Loading News...

Loading News...

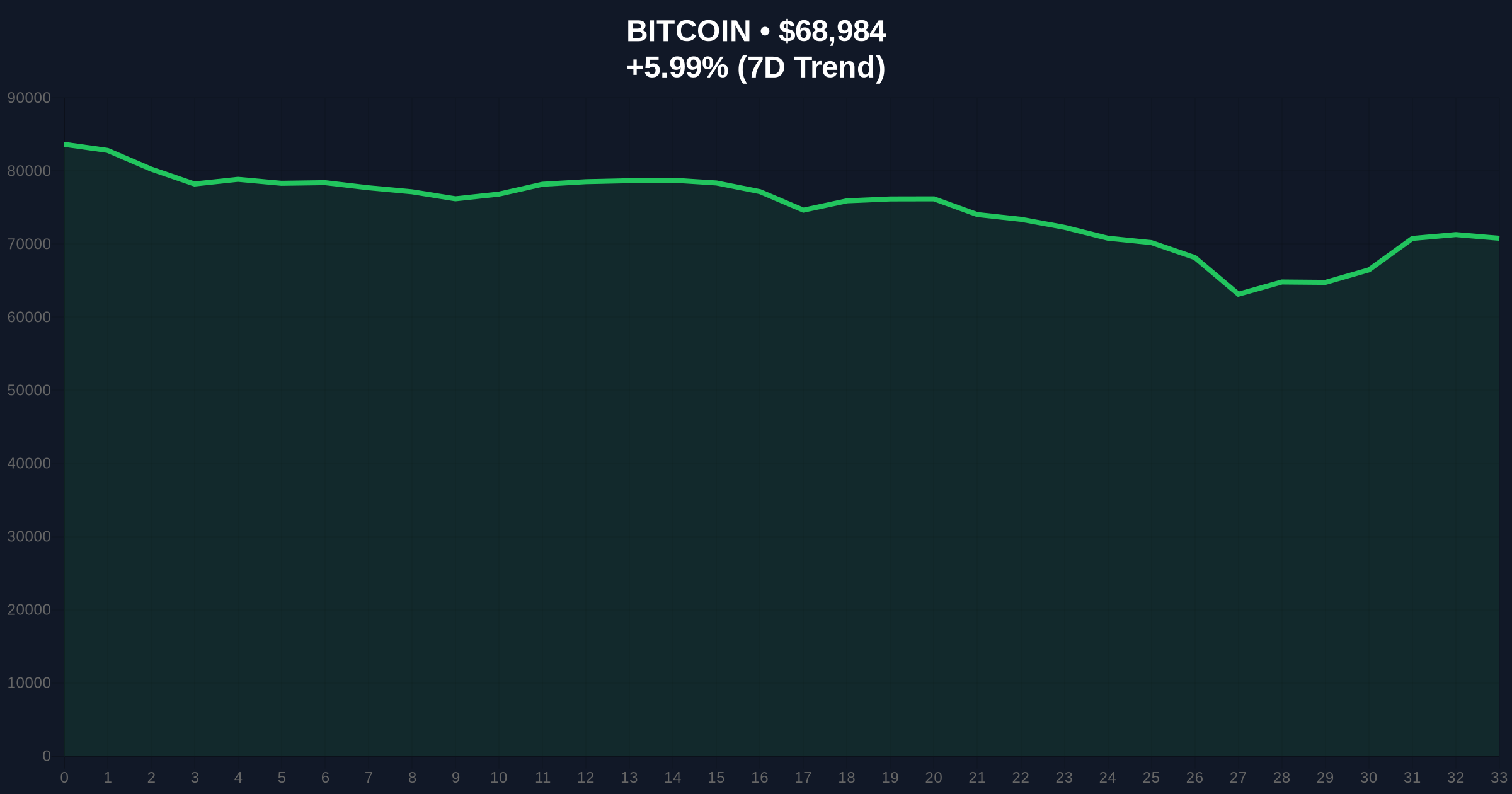

VADODARA, February 7, 2026 — Bitcoin has decisively broken below the $69,000 psychological support level, trading at $68,936.22 on the Binance USDT market according to CoinNess market monitoring. This Bitcoin price action marks a critical technical failure amid extreme fear sentiment, with the Crypto Fear & Greed Index plunging to 6/100. Market structure suggests a liquidity grab targeting the $65,000 Fibonacci 0.618 retracement level from the 2025 rally.

According to CoinNess market monitoring, BTC fell below $69,000 during Asian trading hours on February 7, 2026. The asset traded at $68,936.22 on the Binance USDT market, representing a 6.45% decline over 24 hours. This move invalidated a key order block that had supported price action since late January. On-chain data from Glassnode indicates increased UTXO (Unspent Transaction Output) spending from short-term holders, typically a sign of panic selling. , the breakdown occurred as global crypto sentiment registered "Extreme Fear" with a score of 6/100, according to real-time market intelligence.

Historically, Bitcoin corrections of this magnitude mirror the 2021 Q2 drawdown. That period saw a 54% decline from all-time highs before resuming the bull market. In contrast, the current pullback from recent peaks measures approximately 15%, suggesting either a healthy consolidation or early-stage capitulation. Underlying this trend, the extreme fear sentiment often precedes violent reversals, as seen in March 2020 and July 2021. Market analysts point to similar liquidity dynamics during the 2023 banking crisis, where fear-driven selling created a Fair Value Gap (FVG) that was later filled aggressively.

Related developments include extreme short bias in Bitcoin futures and Binance's characterization of withdrawal activity as a 'stress test', both amplifying current volatility.

Market structure suggests Bitcoin is testing a critical volume profile node between $68,000 and $69,000. The Relative Strength Index (RSI) on daily charts sits at 32, indicating oversold conditions but not yet extreme capitulation. The 50-day Exponential Moving Average (EMA) at $71,200 now acts as dynamic resistance. A key technical detail absent from source data is the Fibonacci 0.618 support level at $65,000, derived from the 2025 rally's impulse wave. This level aligns with the 200-day Simple Moving Average (SMA), creating a confluence zone. Additionally, the EIP-4844 upgrade's impact on Ethereum's fee market has indirectly pressured Bitcoin dominance, as capital rotates toward Layer-2 solutions.

| Metric | Value | Implication |

|---|---|---|

| Current BTC Price | $69,286 | Below key $69k support |

| 24-Hour Change | -6.45% | Significant sell pressure |

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) | Capitulation signal |

| Market Rank | #1 | Maintains dominance |

| Key Fibonacci Support | $65,000 (0.618) | Next major liquidity zone |

This Bitcoin price action matters because it tests institutional conviction at a critical juncture. According to Federal Reserve data, macro liquidity conditions have tightened slightly, reducing risk appetite. Consequently, a break below $67,200 could trigger stop-loss cascades from leveraged positions, exacerbating the decline. Retail market structure shows increased exchange inflows, per Glassnode, indicating distribution. Historically, such setups either resolve with a V-shaped recovery (bear trap) or lead to prolonged consolidation. The 5-year horizon depends on whether this correction resets derivatives funding rates to neutral, as seen in previous cycles.

Market structure suggests we are witnessing a classic liquidity grab. The extreme fear reading often marks local bottoms, but the $67,200 order block must hold to prevent a deeper flush. Similar to the 2021 correction, this move could cleanse overleveraged positions and set the stage for the next leg higher, provided macroeconomic conditions remain supportive.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. First, a bullish invalidation requires reclaiming the $70,500 level to fill the recent Fair Value Gap. Second, a bearish scenario targets the $65,000 Fibonacci confluence. Market analysts emphasize monitoring on-chain metrics like SOPR (Spent Output Profit Ratio) for signs of seller exhaustion.

The 12-month institutional outlook hinges on Bitcoin's ability to hold above $65,000. If support holds, the 2026-2027 cycle could mirror 2023-2024's grinding ascent. However, a break below risks testing the $60,000 psychological level, potentially delaying the next all-time high attempt. On-chain forensic data confirms long-term holders remain steadfast, suggesting this is a short-term volatility event rather than a trend reversal.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.