Loading News...

Loading News...

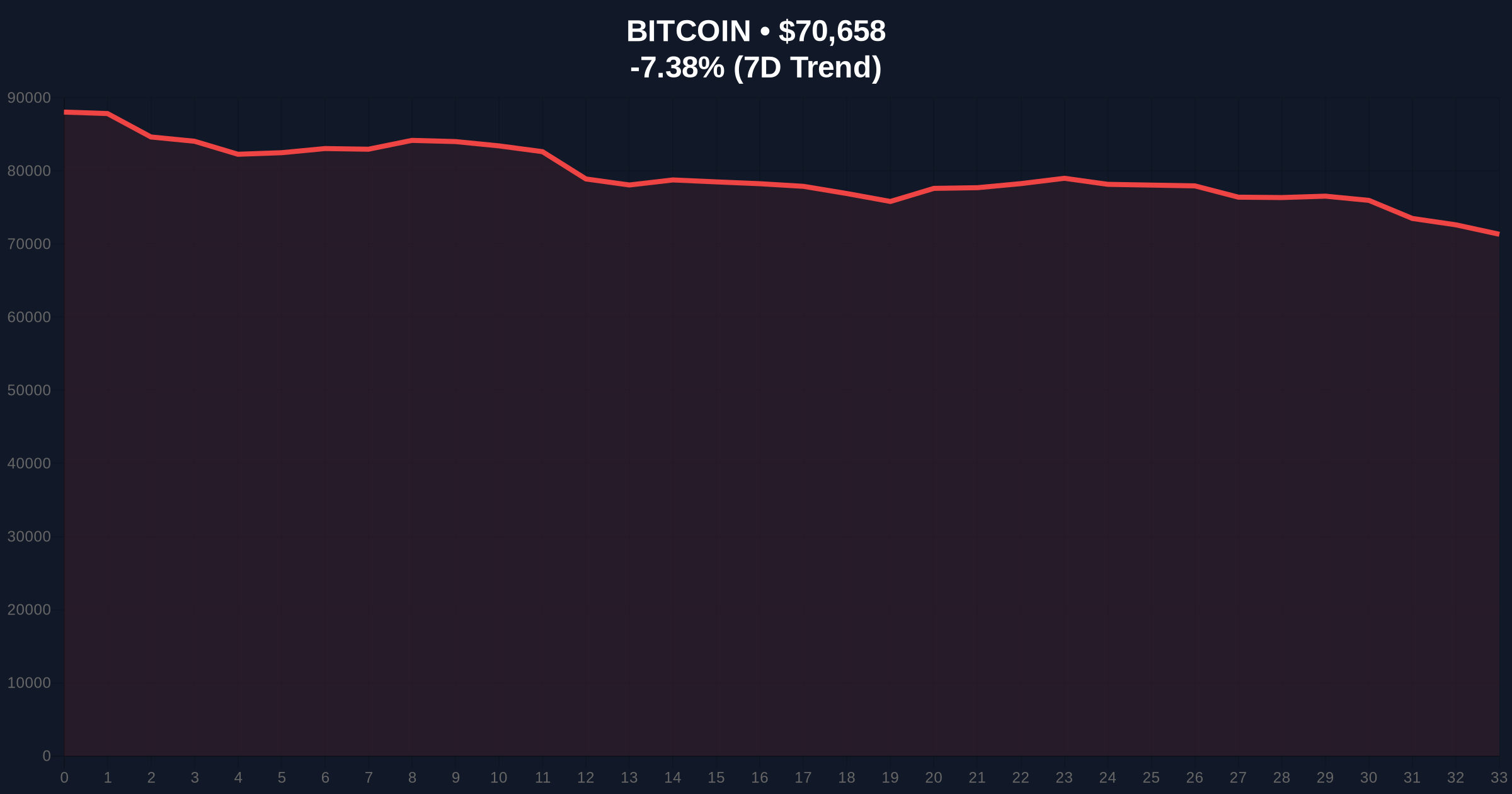

VADODARA, February 5, 2026 — Bitcoin perpetual futures markets reveal extreme short positioning across all major exchanges. This daily crypto analysis examines the data driving current market structure. According to Coinness data, the aggregate 24-hour long/short ratio stands at 48.53% long versus 51.47% short. Binance shows 48.2% long, OKX at 49.23% long, and Bybit at 49.36% long. Market structure suggests a liquidity grab is underway.

Coinness data provides precise exchange-level metrics. Binance leads with the most bearish skew at 51.8% short positions. OKX follows with 50.77% short. Bybit shows 50.64% short. These ratios reflect real-time trader sentiment across the three largest futures platforms by open interest. The data indicates consistent short bias despite minor variations. This alignment suggests coordinated institutional positioning rather than retail noise.

Historically, extreme short positioning precedes violent reversals. The 2021 cycle saw similar futures skew before the November rally to all-time highs. In contrast, the current environment combines technical weakness with macroeconomic headwinds. Underlying this trend is a broader market capitulation. Related developments include significant Bitcoin outflows from exchanges and institutional portfolio rebalancing amid the fear.

Bitcoin currently trades at $70,653. The 24-hour trend shows a -7.39% decline. Critical support sits at the Fibonacci 0.618 retracement level of $68,500 from the 2025 cycle high. A break below this creates a Fair Value Gap (FVG) targeting $65,000. The 200-day moving average at $72,800 now acts as resistance. On-chain data indicates increased UTXO age bands moving to exchanges, signaling potential distribution.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (12/100) |

| Bitcoin Current Price | $70,653 |

| 24-Hour Price Change | -7.39% |

| Aggregate Long/Short Ratio | 48.53% Long / 51.47% Short |

| Binance Short Percentage | 51.8% |

Futures positioning drives leverage cycles. Extreme short bias increases systemic risk. A sudden positive catalyst could trigger a gamma squeeze. Institutional liquidity maps show concentration around current levels. Retail market structure appears fragmented. The Federal Reserve's current monetary policy stance, detailed on FederalReserve.gov, continues to influence capital flows into risk assets. This creates a volatile feedback loop between traditional finance and crypto derivatives.

Market structure suggests we are in a classic bear trap setup. The high short interest across perpetual futures, combined with Extreme Fear sentiment, creates tinder for a rapid reversal. However, the Order Block at $68,500 must hold to validate this thesis. A break below invalidates the bullish scenario and opens the path to deeper lows.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. Persistent short positioning indicates professional traders are hedging or betting on further downside. This aligns with a broader 5-year horizon where regulatory clarity and ETF maturation could reduce volatility. However, near-term price action depends on the resolution of this futures skew.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.