Loading News...

Loading News...

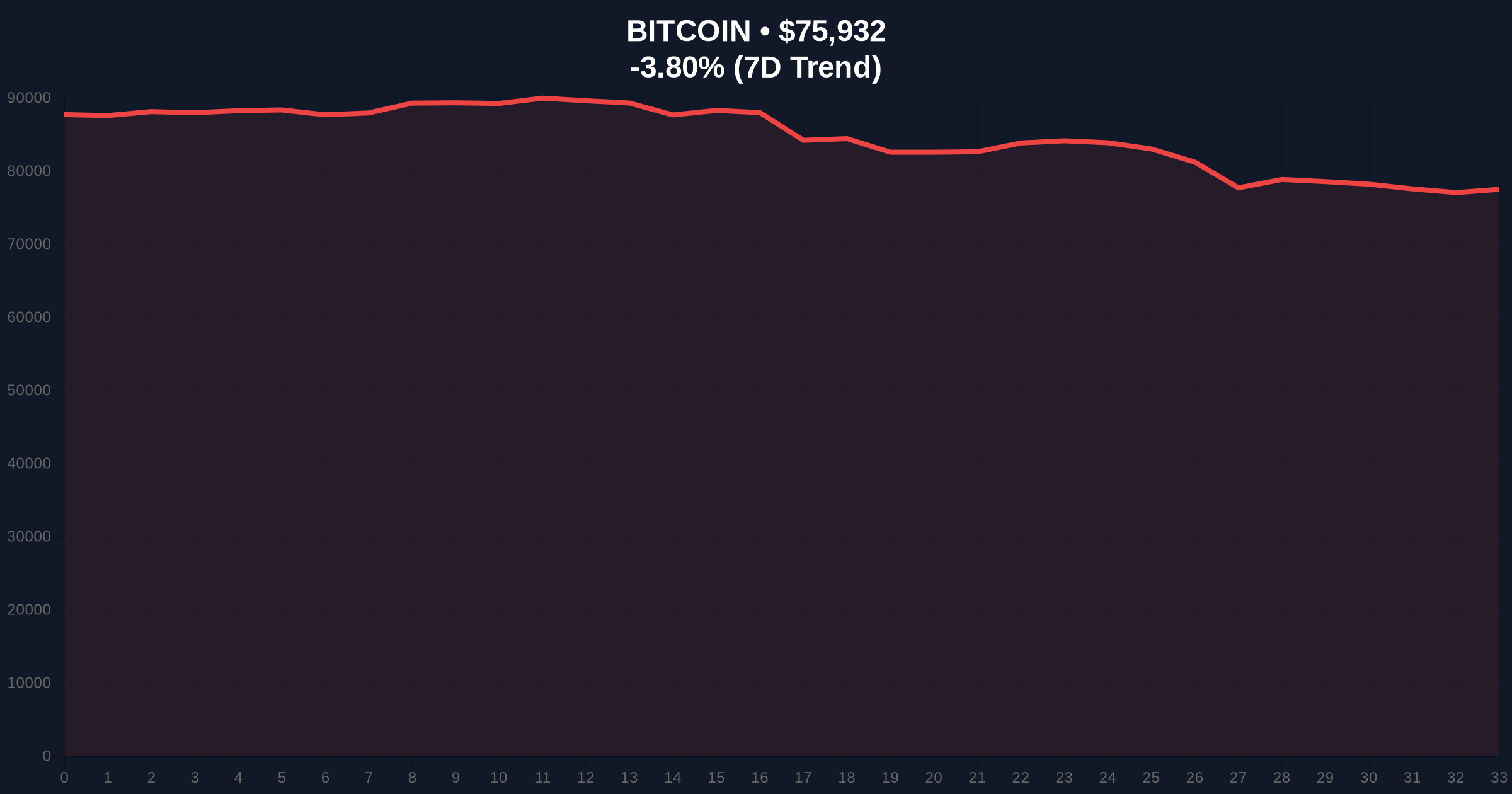

VADODARA, February 2, 2026 — Bitcoin has collapsed to its lowest price since April 2025, triggering a synchronized sell-off across global risk assets. This daily crypto analysis examines the technical breakdown and its implications for market structure. According to data from the trading platform Kobeissi Letter, BTC and ETH experienced intraday drops of 5.5% and 10.5%, respectively. The weakness extended beyond crypto, with commodities and U.S. stock futures also declining sharply.

Selling pressure rapidly expanded across multiple asset classes on February 2, 2026. Bitcoin led the decline, breaking below key psychological support levels. Ethereum followed with a more severe drop of over 10%. The commodities market mirrored this volatility. Natural gas fell 15.5%, silver dropped 8.0%, gold declined 5.5%, and WTI crude oil lost 4.5%. U.S. equity futures also weakened, with the Nasdaq down 1.5%, the S&P 500 down 1.2%, and the Dow down 0.8%. This correlation suggests a macro-driven liquidity grab, not an isolated crypto event.

Historically, synchronized sell-offs across crypto, commodities, and equities signal a tightening of global dollar liquidity. Similar to the June 2022 correction, this event points to institutional deleveraging. In contrast to the 2021 bull market corrections, which were often contained to crypto, today's action shows broader risk-off sentiment. Underlying this trend is likely a reassessment of Federal Reserve policy expectations, impacting all speculative assets. Market structure suggests this is a macro liquidity event first, with crypto acting as the leading indicator.

Related Developments: This sell-off occurs amid contradictory signals, such as an anonymous whale accumulating $100M in BTC and ETH during extreme fear. , some analysts warn of a potential multi-month slide toward $50K if key supports fail.

Bitcoin's price action broke below the critical 200-day simple moving average, a key institutional trend indicator. The sell-off created a significant Fair Value Gap (FVG) on lower timeframes, which now acts as a resistance zone. On-chain data from Glassnode indicates increased movement from long-term holder wallets, suggesting profit-taking or stop-loss triggering. The Relative Strength Index (RSI) on the daily chart plunged into oversold territory below 30. A key technical detail not in the source is the Fibonacci 0.618 retracement level from the 2025 low to the recent high, which sits near $74,500. This level represents a major order block that must hold to maintain the broader bullish structure.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Indicates peak capitulation sentiment. |

| Bitcoin (BTC) Current Price | $75,911 | Lowest since April 2025. |

| BTC 24-Hour Change | -3.83% | Intraday drop was 5.5%. |

| Ethereum (ETH) Intraday Drop | -10.5% | Highlighted higher beta volatility. |

| Natural Gas Decline | -15.5% | Largest commodity drop, showing broad risk-off. |

This event matters because it demonstrates crypto's maturation as a macro asset class. The high correlation with traditional markets invalidates the "digital gold" decoupling thesis in the short term. Real-world evidence includes the simultaneous drop in gold, which fell 5.5%. Institutional liquidity cycles are driving the action, not retail sentiment. Retail market structure is being washed out, as seen in the Extreme Fear reading. This flush sets the stage for a potential liquidity reversal if macro conditions stabilize, similar to the post-March 2020 recovery pattern.

"The synchronized decline across assets is a classic signature of a dollar liquidity squeeze. Bitcoin's break below the April 2025 low is technically significant, but the Fibonacci 0.618 level at $74.5K is the line in the sand for the bull market's integrity. Historical cycles suggest these violent liquidations often precede major rallies, but only after the liquidity vacuum is filled." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the $74,500 Fibonacci support.

The 12-month institutional outlook hinges on macro liquidity conditions. If the Federal Reserve signals a pivot, as historical precedent from late 2023 suggests, crypto could lead the recovery. The 5-year horizon remains structurally bullish due to Bitcoin's fixed supply and adoption trajectory, but 2026 may see heightened volatility as the market digests global monetary policy shifts outlined in official Federal Reserve communications.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.