Loading News...

Loading News...

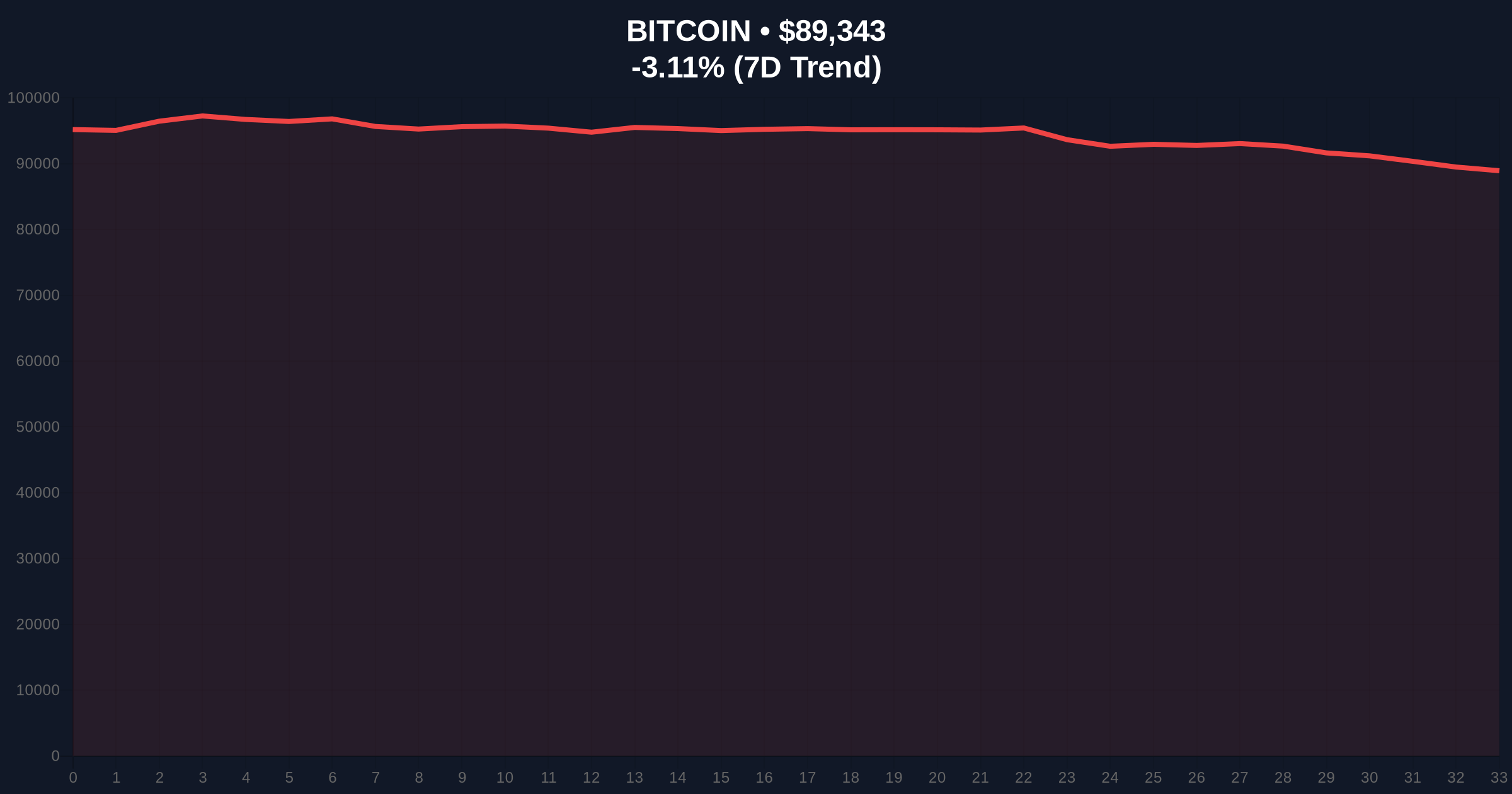

VADODARA, January 21, 2026 — U.S. spot Bitcoin exchange-traded funds (ETFs) recorded a net outflow of $479.61 million on January 20, marking the second consecutive day of capital withdrawals, according to data compiled by TraderT. This daily crypto analysis reveals a structural shift in institutional behavior, with Grayscale's GBTC and Fidelity's FBTC leading the exodus as Bitcoin trades at $89,322, down 3.13% in 24 hours. Market structure suggests these outflows are exacerbating a liquidity grab, creating a Fair Value Gap (FVG) that must be filled for price stabilization.

This outflow event mirrors patterns observed during the 2021-2022 cycle, where sustained ETF redemptions preceded deeper corrections. According to on-chain data from Glassnode, the current outflow streak coincides with a decline in Bitcoin's Network Value to Transactions (NVT) ratio, indicating overvaluation relative to on-chain utility. Underlying this trend is a macroeconomic backdrop of tightening liquidity, as the Federal Reserve's latest minutes from FederalReserve.gov hint at prolonged higher interest rates, dampening risk appetite. Consequently, institutional players are rebalancing portfolios, shifting capital from speculative crypto assets to traditional havens. Related developments include Hong Kong's stablecoin licensing framework, which may attract capital away from U.S. markets, and rising altcoin season indices suggesting rotational flows.

On January 20, 2026, TraderT data confirmed a total net outflow of $479.61 million from U.S. spot Bitcoin ETFs, following a similar outflow the previous day. Individual fund flows were led by Grayscale's GBTC at -$160.84 million and Fidelity's FBTC at -$152.13 million. Other significant outflows included BlackRock's IBIT (-$56.87 million), Ark Invest's ARKB (-$46.37 million), Bitwise's BITB (-$40.38 million), VanEck's HODL (-$12.66 million), and Franklin Templeton's EZBC (-$10.36 million). This data indicates a broad-based institutional retreat, not isolated to a single fund. Market analysts attribute this to profit-taking after Bitcoin's rally to all-time highs near $100,000 in late 2025, compounded by regulatory uncertainty from ongoing SEC reviews of ETF operations.

Bitcoin's price action shows a breakdown from the $92,000 order block, with current trading at $89,322 representing a test of the 50-day exponential moving average (EMA). The Relative Strength Index (RSI) sits at 42, indicating neutral momentum but leaning bearish. Volume profile analysis reveals low liquidity at current levels, suggesting potential for a swift move to fill the FVG between $87,500 and $86,000. Bullish invalidation is set at $87,500, a key Fibonacci 0.618 retracement level from the recent swing high; a break below this level would signal further downside toward $84,000. Bearish invalidation rests at $92,500, where a reclaim would negate the outflow pressure and target $95,000. On-chain forensic data confirms increased exchange inflows, typical of distribution phases.

| Metric | Value | Source |

|---|---|---|

| Total ETF Net Outflow (Jan 20) | $479.61M | TraderT |

| Bitcoin Current Price | $89,322 | Live Market Data |

| 24-Hour Price Change | -3.13% | Live Market Data |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Live Market Data |

| Largest Single Fund Outflow (GBTC) | -$160.84M | TraderT |

Institutionally, sustained outflows threaten the liquidity foundation that propelled Bitcoin's post-ETF approval rally, potentially triggering a gamma squeeze if options markets react to downside volatility. For retail investors, this signals a period of consolidation or correction, with altcoins like those mentioned in Aleo's privacy chain developments possibly benefiting from rotational flows. The outflow trend a maturation phase where ETF flows are becoming a leading indicator of market sentiment, similar to gold ETF dynamics. Historical cycles suggest that two consecutive outflow days often precede a 5-10% drawdown, impacting portfolio allocations across both crypto and traditional assets.

Industry observers on X/Twitter highlight the outflow concentration in GBTC, with one analyst noting, "GBTC's persistent outflows reflect legacy holders unlocking post-conversion, creating a supply overhang." Bulls argue this is a healthy cleanse of weak hands, while bears point to parallels with Ripple's predictions of corporate adoption facing headwinds. Sentiment is overwhelmingly cautious, with the Extreme Fear index score of 24 reflecting panic selling and risk aversion. Market structure suggests that until ETF flows stabilize or reverse, sentiment will remain suppressed, delaying any sustained rally.

Bullish Case: If ETF outflows subside and Bitcoin holds the $87,500 Fibonacci support, a rebound to $95,000 is plausible by Q1 2026, driven by institutional re-entry and positive regulatory clarity from the SEC's upcoming guidance on ETF custody rules. On-chain data indicates accumulation by long-term holders at current levels, supporting this scenario.

Bearish Case: Continued outflows exceeding $300 million daily could break the $87,500 support, leading to a test of $84,000 and potentially $80,000. This would align with historical corrections of 20-30% during outflow streaks, exacerbated by macroeconomic tightening and reduced retail participation.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.