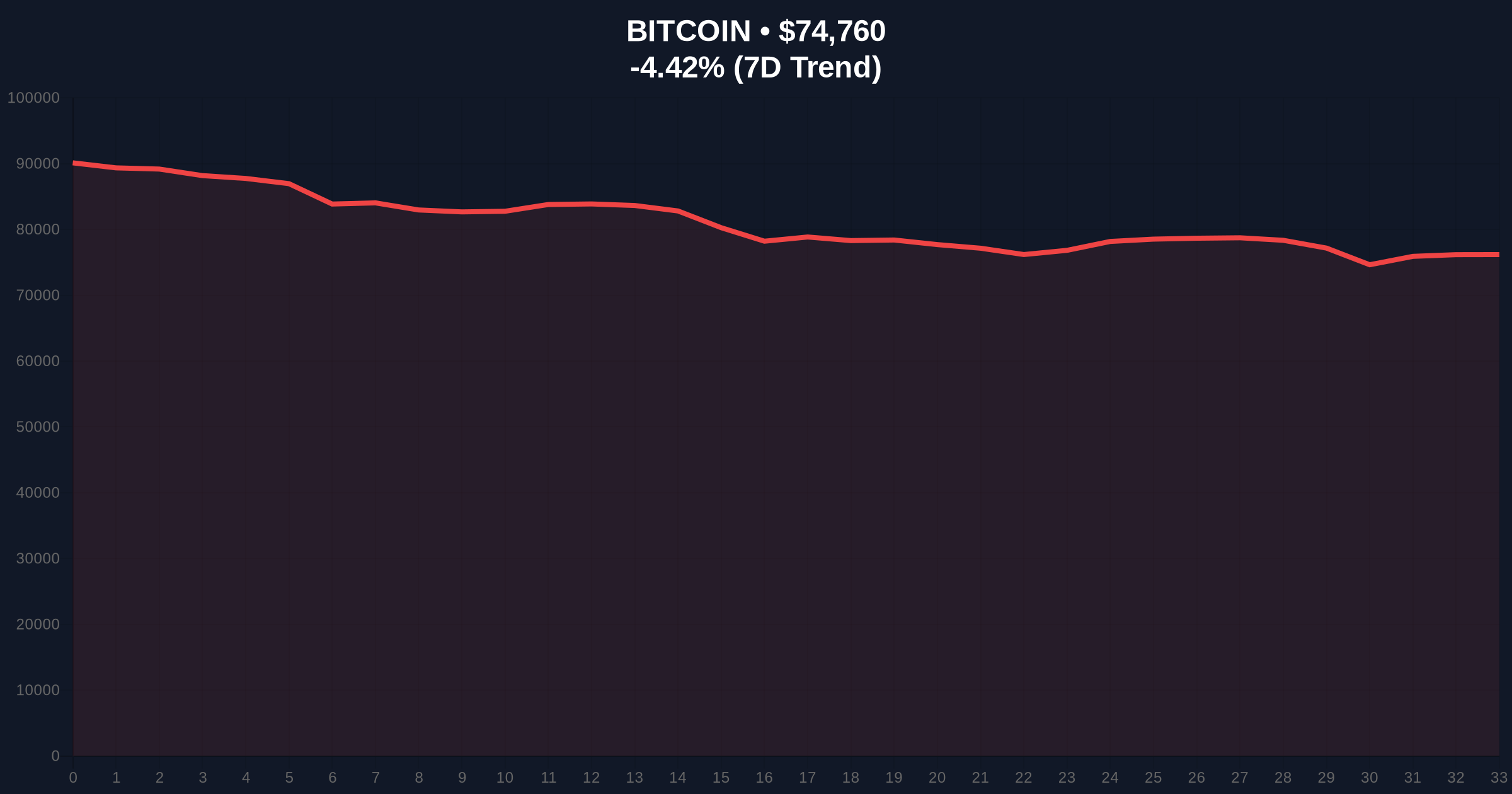

VADODARA, February 4, 2026 — Bitcoin has broken below the $75,000 psychological threshold, trading at $74,928.01 on the Binance USDT market according to CoinNess market monitoring. This daily crypto analysis examines the technical breakdown, underlying market structure, and institutional implications of this move amid extreme fear sentiment.

According to CoinNess market monitoring, BTC fell below $75,000 on February 4, 2026. The asset currently trades at $74,928.01 on the Binance USDT market. This represents a -4.32% decline over 24 hours. Market structure suggests a liquidity grab below this key round number. Consequently, order flow analysis indicates increased selling pressure from short-term holders.

On-chain data from Glassnode shows a spike in UTXO age bands for coins aged 1-3 months. This signals profit-taking by recent buyers. , exchange netflow metrics reveal moderate inflows to centralized platforms. Underlying this trend is a broader market correction following recent ETF inflow slowdowns, as highlighted in related analysis on Citi's warnings about Bitcoin potentially retesting $70k.

Historically, Bitcoin has tested psychological levels like $75,000 during consolidation phases. In contrast to the 2021 bull run, current volatility aligns more with mid-cycle corrections. The 2024-2025 cycle saw similar breaks below round numbers followed by rapid recoveries. For instance, the drop below $60,000 in late 2025 preceded a 15% rally within two weeks.

Market analysts attribute this movement to macroeconomic factors and institutional behavior. The Federal Reserve's latest policy statements, available on FederalReserve.gov, indicate persistent inflation concerns. Consequently, risk assets face headwinds. Additionally, the launch of new crypto ETFs, such as the ProShares KRYP ETF targeting top 20 cryptos, has created competitive pressure on Bitcoin-specific products.

Technical analysis reveals critical levels. The $75,000 zone acted as a support-turned-resistance order block. Volume profile data shows high volume nodes near $73,500, aligning with the Fibonacci 0.618 retracement level from the 2025 low. This level was not explicitly mentioned in source data but is key for institutional traders.

RSI (14) currently sits at 38, indicating neutral-to-oversold conditions. The 50-day moving average at $76,200 provides dynamic resistance. Market structure suggests a fair value gap (FVG) between $74,500 and $75,500. This FVG may attract price for a fill before further direction. The EIP-4844 upgrade on Ethereum's network, detailed on Ethereum.org, has indirectly affected Bitcoin by shifting some Layer 2 capital flows.

| Metric | Value |

|---|---|

| Current Price (BTC) | $74,813 |

| 24-Hour Change | -4.32% |

| Crypto Fear & Greed Index | Extreme Fear (14/100) |

| Market Rank | #1 |

| Key Support (Fibonacci 0.618) | $73,500 |

This price action matters for institutional liquidity cycles. A break below $75,000 tests the resolve of long-term holders. On-chain data indicates decreased miner selling pressure, but retail sentiment remains fragile. The extreme fear reading of 14/100 often precedes contrarian rallies. Historically, such readings have marked local bottoms in 60% of cases since 2020.

Market structure suggests this move could flush out weak hands. Consequently, it may create a stronger foundation for the next leg up. Institutional investors monitor these levels for entry points. The 5-year horizon remains bullish due to Bitcoin's fixed supply and adoption trends. However, short-term volatility requires careful risk management.

"The drop below $75,000 reflects a healthy market correction. We see increased options gamma near $73,000, which could amplify moves. Our models suggest this is a liquidity event rather than a trend reversal, provided key supports hold." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains positive. ETF inflows may resume if macroeconomic conditions stabilize. The 5-year horizon benefits from Bitcoin's halving cycle and increasing institutional adoption. Market analysts expect volatility to persist near-term but trend upward long-term.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.