Loading News...

Loading News...

VADODARA, February 5, 2026 — Binance Co-CEO He Yi has sarcastically characterized a community-driven withdrawal campaign as a beneficial "stress test" for exchanges. This latest crypto news emerges as the Crypto Fear & Greed Index plunges to an "Extreme Fear" score of 12/100. According to on-chain data cited by Yi, Binance addresses have actually seen asset increases since the campaign began, contradicting the intended boycott effect.

He Yi directly addressed a spreading boycott and withdrawal campaign targeting Binance. She noted attempts at regular withdrawals from all exchanges serve as a practical stress test. Yi advised users to double-check addresses during withdrawals, emphasizing the irreversibility of on-chain transfer errors. She suggested hardware wallets like Ledger or Trezor as alternatives for users anxious about Binance Wallet or Trust Wallet. The campaign stems from widespread community mistrust, leading some users to attempt mass withdrawals to self-custody wallets. This action contributes to ongoing FUD (Fear, Uncertainty, and Doubt) around the exchange's operational integrity.

Historically, coordinated withdrawal campaigns have acted as liquidity stress tests for centralized exchanges. Similar to the 2021 correction following China's mining ban, such events often reveal underlying market fragility. In contrast, Binance's current position differs from the 2022 FTX collapse, where withdrawal freezes preceded insolvency. Underlying this trend is a persistent tension between centralized custody and decentralized self-sovereignty. The campaign reflects a broader skepticism toward centralized intermediaries that has intensified post-2023 regulatory crackdowns. Market structure suggests these events create Fair Value Gaps (FVGs) that sophisticated traders exploit.

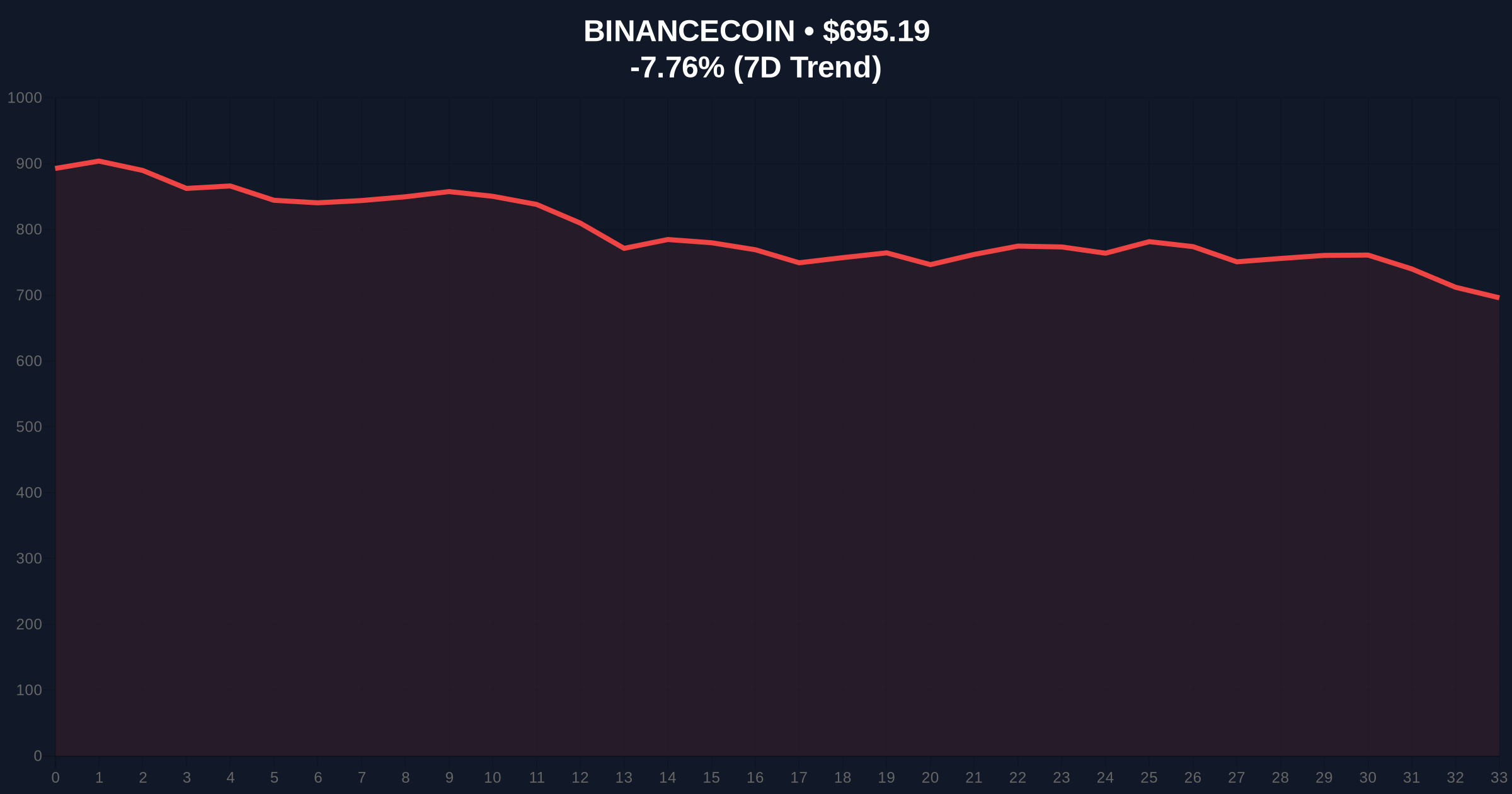

BNB's price action shows a clear bearish bias, dropping 7.79% to $694.94. The asset faces immediate resistance at the $720 Order Block, a level that previously acted as support. Critical support rests at the $680 Fibonacci 0.618 retracement level from the 2025 rally. A break below this invalidation point could trigger a cascade toward the 200-day moving average at $650. The Relative Strength Index (RSI) sits at 38, indicating oversold conditions but not yet extreme capitulation. On-chain data from Etherscan indicates increased transfer volumes from Binance hot wallets, suggesting the campaign has measurable on-chain footprint. This activity mirrors patterns seen during the recent whale dumps of ETH and SOL, where large holders exited positions amid fear.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Historically a contrarian buy signal |

| BNB Current Price | $694.94 | Testing key Fibonacci support |

| BNB 24h Change | -7.79% | Bearish momentum acceleration |

| BNB Market Rank | #4 | Maintains top-5 dominance |

| Bitcoin Price (Context) | Below $72,000 | Broad market sell-off pressure |

This event matters because it tests the resilience of centralized exchange liquidity models during stress. Successful navigation could reinforce Binance's dominance. Failure might accelerate a shift toward decentralized finance (DeFi) and self-custody solutions. The campaign's timing amid extreme fear amplifies its impact on market psychology. Institutional liquidity cycles often pivot on such trust events, as seen with the recent Bitcoin price drop below $72,000. Retail market structure remains fragile, with many holders likely underwater on recent purchases. Regulatory scrutiny, as documented on SEC.gov, continues to shape exchange operational transparency requirements.

"He Yi's framing of withdrawals as a stress test is a calculated risk-management communication. It acknowledges community concerns while projecting operational confidence. However, the real test is whether Binance's proof-of-reserves, aligned with evolving standards like Ethereum's EIP-4844 for data availability, can withstand sustained scrutiny. Historical cycles suggest that exchanges surviving such campaigns emerge stronger, but only if on-chain data verifies their claims." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios for BNB and Binance's ecosystem.

The 12-month institutional outlook hinges on Binance's ability to convert this stress test into a trust-building event. If successful, BNB could reclaim its role as a market leader, benefiting from the broader adoption of new Layer 1 solutions for RWA trading. Conversely, prolonged FUD could erode market share to competitors, impacting BNB's valuation across the 5-year horizon.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.