Loading News...

Loading News...

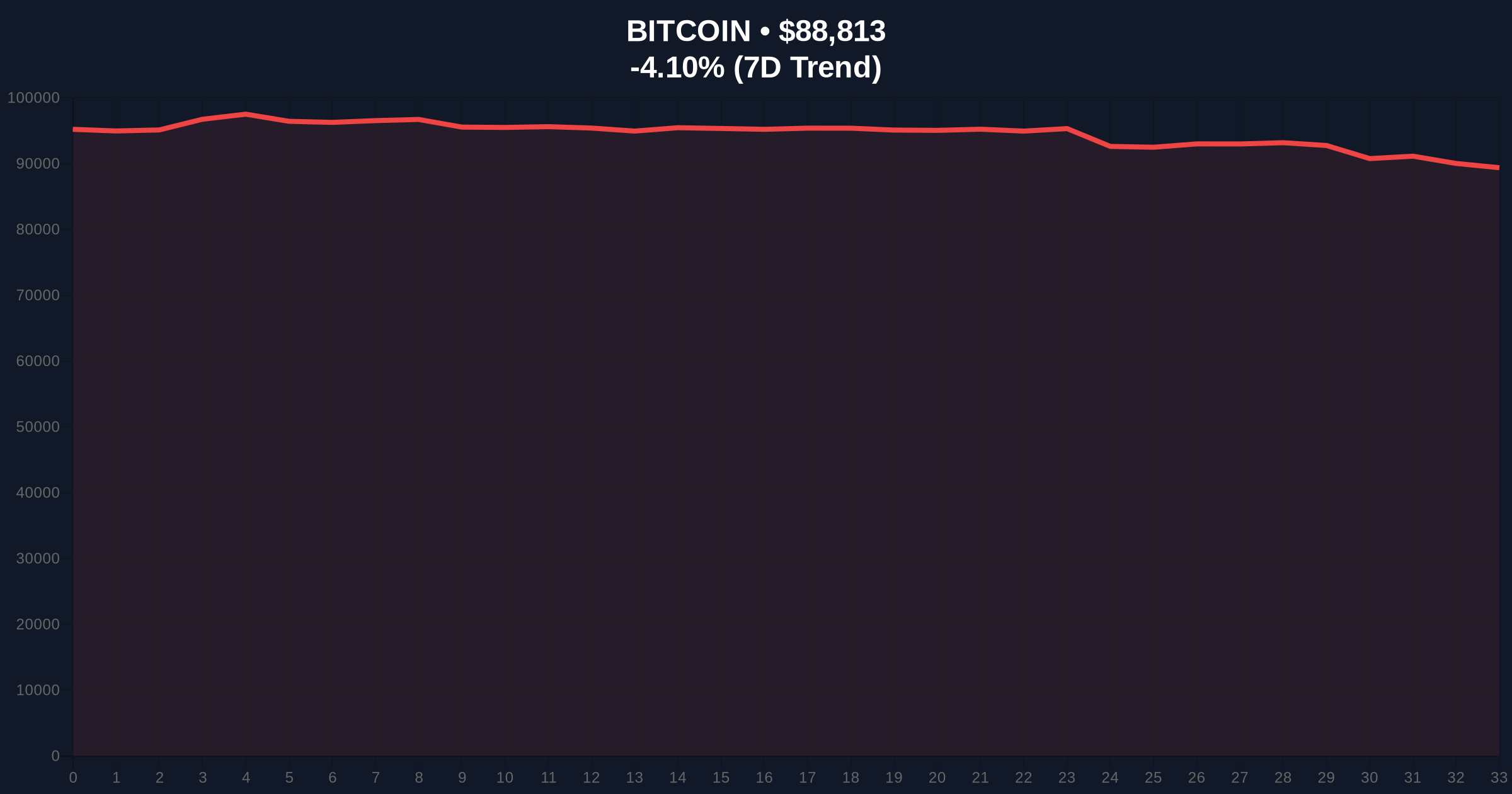

VADODARA, January 21, 2026 — Fundstrat Global Advisors Chairman Tom Lee has issued a bifurcated forecast for Bitcoin in 2026, predicting a painful early-year correction followed by robust year-end recovery to new all-time highs. This daily crypto analysis examines the technical validity of Lee's prediction against current market structure and historical patterns. According to the Master Investor podcast interview reported by Cointelegraph, Lee attributes potential near-term weakness to geopolitical instability and tariff pressures, while anticipating institutional expansion to drive eventual recovery.

Market structure suggests Bitcoin is currently testing critical support levels reminiscent of the 2021 correction that preceded the November 2021 all-time high. Similar to that cycle, current price action shows repeated deleveraging events that have weakened market maker functions, creating what technical analysts identify as a Fair Value Gap (FVG) between $85,000 and $90,000. Historical cycles indicate that such gaps typically fill before sustained upward momentum resumes. The October 2025 leverage liquidations referenced by Lee created a liquidity vacuum that market makers have struggled to replenish, mirroring patterns observed during the March 2020 COVID crash recovery phase.

Related developments in the current market environment include Bitcoin's breakdown of its traditional correlation with bond markets and a $150 billion market cap decline within 24 hours that has pushed sentiment into extreme fear territory.

On January 21, 2026, Tom Lee articulated a two-phase market outlook during his Master Investor podcast appearance. According to the Cointelegraph report, Lee specifically identified tariffs and geopolitical instability as catalysts for potential early-year market correction. He simultaneously projected Bitcoin would reach new all-time highs later in 2026, signaling recovery from the October 2025 leverage liquidation shock. Lee's analysis of the crypto-gold decoupling attributes this divergence to repeated deleveraging that has impaired market maker functionality, with instability likely persisting until institutional participation expands sufficiently.

Current Bitcoin price at $88,836 represents a -4.13% decline in the last 24 hours, testing the psychological $90,000 support level. Volume profile analysis indicates significant accumulation between $82,000 and $85,000, creating what technical analysts identify as a strong Order Block that should provide support during any correction. The 50-day moving average at $91,200 has turned resistance, while the 200-day moving average at $84,500 provides secondary support. RSI readings at 38 suggest oversold conditions are developing but not yet extreme.

Bullish Invalidation Level: $82,000 (Fibonacci 0.618 retracement from October 2025 lows to December 2025 highs). A sustained break below this level would invalidate Lee's recovery thesis and suggest deeper correction to $78,000.

Bearish Invalidation Level: $95,500 (previous resistance turned support). A reclaim of this level would signal early recovery and potentially accelerate toward $100,000 psychological resistance.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Historically contrarian buy signal when below 30 |

| Bitcoin Current Price | $88,836 | -4.13% 24h change, testing $90k support |

| Market Dominance | #1 by Market Cap | Maintains leadership despite altcoin volatility |

| Critical Fibonacci Support | $82,000 (0.618 retracement) | Key level for Lee's dip prediction validation |

| Previous ATH | $94,200 (Dec 2025) | Target for new highs per Lee's year-end forecast |

For institutional investors, Lee's prediction creates a framework for strategic capital deployment during potential weakness. The Federal Reserve's monetary policy trajectory, as documented in official Federal Reserve communications, will significantly influence the timing and magnitude of any recovery. Retail traders face increased volatility risk during the predicted correction phase, particularly those utilizing leverage in what may become a Liquidity Grab scenario as market makers reposition. The decoupling from gold that Lee references represents a fundamental shift in Bitcoin's perceived role, potentially transitioning from inflation hedge to risk-on asset as institutional adoption accelerates.

Market analysts on X/Twitter exhibit polarized responses to Lee's forecast. Bulls highlight his accurate 2024-2025 predictions as validation, while bears question the timing specificity of "early-year" versus "year-end" projections. Quantitative traders note the alignment between Lee's dip prediction and technical support at the $82,000 Fibonacci level, suggesting this represents more than mere speculation. The extreme fear sentiment reading of 24/100 indicates retail capitulation may be nearing, which historically precedes significant rallies when combined with institutional accumulation signals.

Bullish Case: Bitcoin finds support at $82,000-$85,000 Fibonacci zone, institutional participation expands through Q2 2026 as predicted by Lee, and EIP-4844 implementation on Ethereum creates positive spillover effects. This scenario projects a year-end rally to $105,000-$110,000, representing 25-30% upside from current levels and validating Lee's new all-time high prediction.

Bearish Case: Geopolitical instability intensifies, tariff implementation exceeds expectations, and the $82,000 support level fails. This would trigger a deeper correction to $75,000-$78,000 (0.786 Fibonacci retracement), delaying recovery until 2027 and invalidating Lee's timeline. Such a scenario would likely coincide with continued decoupling from traditional safe havens and prolonged market maker dysfunction.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.