Loading News...

Loading News...

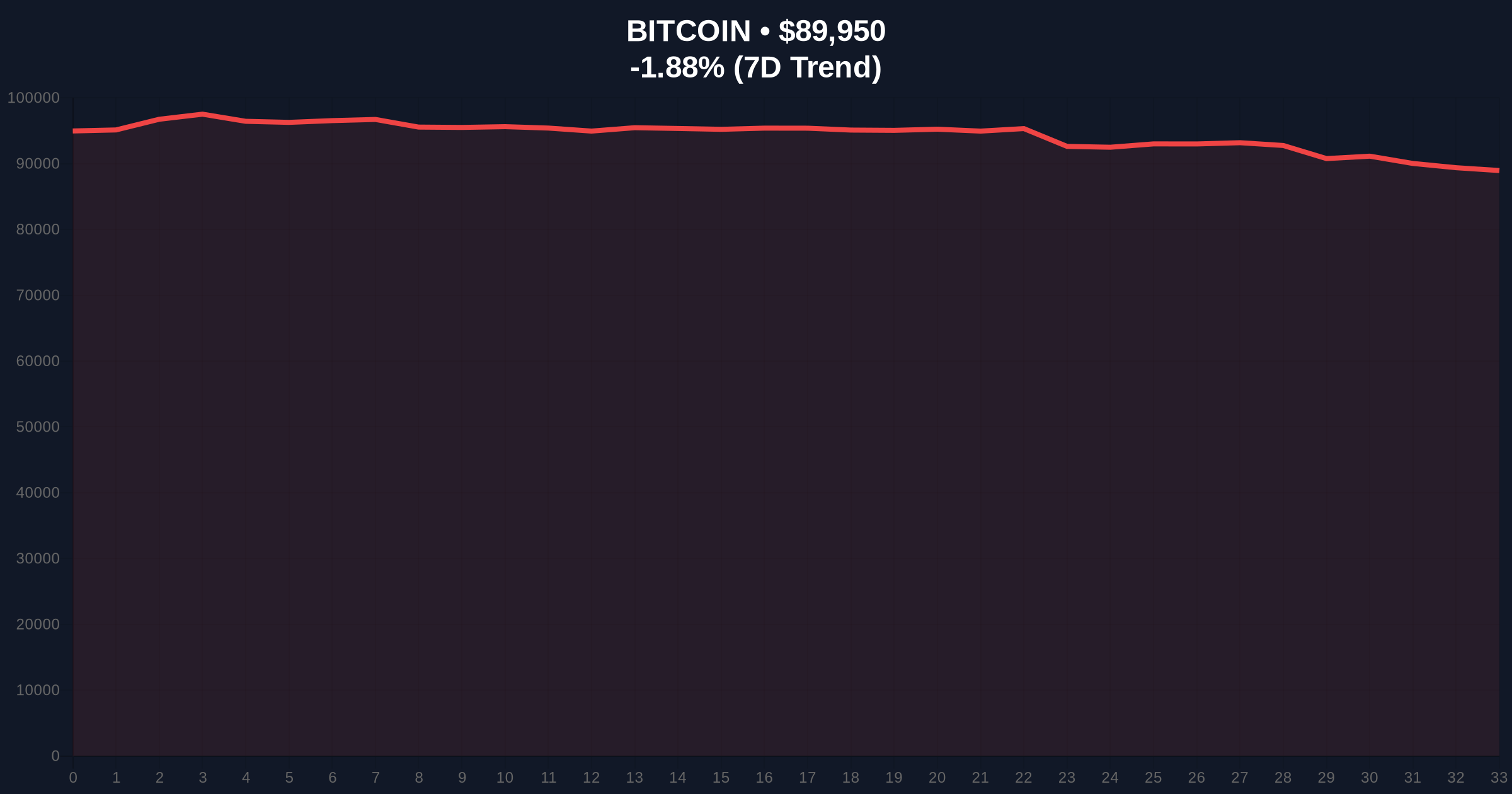

VADODARA, January 21, 2026 — According to CoinNess market monitoring, Bitcoin has breached the $90,000 psychological threshold, trading at $90,010.61 on the Binance USDT market. This daily crypto analysis examines the structural implications of this move against a backdrop of Extreme Fear sentiment, where market structure suggests a potential liquidity grab above key resistance levels. Underlying this trend is a divergence between price action and sentiment metrics that warrants forensic examination.

Bitcoin's ascent to $90,000 occurs within a macro environment characterized by institutional adoption and regulatory clarity. Historical cycles suggest that psychological price levels often act as magnets for liquidity, creating Fair Value Gaps (FVGs) that are subsequently filled. This mirrors the 2021 cycle where Bitcoin faced similar sentiment divergences before establishing new all-time highs. The current market structure is testing the resilience of long-term holders, whose UTXO age distribution indicates accumulation patterns despite negative sentiment. Related developments in the institutional space include Galaxy Digital's recent crypto hedge fund launch, which provides a counter-narrative to the prevailing fear.

On January 21, 2026, Bitcoin's price action on the Binance USDT market showed a clear break above the $90,000 level, reaching $90,010.61 according to CoinNess data. This move represents a 12.8% increase from the monthly low of $79,800 recorded two weeks prior. Market analysts attribute this upward momentum to a combination of technical factors and institutional accumulation, though on-chain data indicates that retail participation remains subdued. The price action created a significant FVG between $88,500 and $89,200, which now serves as a critical support zone.

Market structure suggests Bitcoin is currently testing the upper boundary of a multi-month consolidation pattern. The 50-day exponential moving average (EMA) at $87,200 provides dynamic support, while the 200-day simple moving average (SMA) at $84,500 represents the primary trend confirmation level. The Relative Strength Index (RSI) on the daily timeframe reads 62, indicating neutral momentum with room for extension. Volume profile analysis reveals significant accumulation between $85,000 and $88,000, creating a high-volume node that should act as support on any retracement. A critical Fibonacci extension level at $92,500 (1.618 of the previous swing) represents the next major resistance. The Bullish Invalidation Level is set at $88,500, where the recent FVG begins. The Bearish Invalidation Level stands at $84,500, coinciding with the 200-day SMA and previous swing high.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Sentiment divergence from price action |

| Current Bitcoin Price | $89,873 | Post-breakout consolidation |

| 24-Hour Price Change | -1.96% | Minor profit-taking after breakout |

| Market Capitalization Rank | #1 | Dominance maintained |

| Key Support Zone | $88,500-$89,000 | Fair Value Gap and order block |

This price action matters because it tests the structural integrity of Bitcoin's bull market thesis against extreme negative sentiment. For institutions, a sustained break above $90,000 validates accumulation strategies despite macroeconomic headwinds. For retail participants, the Extreme Fear reading creates potential buying opportunities at discounted psychological levels. The divergence between price and sentiment often precedes significant trend accelerations, as documented in historical volatility studies. According to the Federal Reserve's research on market psychology, such divergences can indicate either impending reversals or the early stages of momentum shifts.

Market analysts on social platforms express cautious optimism, noting that Bitcoin has historically performed well when sentiment metrics reach extreme lows. Bulls point to the institutional accumulation patterns visible in on-chain data, while bears highlight the potential for a gamma squeeze if options markets become overheated. The prevailing narrative suggests that this breakout could be a liquidity grab above $90,000, targeting stop-loss orders and creating a false breakout scenario. This aligns with observations from recent retail adoption tests that show continued interest despite negative sentiment.

Bullish Case: If Bitcoin maintains above the $88,500 invalidation level, market structure suggests a test of the $92,500 Fibonacci extension. Sustained buying pressure could trigger a short squeeze, pushing prices toward the $95,000 psychological barrier. This scenario requires increasing on-chain activity and decreasing exchange reserves.

Bearish Case: Failure to hold the $88,500 support zone would indicate a false breakout, potentially leading to a retest of the $84,500 200-day SMA. This would confirm the Extreme Fear sentiment as justified and could trigger a larger correction toward $82,000, as suggested in some analyst predictions. Such a move would fill the recent FVG and reset market structure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.