Loading News...

Loading News...

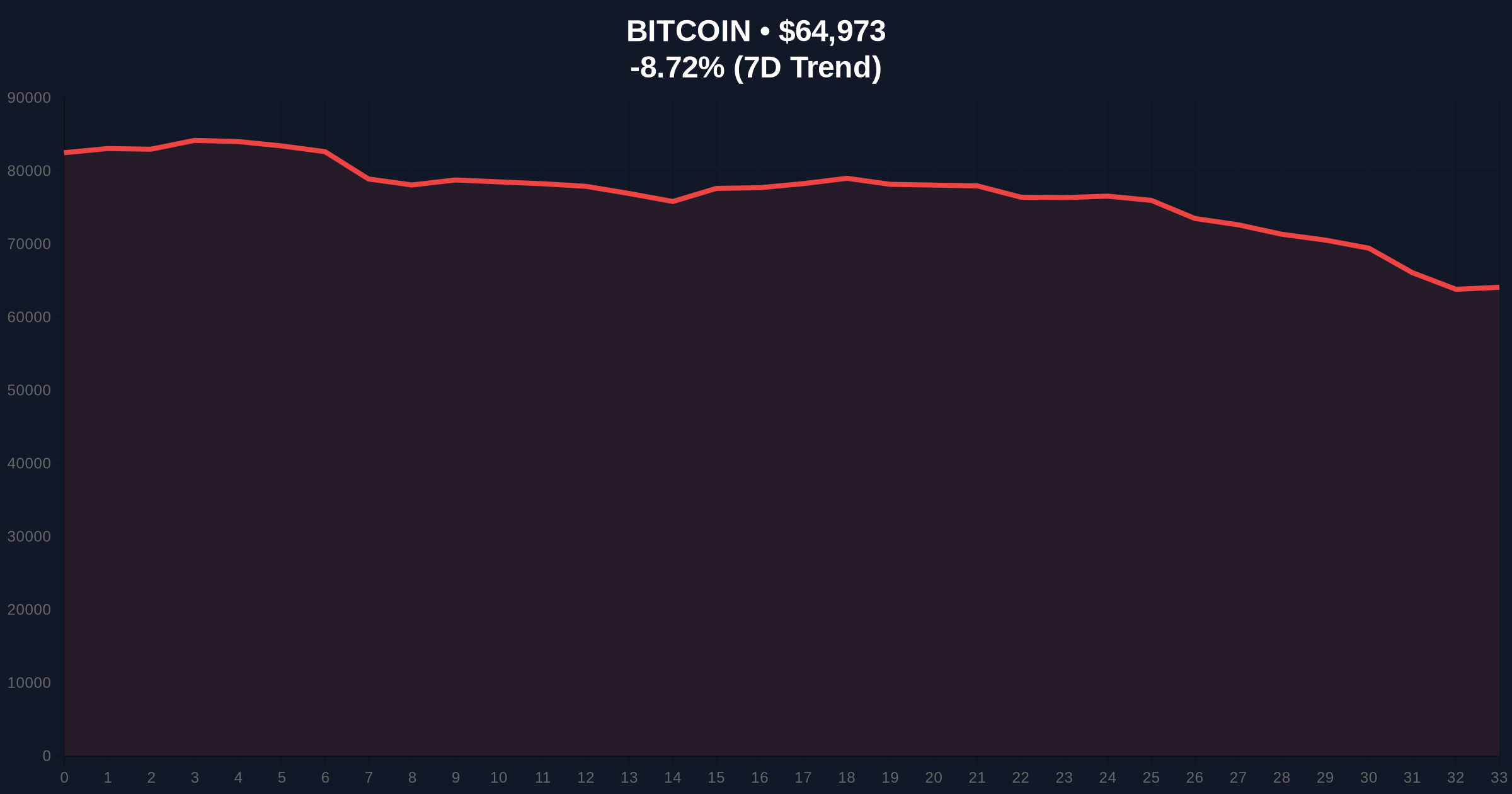

VADODARA, February 6, 2026 — Bitcoin's sharp decline to $64,910, marking an 8.67% drop, has ignited intense speculation among traders that macroeconomic factors alone cannot explain the sell-off. According to a CoinDesk report cited by Coinness, market participants are increasingly pointing to a potential 'hidden hand' orchestrating the plunge, with theories ranging from sovereign nation dumps to forced options liquidations. This latest crypto news event unfolds as the Crypto Fear & Greed Index plunges to an 'Extreme Fear' score of 9/100, signaling deep market distress.

Market structure suggests the recent price action deviates from typical macro-driven deleveraging. The primary theories, as reported by CoinDesk, propose specific, high-impact catalysts. First, a massive sell-off by an 'invisible hand' potentially involving a nation-state like Saudi Arabia, the UAE, Russia, or China dumping over $10 billion in BTC. Alternatively, an exchange facing bankruptcy may have triggered forced liquidations. Second, the failure of a yen carry trade by Asia-based traders could have cascaded, where a large non-crypto firm engaged in leveraged market making on Binance faced unwinding pressure. Third, forced liquidation of BlackRock's iShares Bitcoin Trust (IBIT) options is suspected, given IBIT recorded its highest-ever trading volume at $10.7 billion and options premium of $900 million. This pattern resembles large-scale options position unwinding rather than organic selling. Fourth, Hong Kong hedge funds that borrowed yen for high-leverage bets on IBIT options may have dumped BTC holdings after rising funding costs and losses in silver trading.

Historically, Bitcoin sell-offs attributed to macro factors like Fed rate hikes or inflation data show gradual, volume-profile-aligned declines. In contrast, this event's velocity and concentrated theories suggest a liquidity grab from a single large entity. Underlying this trend is a critical divergence: on-chain data from Glassnode indicates exchange outflows, yet price action shows aggressive selling pressure—a contradiction that fuels the 'hidden hand' narrative. This mirrors the 2021 China mining ban sell-off, where a specific catalyst caused a sharp, non-macro drop. , the current extreme fear sentiment echoes the March 2020 crash, where panic selling led to a V-shaped recovery once hidden liquidity was absorbed.

Related Developments: This plunge occurs amid broader market stress, as seen in Bitcoin breaking below $61,000 support and entities like TrendResearch depositing 20,000 ETH to avoid liquidation.

Technical analysis reveals a critical Fair Value Gap (FVG) between $67,000 and $69,000 that must be filled for bullish structure recovery. The current price of $64,910 sits below the 50-day moving average, with RSI dipping into oversold territory at 28. Market structure suggests key support at the $63,000 level, aligning with the 0.618 Fibonacci retracement from the recent all-time high. A break below this invalidates the bullish order block established in late January. Conversely, resistance forms at $68,500, a previous volume node. The rapid decline indicates stop-loss hunting and liquidation cascades, typical of forced selling events rather than organic macro repricing.

| Metric | Value | Context |

|---|---|---|

| Bitcoin Current Price | $64,910 | Down 8.67% in 24h |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Indicates peak market stress |

| IBIT Trading Volume (Theorized) | $10.7 billion | Record high, per report |

| Potential 'Hidden Hand' Sell-Off | >$10 billion | Estimated dump size |

| RSI (Relative Strength Index) | 28 | Oversold condition |

This event matters because it challenges the foundational narrative that Bitcoin's price is primarily driven by macroeconomic liquidity cycles. If a 'hidden hand'—such as a nation-state or failing institution—can precipitate an 8.67% drop, it exposes latent systemic risks not captured in traditional models. Institutional investors, who rely on macro correlations for portfolio allocation, must now account for opaque, large-scale actors. , the forced liquidation theories around IBIT options highlight the growing complexity and leverage in crypto derivatives, which can amplify sell-offs. Retail market structure is also impacted, as stop-losses are triggered en masse, creating liquidity vacuums that exacerbate volatility.

"The velocity and narrative divergence here are telling. Macro factors like Fed policy operate on a slower, more transparent timeline. This sell-off's signature suggests a concentrated liquidity event—possibly a sovereign wealth fund rebalancing or a leveraged entity unwinding. The critical level to watch is the $63,000 support; a break there confirms structural damage beyond typical fear-driven selling." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. First, a bullish recovery if the $63,000 support holds and the FVG up to $69,000 is filled, driven by bargain-hunting and short covering. Second, a bearish continuation if support fails, potentially targeting the $60,000 psychological level, as forced selling cascades. The 12-month institutional outlook hinges on identifying the 'hidden hand.' If it's a one-off event, Bitcoin may resume its macro-driven trend. If it reveals ongoing opaque selling pressure, volatility could persist, affecting long-term adoption narratives.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.