Loading News...

Loading News...

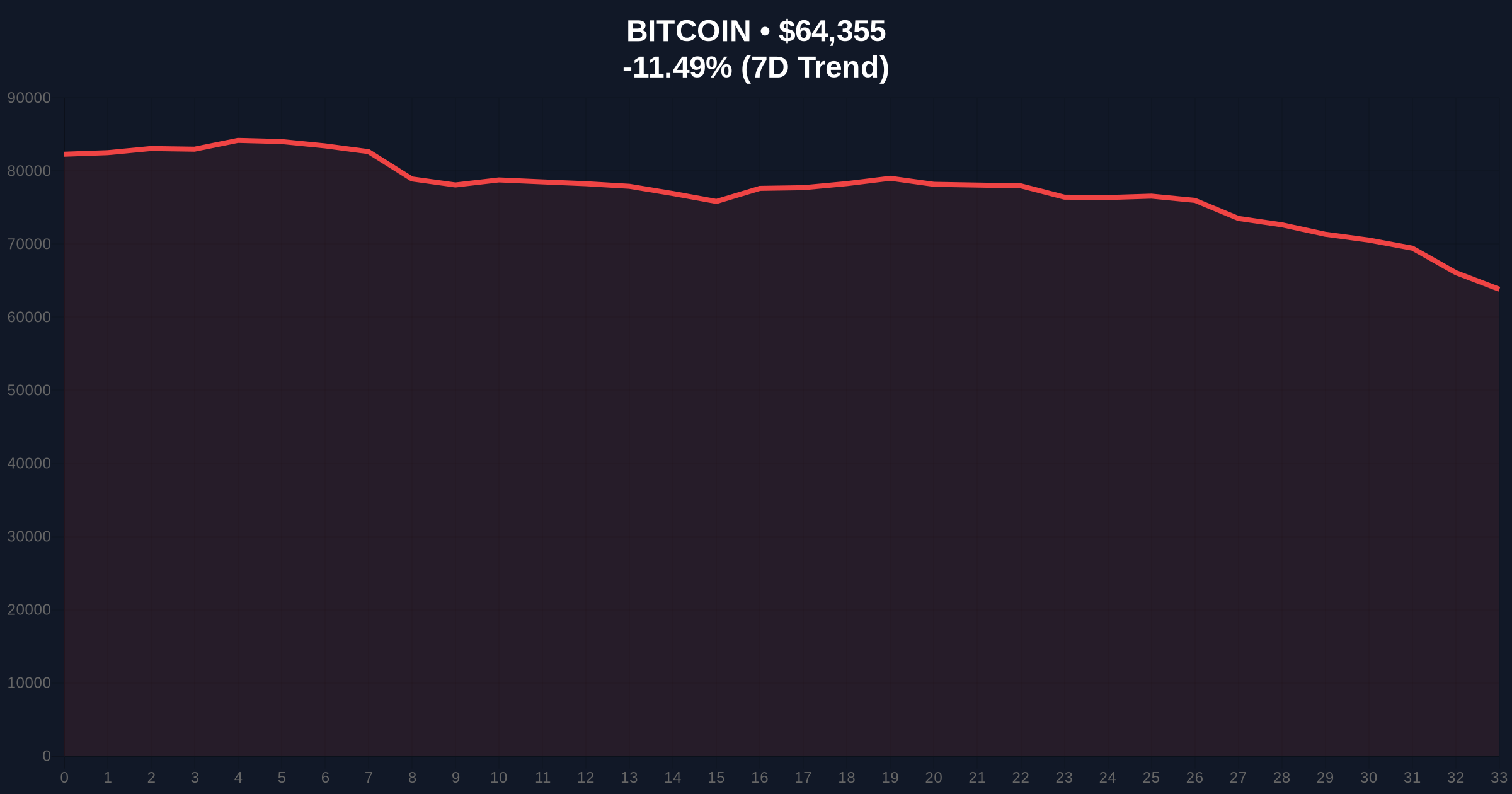

VADODARA, February 6, 2026 — Whale wallets dumped 81,068 BTC over eight days. This massive sell-off drove Bitcoin price to $64,290. According to Santiment on-chain data, whale supply share fell to a nine-month low of 68.04%. Retail addresses with less than 0.01 BTC hit a 20-month high of 0.249%. Market structure suggests a classic bear market setup.

Santiment analysis confirms a stark divergence. Whale wallets holding 10 to 10,000 BTC reduced their supply share to 68.04%. This marks a nine-month low. These entities sold 81,068 BTC in just eight days. In contrast, retail addresses increased their holdings to 0.249% of total supply. That is a 20-month high. Santiment describes this dynamic as typical for bear markets. The firm predicts whales will continue selling. They will observe from the sidelines until retail capitulation occurs.

Historically, whale distribution precedes major corrections. The 2021 cycle saw similar patterns before the $69,000 all-time high correction. In contrast, retail accumulation often signals late-cycle euphoria or impending panic. Underlying this trend is a liquidity grab by institutional players. They are exiting positions ahead of potential macroeconomic shifts. Related developments include Bitcoin breaking below $66,000 support and crypto futures liquidations hitting $431 million in one hour amid extreme fear.

Bitcoin price action shows a clear breakdown. The asset trades at $64,290, down 11.58% in 24 hours. Key support at the Fibonacci 0.618 level of $62,000 is critical. A break below this level would invalidate the current bullish structure from the 2025 low. Resistance now forms at the $68,000 order block. RSI readings indicate oversold conditions. However, volume profile shows selling pressure persists. The 200-day moving average at $70,500 acts as a major resistance zone.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Bitcoin Current Price | $64,290 |

| 24-Hour Price Change | -11.58% |

| Whale BTC Sold (8 Days) | 81,068 BTC |

| Retail Supply Share | 0.249% (20-month high) |

This whale exodus matters for institutional liquidity cycles. Large holders are front-running retail sentiment. They are creating a supply overhang. Retail buying at highs often leads to capitulation. Market structure suggests a final flush-out is needed. This could establish a stronger foundation for the next leg up. On-chain data indicates whale wallets are waiting on the sidelines. They will likely re-enter after retail exhaustion.

"The data shows a clear distribution phase. Whales are taking profits while retail accumulates. This is a classic sign of a market top or correction. Until retail fully capitulates, whales will remain cautious. The key is watching for a surge in exchange inflows from small addresses," said the CoinMarketBuzz Intelligence Desk.

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook hinges on retail behavior. If capitulation occurs swiftly, whales may re-enter, setting up a rally into 2027. However, prolonged retail holding could extend the downtrend. The 5-year horizon remains bullish due to Bitcoin's fixed supply and adoption trends, but short-term pain is likely.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.