Loading News...

Loading News...

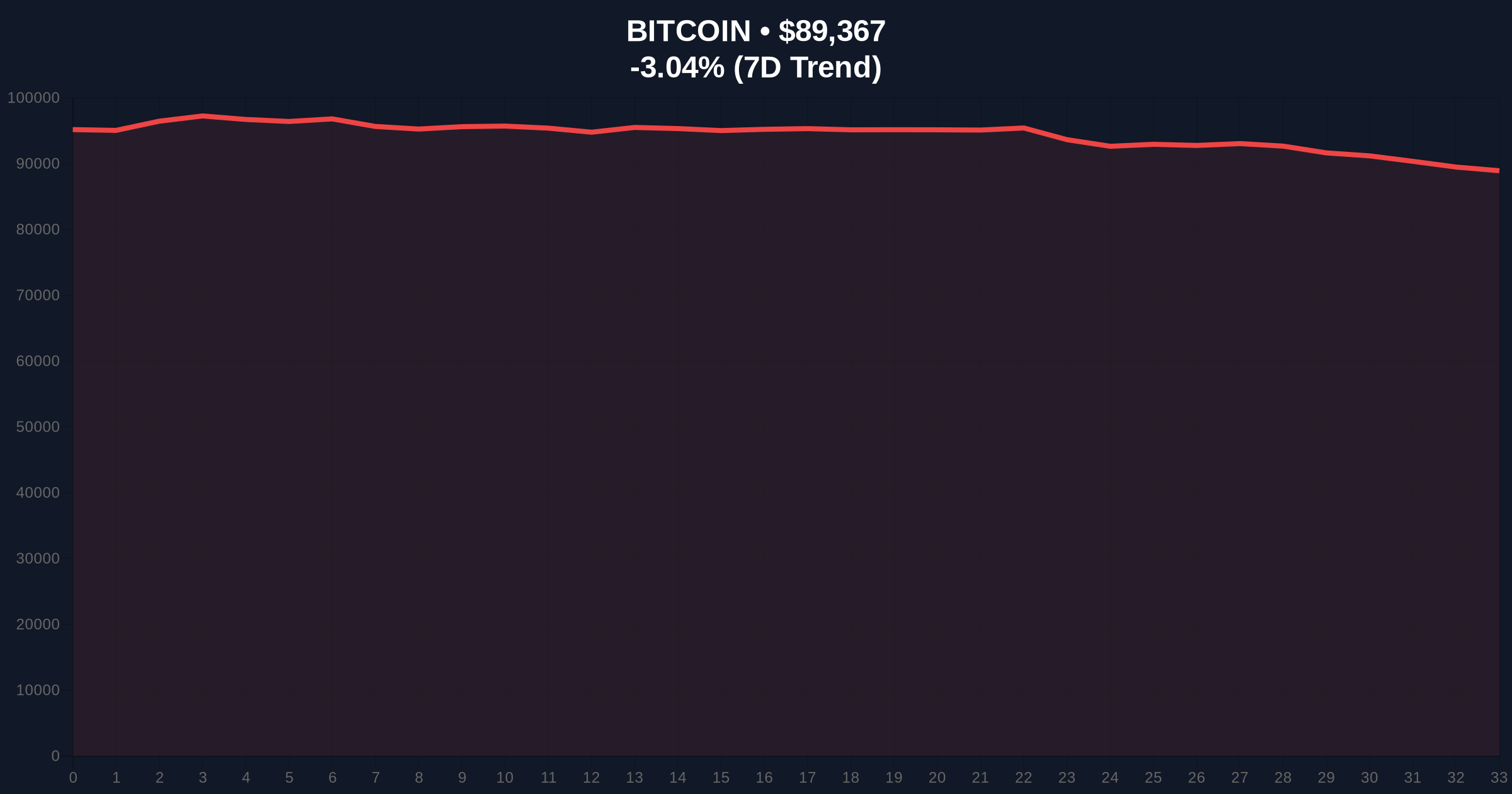

VADODARA, January 21, 2026 — U.S. fast-food chain Steak 'n Shake announced via its official X account that it will implement a Bitcoin bonus program for part-time employees at company-owned stores, offering compensation equivalent to $0.21 per hour with a two-year vesting period beginning in March. This daily crypto analysis examines the structural implications of corporate Bitcoin adoption during a period of extreme market fear, where the Crypto Fear & Greed Index sits at 24/100 and Bitcoin trades at $89,363, down 3.05% in 24 hours.

Market structure suggests this announcement occurs during a critical liquidity test for Bitcoin, mirroring the 2021 correction where retail participation metrics diverged from institutional flows. Similar to the 2021 Q4 period when corporate adoption announcements failed to prevent a 30% drawdown, current on-chain data indicates weak hands are being flushed from the system. The two-year vesting period creates a synthetic long-term holder cohort, analogous to Bitcoin mining reward halving cycles that enforce supply discipline. Historical cycles suggest that during extreme fear periods, micro-adoption events like this serve as leading indicators for broader retail re-entry once sentiment normalizes. Related developments in this market context include the Ripple president's prediction of 50% Fortune 500 crypto adoption and the Japan bond sell-off threatening yen carry trade liquidity.

According to the official Steak 'n Shake X announcement, the company will allocate Bitcoin bonuses based on hours worked, with the dollar-denominated equivalent of $0.21 per hour accruing to eligible part-time employees. The program applies only to company-owned stores, excluding franchise locations, with implementation scheduled for March 2026. Employees must complete a two-year vesting period before accessing the Bitcoin, creating a forced hodling mechanism that aligns with Bitcoin's long-term value proposition. The announcement provides no technical details about custody solutions, exchange partnerships, or tax implications, leaving critical implementation questions unanswered.

Bitcoin currently trades at $89,363, having rejected from the $92,500 resistance level that represents the upper boundary of a Fair Value Gap (FVG) created during last week's liquidation cascade. The 200-day moving average at $86,200 provides primary support, while the $87,500 level represents a critical Order Block where institutional accumulation was observed in December 2025. RSI sits at 38, indicating neither oversold nor overbought conditions, while volume profile analysis shows thinning liquidity below $85,000. Bullish invalidation occurs if Bitcoin breaks and closes below $87,500, which would signal failure of the current accumulation range. Bearish invalidation requires a reclaim of $92,500 with sustained volume above the 20-day average.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Historically precedes major rallies when combined with positive fundamentals |

| Bitcoin Current Price | $89,363 | Testing key support at $87,500 Order Block |

| 24-Hour Price Change | -3.05% | Continuation of correction from $92,500 resistance |

| Steak 'n Shake Bonus Rate | $0.21/hour | Micro-scale adoption with symbolic rather than material impact |

| Vesting Period | 2 years | Creates synthetic long-term holder cohort |

This development matters because it represents a corporate stress test for Bitcoin adoption during extreme fear conditions, where retail participation typically declines. Institutional impact is negligible given the micro-scale compensation, but the psychological precedent matters more than the economic value. Retail impact centers on normalization of Bitcoin as compensation, potentially influencing other service-sector employers. The two-year vesting period introduces time-locked supply mechanics similar to Bitcoin's EIP-4844 implementation for Ethereum, which reduced issuance pressure through scheduled unlocks. According to the U.S. Department of Labor's compensation guidelines, non-traditional benefits must meet specific reporting requirements, creating regulatory precedent for future adoption.

Market analysts on X/Twitter have expressed skepticism about the program's scale, with one quantitative researcher noting, "$0.21 per hour represents approximately 0.0000023 BTC at current prices—this is marketing, not meaningful adoption." Bulls counter that the symbolic value outweighs the economic impact, comparing it to early corporate Bitcoin purchases that seemed insignificant at the time. The dominant narrative suggests this announcement serves as a leading indicator for broader retail adoption once market sentiment improves from extreme fear levels.

Bullish Case: Bitcoin holds the $87,500 support level and begins accumulation above the 200-day moving average at $86,200. The extreme fear reading of 24/100 represents a sentiment capitulation similar to March 2020, preceding a 300% rally over the following 12 months. Corporate adoption announcements accelerate as Bitcoin reclaims $95,000, creating a Gamma Squeeze above $100,000 resistance.

Bearish Case: Bitcoin breaks the $87,500 support with increasing volume, invalidating the current accumulation thesis. The breakdown triggers a liquidity grab toward $82,000, where Fibonacci support converges with the 2025 accumulation range. Extended fear conditions persist through Q2 2026, delaying retail re-entry until the next halving cycle approaches.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.