Loading News...

Loading News...

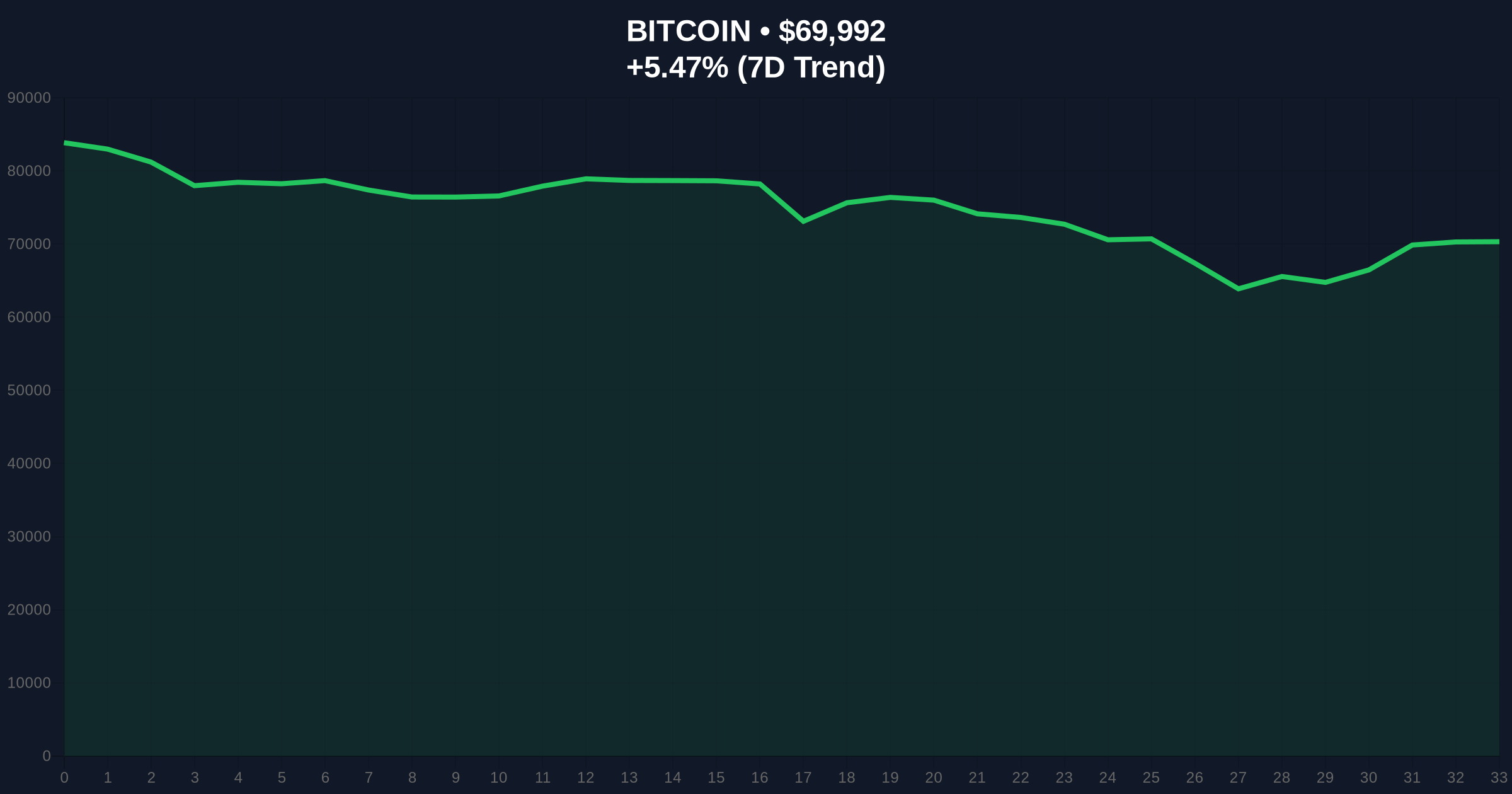

VADODARA, February 7, 2026 — Bitcoin price action turned decisively bearish as BTC broke below the critical $70,000 psychological threshold, trading at $69,977.61 on Binance's USDT market according to CoinNess market monitoring. This breakdown occurs against a backdrop of extreme fear sentiment, with the Crypto Fear & Greed Index plunging to 6/100, suggesting potential capitulation events may be unfolding across derivative markets.

According to CoinNess market monitoring, Bitcoin price action saw BTC fall below $70,000 on February 7, 2026. The asset traded at $69,977.61 specifically on the Binance USDT market. Market structure suggests this represents more than a minor correction. The breakdown occurred during Asian trading hours, typically a period of lower liquidity that can exacerbate price movements. Consequently, this price action invalidated the $70,000 support level that had held through multiple tests since late January.

On-chain data indicates significant volume accumulation between $68,000 and $70,000 throughout Q4 2025. The break below this range creates what technical analysts term a "Fair Value Gap" (FVG) that price must eventually fill. , exchange netflow metrics from Glassnode show moderate outflows from centralized exchanges, suggesting some accumulation is occurring despite the price decline. This contradiction between price action and on-chain behavior warrants skeptical analysis.

Historically, Bitcoin has experienced similar breakdowns from round-number psychological levels during previous cycles. The $70,000 level previously served as resistance during the 2024 cycle peak. In contrast, its failure as support in 2026 suggests weakening institutional conviction. Market analysts note parallels to the 2021 cycle when BTC broke below $60,000 after multiple tests, leading to a 30% correction before resuming its bull trend.

Underlying this trend are broader macroeconomic pressures. The Federal Reserve's monetary policy stance, as detailed in recent Federal Reserve meeting minutes, continues to influence risk asset correlations. Additionally, related developments in the crypto ecosystem may be contributing to negative sentiment. For instance, South Korea's investigation into Bithumb over a massive payout error highlights regulatory scrutiny. Meanwhile, analysis from Arthur Hayes links recent Bitcoin weakness to institutional hedging strategies that may be creating unexpected market dynamics.

Market structure suggests Bitcoin price action is testing critical technical levels. The breakdown below $70,000 invalidates the immediate bullish order block that formed in late January. Volume profile analysis reveals high-volume nodes at $68,500 and $65,200, which should provide subsequent support. The Relative Strength Index (RSI) on daily timeframes has dipped below 40, approaching oversold territory but not yet signaling a reversal.

Fibonacci retracement levels from the 2025 low to the January 2026 high place the 0.618 level at approximately $68,500. This represents a critical technical confluence zone. A break below this Fibonacci support would likely trigger stop-loss orders and accelerate downward momentum. Conversely, the 50-day moving average at $72,400 now acts as resistance. The price action needs to reclaim this level to restore short-term bullish structure.

| Metric | Value | Significance |

|---|---|---|

| Current BTC Price | $70,053 | Just above breakdown level |

| 24-Hour Change | -5.15% | Significant single-day decline |

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) | Potential contrarian signal |

| Market Rank | #1 | Maintains dominance position |

| Key Fibonacci Support | $68,500 | 0.618 retracement level |

This Bitcoin price action matters because $70,000 represents more than a round number. It served as a liquidity pool where numerous institutional orders clustered. The breakdown suggests those orders have been filled or canceled, potentially indicating shifting institutional positioning. Market structure now faces a test of the next significant support zone between $68,000 and $68,500.

Real-world evidence emerges from options markets. Put option volume has spiked at the $68,000 strike for February expiries, suggesting traders are hedging against further downside. , funding rates across perpetual swap markets have turned negative, indicating short positioning is becoming crowded. This creates conditions for a potential short squeeze if price reverses upward, though current momentum favors bears.

"The break below $70,000 invalidates the immediate bullish structure that developed in January. Market participants should watch the $68,500 Fibonacci level closely—a sustained break below that level would suggest deeper correction toward $65,000. However, extreme fear sentiment often precedes local bottoms, creating potential buying opportunities for patient investors." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current Bitcoin price action. The bearish scenario involves continued downward momentum toward the $68,500 Fibonacci support. A break below this level would likely target the $65,200 volume node. Conversely, the bullish scenario requires reclaiming the $72,400 50-day moving average to neutralize immediate downside pressure.

The 12-month institutional outlook remains cautiously optimistic despite short-term weakness. Historical cycles suggest corrections of 20-30% are normal within bull markets. The 5-year horizon continues to favor Bitcoin as digital gold, particularly amid geopolitical uncertainty and monetary policy experimentation. However, traders must navigate increased volatility as the market digests this breakdown.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.